Executive summary

Welcome to our fifth annual report on mergers and acquisitions (M&A) activity in the global insurance market. At the time of writing – mid-summer 2015 – the deal environment is hot. Every day seems to bring another major announcement. In recent weeks, ACE has agreed to buy Chubb, Willis has moved for Towers Watson and Zurich has said it is considering a takeover of RSA.

As the upturn in activity that began in the first half of 2014 has gathered momentum, a number of drivers are at play. Just as last year, the on-going low interest environment continues to impact investment returns while keeping the cost of borrowing low. Combined with an abundance of capital in the market, there is no shortage of funds with which to finance transactions. While levels of competition in the market keeping prices low and depressing return on equity has been ongoing, it seems to have reached a tipping point. Previously we have seen excess capital being deployed in share buybacks, now however there has been a shift in market sentiment towards deal activity that can deliver diversification, geographic reach and cost savings.

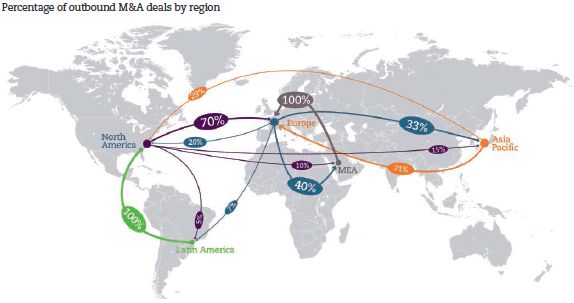

The search of growth remains paramount, especially for those whose domestic markets have stagnated. The acquisition of Protective Life Corp. of the United States by Japan's Dai-ichi Life Insurance Co. for USD 5.7 billion is just one example. European insurers too are looking beyond their own region to Asia and Africa to find the expansion opportunities that are not available at home. By contrast, businesses based in dynamic emerging markets such as China's Fosun and BTG Pactual of Brazil are making significant moves into mature markets to acquire assets that can fuel their international growth ambitions.

Regulation too remains a driver, especially in emerging markets. The raising of the foreign investment cap in India is likely to usher in a wave of M&A while new rules recently introduced in China are starting to take effect. The Middle East, long considered ripe for M&A, is set for a combination of domestic consolidation and inbound investment as a result of legislation designed to squeeze out smaller players with weaker balance sheets.

Looking ahead, although we expect M&A to continue across a range of markets, challenges remain in certain jurisdictions. Deal-making in Europe meanwhile has been patchy. A cloud of uncertainty overhangs the region, and in the UK in particular this is exacerbated by the possibility of an exit from the European Union. Many would-be deal-makers in the continent have adopted a "wait and see" attitude as a result, which is acting as a brake on transactions.

In the USA, the positive macro-economic outlook, combined with on-going fierce competition in the re/ insurance marketplace and ever increasing levels of capital – including that from new and alternative sources – points to more M&A to come.

Although activity in Asia Pacific has fallen back slightly over the last 12 months, there has been an increase in the number of cross-border acquisitions; nine of the period's ten largest transactions involving Asia Pacific acquirers had foreign targets. We expect this trend to continue amid clear signs in a number of markets in the region – as elsewhere in the world – that M&A activity is set to surge.

Top ten facts

North America

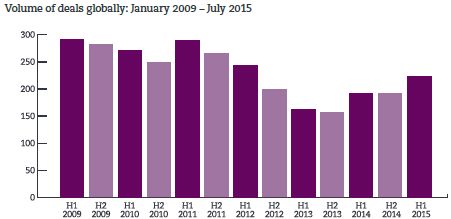

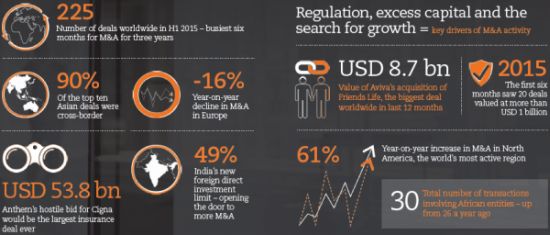

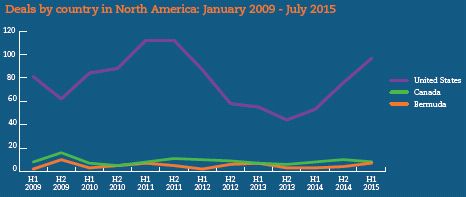

M&A activity in the re/insurance markets of North America has seen a 61% year-on-year increase with 217 completed transactions between July 2014 and June 2015, compared to 132 in the previous 12-month period.

Historically, North America has dominated the global M&A scene – an entirely natural consequence of its size and maturity as the world's leading re/insurance market. However, at the time of our last report, it had lost its premiere position to Europe, with deal flow slowing in response to a combination of factors such as differing buyer/seller perceptions of company value, ongoing regulatory uncertainty and mediocre economic performance.

It has, however, now re-established itself as the overall leader in re/insurance M&A, accounting for 38% of the deals completed worldwide in the last 12 months. The announcement in the summer of 2015 of the acquisition of Chubb by ACE and HCC by Tokio Marine provides a clear indication that there is a continuing acceleration of M&A activity in the North American re/insurance market, and of larger deals in particular.

There are a number of trends that are likely to result in more deals in the coming year. These include a strengthening macro-economic outlook for the USA, ongoing fierce competition in the re/insurance marketplace, ever-increasing levels of capital in the industry (including from new and "alternate" sources), and investments into the USA by overseas players looking for diversification out of their home markets. With an increasingly robust economy, a prolonged low interest rate environment, more readily available finance and companies looking to deploy their surplus cash, it is likely that the conditions for deal-making in the USA will persist for the near-term.

Looking for growth

Despite the fact that almost every corporate statement talks about the need to grow the company's business, finding that growth, and ensuring that it is profitable, is proving elusive for many re/insurance companies.

A combination of reduced investment returns from low interest rates and fierce competition on pricing in an ongoing soft market continued to depress the return on equity for many insurers in 2014 and the first half of 2015. For many publicly-listed insurance holding groups, special dividends and share buy-backs remain frequently-used tools to address the issue of excess capital. The last few years have seen a number of insurance holding groups announce sizeable examples of this. These include Chubb Corporation's announcement of a share repurchase programme of up to USD 1.5 billion of its common stock in 2014. "Capital management continues to be an important focus for Chubb," said John D. Finnegan, Chairman, President and Chief Executive Officer, continuing: "This new share repurchase program reflects the Board's continued confidence in Chubb's strong financial condition reflecting our solid balance sheet, our conservative capital structure and our commitment to returning excess capital to our shareholders." In 2014 and 2015 Allstate also announced share buy-backs of USD 2.5 billion and USD 3 billion, respectively, based on better than expected profits and the proceeds of asset sales.

Nevertheless, many activist shareholders have increased the pressure on management and boards to actively consider M&A as a strategic tool for use of available capital and to increase the return on equity, which is now driving the increased level of transactions. These strategic acquisitions have taken a number of forms, from bolt-on buys to diversify a portfolio or scale-up in a particular line of business, to more transformational deals between domestic and international carriers. As more deals are announced the pressure to buy – or be bought – may ratchet up further.

The re/insurance M&A landscape in North America has seen a whole range of activity in both size and focus, with buyers seeking market access, diversification and/or scale. The expansion by Progressive Insurance – the fourth-largest USA auto insurer – into home coverage through the purchase of a majority stake in ARX Holding Corp is an example of the former – a business looking for growth by rounding-out its offering. "Progressive is committed to becoming the insurance destination brand for consumers," Chief Executive Officer, Glenn Renwick said in a statement when the deal was announced. "As such, we need the reliable availability of many more products than we intend to manufacture." TPG Capital Management's purchase of Warranty Group Inc, a provider of extended warranty contracts, and Alliant's expansion into crop insurance with its offer for Mary Roach, are both examples of deals in specific lines.

The completion of the acquisition of Catlin by the XL Group in May 2015 illustrated the more transformative end of the deal spectrum. Commenting on the announcement, XL Chief Executive Officer, Mike McGavick said: "After nearly two years of discussions, and several months of intense planning, we are extremely pleased to officially be one company. Starting today, we are a larger, stronger, more capable firm, with a leading presence in the global specialty insurance and reinsurance markets." McGavick added, in an update 28 days after the deal closed, that XL Catlin had been shown new business and new facilities since the deal completed.

This trend for larger and larger deals looks set to continue with the announcement in July 2015 of the acquisition of Chubb by ACE, making the combined group one of the world's largest P&C insurance companies. The USD 28.3 billion deal, expected to close in the first quarter of 2016, marks the biggest acquisition in the industry since the global financial crisis. While increased competition, depressed prices and low interest rates have been quoted as the drivers behind M&A activity in North America, this is not the case for the ACE-Chubb deal, according to ACE Chief Executive Officer, Evan Greenberg. "Most of the deals I see being done are being done defensively, because of the pressures companies are feeling," he said. "This deal is being done on the offensive."

Home or away?

Stagnant domestic markets are probably one of the most significant drivers of M&A activity. The result is that, while large North American insurers look to emerging markets for targets, insurers from more mature Asian markets, particularly Japan, are targeting the USA. While the USA is not considered high growth, it is the largest insurance market in the world offering a range of targets as well as growth prospects to offset the acquirers' shrinking market at home. Establishing a presence in the USA and then using this as a base for growth – either organically or by further acquisition – offers more growth potential than emerging markets where the percentage increases may be larger, but from a much smaller base.

In 2014 there were a number of acquisitions to exemplify this trend, including Dai-ichi Life's purchase of Protective Life for USD 5.7 billion. It looks set to continue with Tokio Marine announcing in June 2015 that it had agreed to buy US specialty insurer HCC Insurance for USD 7.5 billion, in what would be the biggest M&A re/insurance deal this year by a Japanese company. With insurers among the most acquisitive Japanese companies, Tokio Marine alone has spent more than USD 8 billion on international deals since 2008, including acquistions of US insurers Philadelphia Consolidated for USD 4.7 billion in 2008 and Delphi Financial for USD 2.7 billion in 2012. Tokio Marine President, Tsuyoshi Nagano told Reuters in October, 2014: "There are still possible options in the North American market. The insurance market is big, and there are many specialty companies. There are still many good targets."

There is also increasing evidence that emerging market insurers are spreading their wings and looking to broaden out their portfolios in the more developed markets. Probably the most active example of this is China's Fosun International, which has made a number of purchases in North America in the last year including Meadowbrook Insurance Company and Ironshore in Bermuda. In March 2015, in an interview with the Wall Street Journal, Fosun Chief Executive, Liang Xinjun said the group was planning to spend at least USD 2.4 billion to buy five insurers in the USA, Europe and Asia. "Insurance is the most important business segment for us – the build-out of insurance gives us a cheap and sustainable source of funding," said Mr Liang.

In February 2015 Brazil's Grupo BTG Pactual SA – the largest independent investment bank in Latin America – completed its acquisition of Bermuda-based reinsurer Ariel Re Holdings Ltd for USD 350 million in order to expand its presence in the P&C industry outside of its local market.

This can be seen as part of the company's effort to broaden potential revenue and business opportunities sources as financial markets in Brazil struggle after three years of sub-par growth.

The Canadian market, by contrast, is primarily a story of domestic activity, with the second half of 2014 seeing 16 completed deals where both parties were based in Canada. Most of these transactions were valued at under USD 100 million. Growth and the desire for scale is also a driver in Canada, but another factor may be at play. Some commentators have noted that a large number of Canadian transactions involve small and medium sized entities, often in the distribution channel. Many of these – up to around 30% – are thought to be owned by baby boomers looking for an exit strategy. Private sales also look to be a popular route; if so, we should expect more to follow.

Competition and consolidation

Although the wave of M&A in the insurance industry is touching almost every sector, there is no doubt that attention this year has been more focussed on the reinsurance sector and in particular on Bermuda. In the second half of 2014 there were four completed transactions involving Bermudan entities, including the acquisition by the Canada Pension Plan Investment Board of Wilton Re Holdings Ltd. for USD 1.8 billion. 2015 has seen a continuation of the merger frenzy, with XL's deal to acquire Catlin, Endurance's purchase of Montpelier Re (after abandoning a hostile bid for Aspen), RenaissanceRe's acquisition of Platinum and the acquisition of PartnerRe by Exor. Many believe that the problem for a number of Bermuda companies is that they lack geographic diversification and are too dependent on the once profitable property catastrophe business. This narrowness of focus is out of step with an industry that has an increasing desire to diversify. Combine this with the influx of third party capital into the ILS sector and the consequent driving down of prices in these traditional sectors and you have significant pressure for consolidation.

Another factor driving this trend is so-called 'tiering' which, while not a new trend, has been growing in recent years. According to the big three brokers, there is a heavy focus on the top reinsurers, with more clients seeking to maximise their relationships with these companies. Reinsurers are therefore looking at mergers as a route to ensure that they retain their place in, or can enter, the coveted top 20.

Applying the brakes

While there is no doubt that the impetus behind M&A is growing in North America, there are some issues that might slow down that activity and the unsettled regulatory environment will probably be one of them. A range of new rules and modified requirements, including: SIFI designation, risk-based capital frameworks, principle-based reserving, and governance and risk, may create sufficient uncertainty so as to impede transactions and significantly affect how companies operate and engage in M&A.

| Case study:

Dai-ichi/Protective Life Dai-ichi Life Insurance – one of Japan's largest life insurers – acquired US insurer Protective Life in a deal valued at about USD 5.7 billion. The deal represents the largest takeover of an American insurer by a Japanese insurer to date. The Japanese insurance market has been stagnant, with shrinking demand from an aging and eroding population, so over the past three years, Japanese companies have been looking abroad for growth as their home market continues to slow. The USA – which represents 22% of the global insurance market – presents just such an opportunity, and has meant that some Japanese firms are willing to pay a premium for deals. "With a strong leadership team, vibrant and growing retail franchise and long track record of profitable growth organically and through the acquisition and integration of attractive businesses, Protective is the ideal platform for expansion," said Koichiro Watanabe, President of Dai-ichi Life. "Our companies are an excellent strategic fit and share similar missions and values." |

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.