Changes to Personal Tax Rates

The Liberal Party has proposed to reduce the tax rate for the second lowest tax bracket ($44,700 to $89,401 of taxable income) from 22% to 20.5%, stating that this can result in tax relief of up to $670 per person. The Liberal Party has also proposed a new top federal tax rate of 33% for individuals with taxable income in excess of $200,000. For 2015, the top federal tax rate is 29% on taxable income over $138,586.

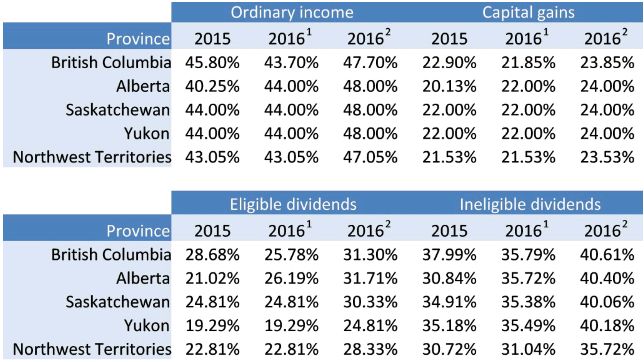

The table below provides the top marginal tax rates for 2015 and 2016. The rates include the Alberta rate increases announced in June of 2015. However, please note that the Alberta tax rates for eligible and ineligible dividends do not account for upcoming changes to the calculation of Alberta dividend tax credits which we expect the Alberta Government to announce in the near future (please see our comments on the 2015 Alberta Budget here).

If the new 33% federal tax rate becomes effective as of January 1, 2016, the increase in tax rates for individuals with more than $200,000 of taxable income will be significant. Accordingly, you may consider reviewing the timing of discretionary bonus and dividend payments, and accelerating such payments to 2015.

Corporate Tax Measures

The Liberal Party has supported the reduction of the small business tax rate for Canadian-Controlled Private Corporations ("CCPCs") from 11% to 9% that was proposed in the most recent Federal Budget. However, they have stated their intention to ensure that CCPC status is not used to reduce personal income tax obligations for high-income earners rather than supporting small businesses. We expect additional details on how the Liberal Party intends to enact these measures at a later date.

Other Tax Measures

The Liberal Party's platform also mentions the following items that it plans to implement.

- Eliminate the education and textbook tax credits and increase access to student grants.

- Introduce a refundable tax credit for teachers and early childhood educators who purchase certain supplies for their students.

- Cancel the increase of the Tax Free Savings Account annual contribution limit to $10,000.

- Eliminate the Family Tax Cut tax credit.

- Replace the Universal Child Care Benefit, the Canada Child Tax Benefit and the National Child Benefit with a new tax-free Canada Child Benefit.

- Restore the Old Age Security and Guaranteed Income Supplement eligibility age to 65 and increase the Guaranteed Income Supplement.

- Increase the Northern Residents Deduction to a maximum of $8,000 per year and index the amount in subsequent years.

- Limit the stock option deduction for individuals with more than $100,000 in annual stock option gains.

- Overhaul Canada Revenue Agency's service model to be more client-focused. For example, by proactively contacting Canadians who are entitled to, but not receiving, tax benefits.

Footnotes

1 These rates assume that the 33% federal rate does not become effective as of January 1, 2016.

2 These rates assume that the 33% federal rate does become effective as of January 1, 2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.