The new Liberal government's first federal budget focuses on growing the middle class and strengthening the economy through both tax measures and non-tax measures, such as infrastructure investments and in strategic investments in clean technology.

Forecasted deficits

As widely anticipated, the budget projects significant deficits over the next several years.

The government forecasts a deficit of $5.4 billion for 2015–16, and projects additional deficits of $29.4 billion, $29 billion, $22.8 billion, $17.7 billion and $14.3 billion for 2016–17, 2017–18, 2018–19, 2019–2020 and 2020–2021 respectively. Although the Conservative government passed the Federal Balanced Budget Act in June 2015, the Liberals have indicated that they will propose legislative repeal of this Act.

On a positive note, Canada is starting from a relatively strong fiscal position in 2016, with the lowest total government net debt-to-GDP ratio of all G7 countries. This ratio is projected to decline beginning in 2017–18 to the end of the fiscal horizon.

Investing in infrastructure and innovation

The budget proposes to invest over $120 billion in infrastructure over 10 years. The plan includes a short-term first phase of $11.9 billion over the next five years to upgrade and improve public transit systems, invest in water, wastewater and green infrastructure projects, and for social infrastructure investments including affordable housing, early learning and child care. Phase two of the plan will include broader projects designed to reduce urban transportation congestion, improve and expand trade corridors and produce a cleaner low-carbon national energy system.

The government will also redesign and redefine how it supports innovation and growth, in partnership and coordination with the private sector, provinces, territories and municipalities, universities and colleges, and the not-for-profit sector through its "Innovation Agenda." This will include increased financing for fundamental research by $95 million annually and the investment of up to $2 billion over three years in a new Post-Secondary Institutions Strategic Investment Fund to modernize on-campus research, commercialization and training facilities.

Consulting stakeholders

In last year's budget, the previous government announced a review of the circumstances in which income from a business, the principal purpose of which is to earn income from property, should qualify as active business income. This examination is now complete and the new Liberal government is not proposing any modifications to the rules at this time.

Tax measures

Late last year, the government implemented a number of the tax measures that were included in their election platform, as well as some new measures taking effect in 2016, specifically

- a 4% increase in the top federal rate of personal income tax (from 29% to 33%) for taxable income over $200,000;

- a reduction in the second-lowest federal tax bracket rate from 22% to 20.5%;

- a reduction in the annual Tax-Free Savings Account (TFSA) contribution limit from $10,000 to $5,500; and

- changes to several tax measures affecting Canadian-controlled private corporations (CCPCs) and other private corporations.

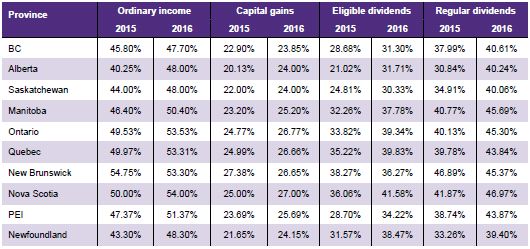

You can read more about these changes in our releases titled New Liberal government announces tax measures and Liberal government implements measures impacting the taxation of CCPCs. The chart below illustrates the impact of the new top 33% federal rate on various types of income by comparing 2015 with 2016 rates.

A number of additional measures were included in this year's budget. The following pages provide an overview of the budget's tax measures.

Personal income tax measures

In December 2015, the Liberal government announced a reduction in the second 22% federal tax bracket to 20.5% and a new top tax bracket of 33%. The following chart illustrates the impact of the new top 33% federal rate on various types of income (for the years 2015 and 2016 inclusive):

To continue reading this article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.