Both the provincial government and the incoming federal government have raised, or have pledged to raise, income tax rates for high income earning individuals. Both have also pledged to make certain changes to corporate tax rates. Assuming that the federal changes are introduced effective January 1, 2016, we expect combined federal and provincial tax rates for Alberta residents in 2015 and 2016 to be as follows:

Individuals – Top marginal rate (Alberta)

| Ordinary income | Capital gains | Eligible dividends | Non-eligible dividends | ||||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 |

| 40.25% | 48.00% | 20.13% | 24.00% | 21.02% | 31.71% | 30.84% | 40.40% |

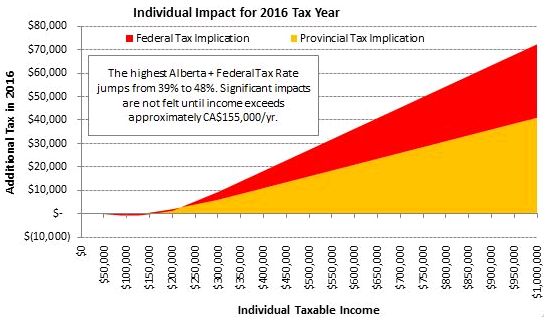

Individuals earning employment income will see the top marginal rate increase from 40.25% to 48% (an increase of almost 20%). Likewise, the top marginal rate on capital gains will increase from 20.13% to 24% (again, almost a 20% increase). Individuals who earn dividend income will face even greater increases, as the top marginal rate will increase from 21.02% to 31.71% (increasing their tax burden by more than 50%) for eligible dividends and from 30.84% to 40.40% (increasing their tax burden by more than 30%) for non-eligible dividends. The cumulative impact of the 2015 and 2016 tax changes on ordinary income is reflected below:

The income tax changes proposed for 2016 may affect how owner-managers receive income from their corporations (through salary, eligible, or non-eligible dividends). The combined corporate and personal rates for each of those alternatives are as follows:

| Salary | Eligible dividends (combined rate) |

Non-eligible dividends (combined rates) |

|||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 |

| 40.25% | 48.00% | 41.55% | 50.15% | 40.52% | 47.55% |

In 2015 it is most effective to pay salaries and bonuses rather than dividends. In 2016, there is a 2.15% disincentive to earning income at the general corporate rates and paying eligible dividends, such that business owners may want to consider "bonusing down" to the CA$500,000 small business limit. For income earned at the small business rate in 2016, non-eligible dividends are more tax efficient than salary or bonuses.

It is clear that there are material tax advantages to receiving income in 2015 for some taxpayers, particularly for individuals earning more than $300,000 per year, as the individual income tax rates are increasing for all categories of income in Alberta. High-earning Albertans should consult their tax advisor to determine whether it is possible to accelerate taxable receipts to 2015 (for example, choosing to not claim a capital gains reserve). In particular, if significant events such as the sale of a business are contemplated in 2016, there may be planning opportunities available in 2015 to mitigate these tax rate changes.

In its 2015 Budget, the Alberta government pledged to reduce the effective tax rate on non-eligible dividends in 2016. The revised rates will be released later this year. The Alberta government has also pledged to review the tax rate applicable to eligible dividends in its 2016 Budget.

Corporations – Income tax rates

The Alberta government has also raised corporate income tax rates for non-small business corporations, while the Liberal Party's platform called for a reduction in the corporate tax rate applicable to Canadian-controlled private corporations ("CCPCs") earning active business income, as follows:

| CCPC – Small business income up to CA$500,000 | CCPC – Investment income1 | General corporate tax rate2 | |||

| 2015 | 20163 | 2015 | 2016 | 2015 | 2016 |

| 14.0% | 12.0% | 45.7%4 | 46.7 | 26.0%5 | 27.0% |

CCPCs earning income eligible for the small business deduction will see the tax rate drop from 14.0% to 12.0% (reducing their tax burden by almost 15%). As a result, these corporations may wish to maximize any discretionary deductions (such as capital cost allowance) available to them in 2015. They may also wish to accelerate the payment of employee bonuses from 2016 to 2015, which will also benefit the bonus recipient, who will likely be facing higher tax rates in 2016.

Non-CCPCs and CCPCs earning active business income in excess of $500,000 will see the tax rate increase from 26.0% to 27.0% (increasing their tax burden nearly 4%). Due to this increase, non-CCPCs may wish to defer taking discretionary deductions until 2016. CCPCs earning active business income in excess of $500,000 may also wish to defer taking discretionary deductions until 2016 in certain circumstances. Finally, CCPCs will see the tax rate on any investment income they earn increase from 45.7% to 46.7% (increasing their tax burden by approximately 2%).

Footnotes

1 A portion of this tax (up to 26.67%) is refundable when the CCPC pays dividends.

2 Applicable to all income earned by non-CCPCs and to actives business income earned by CCPCs in excess of CA$500,000.

3 We have assumed that the reduction in the federal small business rate from 11.0% to 9.0% proposed as part of the Liberal Party's platform will be effective January 1, 2016. However, it is possible that this reduction will be phased in over a number of years, similar to the reduction introduced in the Federal 2015 Budget (which introduced such a reduction over the course of the next four years).

4 This rate increased on July 1, 2015 from 44.7% to 46.7%. A blended rate of 45.7% is used but the actual rate will depend on the year end of the corporation.

5 This rate increased on July 1, 2015 from 25% to 27%. A blended rate of 26% is used but the actual rate will depend on the year end of the corporation.

About Dentons

Dentons is a global firm driven to provide you with the competitive edge in an increasingly complex and interconnected marketplace. We were formed by the March 2013 combination of international law firm Salans LLP, Canadian law firm Fraser Milner Casgrain LLP (FMC) and international law firm SNR Denton.

Dentons is built on the solid foundations of three highly regarded law firms. Each built its outstanding reputation and valued clientele by responding to the local, regional and national needs of a broad spectrum of clients of all sizes – individuals; entrepreneurs; small businesses and start-ups; local, regional and national governments and government agencies; and mid-sized and larger private and public corporations, including international and global entities.

Now clients benefit from more than 2,500 lawyers and professionals in 79 locations in 52 countries across Africa, Asia Pacific, Canada, Central Asia, Europe, the Middle East, Russia and the CIS, the UK and the US who are committed to challenging the status quo to offer creative, actionable business and legal solutions.

Learn more at www.dentons.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Specific Questions relating to this article should be addressed directly to the author.