The Canadian Securities Administrators' (CSA) second version of proposed National Instrument 94-101 Mandatory Central Counterparty Clearing of Derivatives (the Clearing Rule) and proposed Companion Policy 94-101 (the Clearing CP) limit their application to direct clearing participants (and their affiliates) and major swap market participants. For a rule directed primarily at reducing systemic risk, this is a sensible and welcome approach, and one that recognizes that the Canadian market comprises a relatively small part of the global market. Initially, the products mandated to clear will be certain interest rate derivatives. In this post we review the main features of the Clearing Rule.

The Clearing Rule will require a "local counterparty" to clear a "mandatory clearable derivative" if both counterparties meet certain criteria, and it sets out the process for determining which derivatives will be mandated for clearing.

Proposed Basic Clearing Requirement

The basic requirement to submit a transaction for clearing to a "regulated clearing agency" is imposed on a "local counterparty" to a transaction in a "mandatory clearable derivative", if each party meets certain counterparty criteria (s. 3(1)).

Counterparty Criteria

The counterparty criteria significantly limit the scope of the clearing requirement. This is an important change from the initial draft of the National Instrument.

The clearing requirement applies only if each party meets at least one of the following criteria:

- a participant of a regulated clearing agency that offers clearing services for the derivative and it is a subscriber for the relevant clearing service

- an affiliated entity of such a participant

- a local counterparty in any Canadian jurisdiction that meets a trading threshold.

The trading threshold is a month-end gross notional amount under all outstanding derivatives of the local counterparty exceeding C$500,000,000,000 in any month after the instrument comes into effect. The local counterparty has to include transactions entered into by affiliated local counterparties in the calculation but not transactions excluded by the intra-group exemption (read on for a description of that exemption).

So for example, if a foreign dealer transacts with a Canadian bank, LCH clears the particular mandatory clearable derivative as part of its SwapClear service and both parties are participants in SwapClear, then the rule will apply. Similarly, the rule will apply if an affiliated entity of the foreign dealer is a SwapClear participant, even if the foreign dealer itself is not. The assumption, presumably, is that the foreign dealer can clear through its affiliate. It could also apply if the parties participate in different clearing agencies both of which clear the transaction. In that case they arm-wrestle to determine which clearing agency to use. (Just checking that you are still reading. It's up to the parties to decide between them in that case, so arm-wrestling is only one of many ways this could be determined.)

A future iteration of the Clearing Rule may bring other derivatives markets participants into scope.

"Mandatory Clearable Derivative"

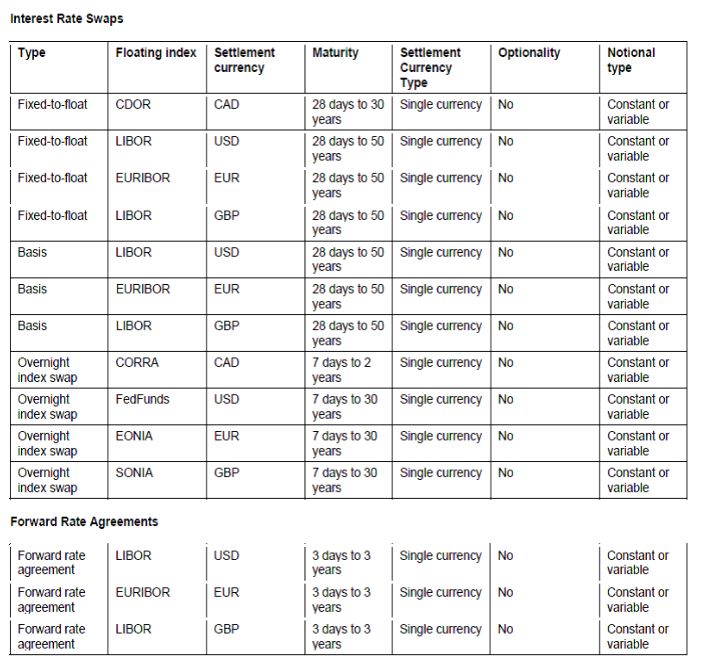

The mandatory clearable derivatives will be determined by the local regulatory authority. They will be published as an appendix to the Clearing Rule (except in Quebec). The proposed appendix is as follows:

The CSA has noted that no jurisdiction currently mandates clearing of CAD interest rate swaps (IRSs), although it is being considered in certain jurisdictions. Based on concerns about negatively affecting the access of Canadian market participants to counterparties for these products, the CSA is considering delaying the determination of CAD IRSs as mandatory clearable derivatives, at least where a foreign counterparty is involved. The CSA has specifically requested feedback on the transaction types proposed for mandatory clearing.

"Local Counterparty"

The local counterparty test is similar to the definition in the trade reporting rules, namely one or more of the following describe the counterparty:

- it is organized under the laws of the local jurisdiction or has it head office or principal place of business in the local jurisdiction (similar to the trade reporting rules that we previously discussed); or

- it is an affiliated entity of such a person and such person is responsible for all or substantially all of its liabilities.

A party may be a local counterparty in more than one jurisdiction.

Pre-existing Transactions

The Clearing Rule does not apply to transactions that were entered into prior to the Clearing Rule coming into effect. However, if a material amendment is made to a pre-existing transaction, it is novated or assigned or otherwise acquired or disposed of after the rule is in force, then the transaction could be subject to the clearing requirement. A material amendment, according to the Clearing CP, is one that changes information that would reasonably be expected to have a significant effect on the derivative's attributes, including its value, the terms and conditions of the contract evidencing the derivative, transaction methods or the risks related to its use. Several factors would be relevant in this determination, such as whether the modification would result in a large change in the value of the transaction and could result in differing cash flows or creating upfront payments.

Substituted Compliance

There is a substituted compliance regime, but only in limited circumstances. If the only reason that the transaction has to be cleared is because the local counterparty guaranteed affiliate category applies, then the local counterparty can submit it for clearing under the law of a foreign jurisdiction that is listed in Appendix B of the rule. No jurisdictions are yet specified, but we would anticipate U.S. and European rules to be designated.

A local counterparty may still be required to clear by the laws of multiple jurisdictions if, for example, it is organized under the laws of Canada, but is subject to a clearing requirement in a country where it conducts business. There is no substituted compliance regime in that case, but an exemption could be applied for if it was not possible to comply with both (if, for example, different clearing agencies are recognized).

Proposed Timelines for Submitting Derivatives for Clearing

The transaction must be submitted for clearing no later than the end of the business day on which it is entered into, or the next day if entered into after business hours of the regulated clearing agency (s. 3(2)). The Clearing CP states that the transaction is to be submitted as "soon as practicable".

There is a transitional period for compliance where the applicable counterparty criteria is based on gross notional amount. In that case the party has 90 days from the date it first met the criteria to clear the transaction.

Proposed Exemptions

There are four principal proposed exemptions from the clearing requirement. Though there is no end-user exemption, one should not be necessary given the counterparty criteria.

Intra-group Trading (s. 7)

The clearing requirement does not apply to an "intragroup transaction" if

- the transaction is between either of the following:

- two counterparties that are prudentially supervised on a consolidated basis (e.g. by the Office of the Superintendent of Financial Institutions (OSFI));

- a counterparty and its affiliated entity if their financial statements are prepared on a consolidated basis in accordance with certain acceptable accounting principles(e.g. Canadian or US GAAP, or IFRS for entities with a parent entity in Canada).

- both parties agree to rely on this exemption,

- the transaction is subject to centralized risk evaluation, measurement and control procedures reasonably designed to identify and manage risks, and

- there is a written agreement setting out the terms of the transaction between the parties.

To rely on this exemption the local counterparty must submit a Form 94-101F1 Intragroup Exemption to the local securities regulator. The information will be kept confidential generally, but the regulators may require public disclosure of a summary of the information if it considers that disclosure to be in the public interest.

Government Derivatives (s. 6)

The clearing requirement does not apply if one of the counterparties is the Government of Canada, the government of a province or territory, the government of a foreign jurisdiction (both sovereign and sub-sovereign), a crown corporation for which the government of the relevant jurisdiction is responsible for all or substantially all the liabilities, an entity wholly owned by one or more governments that are responsible for all or substantially all of the entity's liabilities, , the Bank of Canada, a central bank of a foreign jurisdiction, the Bank for International Settlements or the International Monetary Fund.

Multilateral Portfolio Compression (s. 8)

The clearing requirement does not apply to a mandatory clearable derivative that results from a multilateral portfolio compression exercise if:

- the resulting transaction is entered into as a result of more than two counterparties changing or terminating and replacing prior transactions

- the prior transactions do not include a transaction entered into after the effective date on which the derivative or class of derivatives became a mandatory clearable derivative

- the prior transactions were not cleared by a regulated clearing agency;

- the resulting transaction is entered into by the same counterparties as the prior transactions, and

- the multilateral portfolio compression exercise is conducted by a third-party provider

Exemptive Relief (s. 11)

The regulatory authorities may grant exemptions in whole or part on application. An exemption granted in one jurisdiction applies in the others (except for Ontario and Alberta).

Record Keeping

A local counterparty relying on an exemption must maintain for seven years (eight in Manitoba) from the date the transaction expires or terminates, records of all documentation demonstrating that it is eligible to benefit from the multilateral portfolio compression exemption and the inter-affiliate exemption (s. 9(1)). The records must be kept in a safe and durable form and provided to the regulator within a reasonable period of time following a request. The Clearing CP sets out that the parties should keep full and complete records of any analysis undertaken by the end-user or the party relying on the intragroup exemption.

Designation of Cleared Derivatives

Clearing agencies will be required to submit electronic information on new clearing services for derivatives or classes of derivatives to the regulator within 10 days after providing the new service (s. 10). Also, within 30 days of the Clearing Rule coming into effect, each regulated clearing agency will be required to submit information for all derivatives it provides services for as of the date of coming into force of the Rule (s. 12).

Based on this information, the regulators will determine by rule or otherwise which derivatives or classes of derivatives will be subject to the mandatory clearing rule. Regulators may also determine by rule or otherwise which derivatives or classes of derivatives will be subject to the requirements through a top-down approach.

The Clearing CP sets out the factors the regulators will consider:

- the level of standardization;

- the effect of central clearing of the derivative on the mitigation of systemic risk;

- whether the derivative would bring undue risk to the clearing agency;

- the outstanding notional exposures, liquidity and availability of reliable and timely pricing data;

- the existence of third party vendors providing pricing services;

- the existence of an appropriate rule framework, and the availability of capacity, operational expertise and resources, and credit support infrastructure to clear the derivative on terms that are consistent with the material terms and trading conventions on which the derivative is then traded;

- whether the clearing agency would be able to risk manage the additional derivatives that might be submitted due to the clearing requirement determination;

- the effect on competition, taking into account appropriate fees and charges applied to clearing, and if the proposed clearing requirement determination could harm competition;

- alternative derivatives or clearing services co-existing in the same market; and

- the public interest.

Clearing agencies have a few other obligations:

- The regulated clearing agency must immediately notify the local counterparty if a transaction has been rejected for clearing (s. 4) and its rules must provide for such notification.

- A clearing agency is required to post on its website a list of all derivatives and classes of derivatives it clears and identify whether each is a mandatory clearable derivative (s. 5).

Timing

The draft instrument was published for comment on February 24, 2016 and the comment period ends on May 24, 2016.

The date the rule will come into effect is not yet set.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.