The Australian Prudential Regulation Authority ('APRA') has recently released its latest quarterly property exposure data for domestic and foreign Authorised Deposit-taking Institutions ('ADI's').

Key takeaways...

Overall exposure to property

![]()

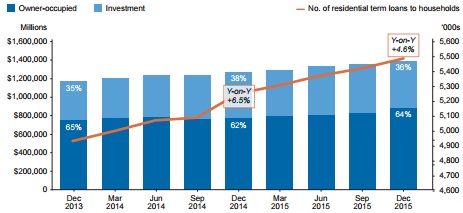

- Growth in overall exposure was almost identical to the September quarter, driven by expanding owner-occupied residential and commercial lending.

- Residential investor exposure contracted further, only the second quarterly contraction since 2008.

Commercial sector

![]()

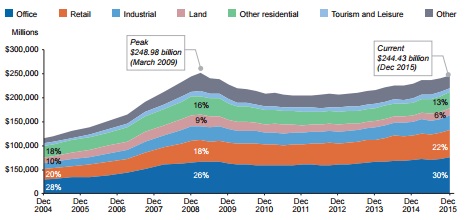

- Office and retail property exposure hit new peaks again this quarter.

- Industrial funding is also just below previous peak exposure (within 1.0%).

- Aggregate commercial exposure is now close to the previous peak exposure in March 2009 (within 2.0%).

- Exposure to land subdivisions grew at 6.3% vs 2.0% for the last quarter, with Y-on-Y growth expanding to 24.7%.

- Growth in exposure to Other Residential contracted (2.8% vs 5.3% for the preceding quarter. Y-on-Y growth was stable at 19.5%.

- Exposure to tourism property again declined markedly (-8.6%).

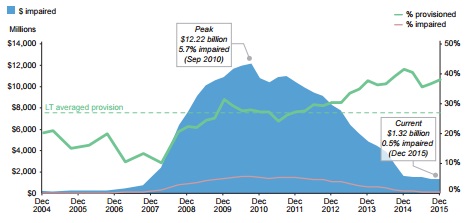

- Impairments increased for the first time since the September 2011 quarter, based on revised September 2015 quarter data.

- Specific provisioning remains above the long-term average of 27.4%.

Residential sector

![]()

- The number of loans held and total exposure to the residential sector continues to increase.

- Loans to owner-occupiers still dominate at 64% of overall residential exposure.

- Recent measures to dampen growth in investor loans continue to bite, with exposure contracting by just under 3%.

- Y-on-Y growth in investor loans has also declined from 18.6% to 9.1% to 2.6% over the last three quarters.

Change in property exposure by sector

Property exposure by lender group

Aggregate residential property exposure by type

New residential loans approved per quarter by LVR

Commercial property exposure by sector

Commercial property impairment

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.