This article provides an overview of the M&A activity in Canada during 2014 and an outlook for the coming year.

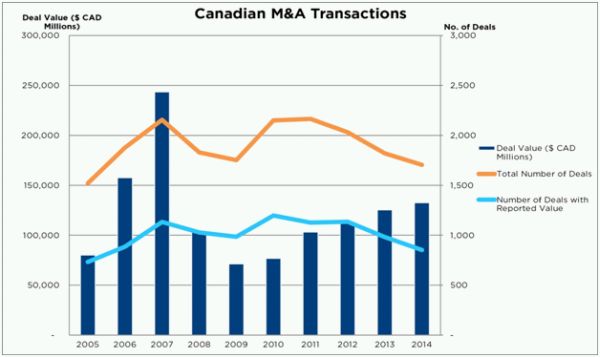

The number of Canadian companies sold in 2014 declined to 1,705 – the lowest level since 2005. However, transaction value (which was disclosed for 852 transactions) increased to $132 billion (Exhibit 1). By contrast, the number of U.S. companies sold in 2014 rose to 16,515 vs. 15,422 in 2013, and U.S. transaction value (where disclosed) increased to USD$1.2 trillion in 2014 vs. USD$959 billion in 2013.

Exhibit 1

Source: S&P Capital IQ

The largest Canadian transaction in 2014 was Brookfield's acquisition of the remaining 50.69% of Brookfield Office Properties (TSX: BPO) that it did not already own, at a purchase price that implied a value of $22 billion (Exhibit 2). However, the most notable transaction of 2014 was the acquisition of Tim Hortons by Restaurant Brands International (aka Burger King) for $14.6 billion. Last year also saw the acquisition of Shoppers Drug Mart by Loblaws for $13.7 billion.

Exhibit 2

Major Transactions Closed in 2014

Source: S&P Capital IQ

The median size for transactions involving the takeover of a Canadian company in 2014 was $9.5 million, which is lower than the median value of U.S.-based companies (USD$15.9 million). In each case, given that the values of many smaller transactions are not reported, the actual median is likely even lower. Transactions with values in excess of $500 million in Canada are infrequent, but they account for a large portion of overall deal value – see Exhibit 3.

Exhibit 3

Source: S&P Capital IQ

Valuation Multiples

Valuation multiples in North American transactions (where determinable) demonstrated an overall upward trend in 2014. Multiples in the financial services sector (which includes the real estate segment) were particularly strong (Exhibit 4).

Exhibit 4

Source: S&P Capital IQ

Public vs. Private

There were 240 publicly-listed Canadian companies sold during 2014 (representing approximately 14% of the total), which is in line with historical norms. The median premium over the stock price was 30% (see Exhibit 5).

By contrast, only 392 U.S. public companies were sold (representing approximately 2.4% of the total), which is lower than historical norms. The median takeover premium of 28% for U.S. public companies was also lower than usual. These statistics are likely the result of a buoyant U.S. equity market, which has made U.S. public companies expensive acquisition targets.

Exhibit 5

Source: S&P Capital IQ

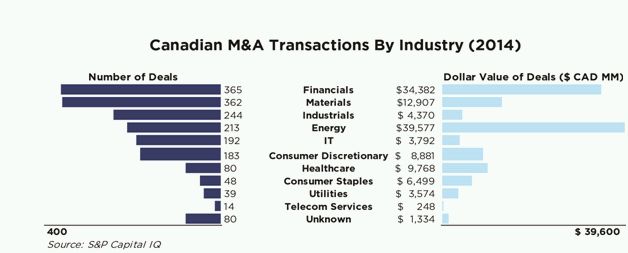

Industry Sectors

In terms of industry sectors, the largest number of Canadian takeover transactions in 2014 involved companies in the materials sector, with 344 deals worth $9.5 billion. However, this represents the lowest number of deals in that sector over the past 10 years, due to the slumping gold price. The financial services sector also saw a marked decline in 2014, with 264 deals worth $32.8 billion. While the number of transactions in the energy sector increased to 242 ($26.9 billion), this figure remains low by historical norms (see Exhibit 6).

Exhibit 6

Cross-Border Transactions

Once again last year, the majority of Canadian divestitures involved a Canadian buyer. Only 366 transactions involved a foreign buyer, representing $66.7 billion in reported transaction value. Industrials and information technology were the most popular takeover targets. By contrast, Canadian companies were quite acquisitive abroad, acquiring 631 foreign entities, representing $69.7 billion in reported transaction value. The financial sector was again a hot area for Canadian-based acquirers, representing about 25% of the transactions (Exhibit 7).

Exhibit 7

As usual, most cross-border transactions during 2014 involved a company based in the U.S. However, Canadian firms also acquired 112 European entities, the highest figure over the past 10 years, which is indicative of a growing interest in that region (Exhibit 8).

Exhibit 8

While the Canadian Dollar has fluctuated significantly against its U.S. counterpart over the past ten years, this does not appear to have an impact on cross-border transaction activity. This suggests that most Canadian and foreign buyers look beyond short-term currency fluctuations when making corporate acquisition decisions.

Looking Ahead

With the economic recovery in full swing, 2015 is expected to be a strong year for M&A activity. Corporate acquirers still have significant amounts of cash available, and private equity firms have more than USD$1 trillion globally to invest.

The recent plunge in oil prices may cause some divestitures to be deferred; but it may also result in opportunistic buying opportunities. The consequential decline in the Canadian dollar vs. its U.S. counterpart could lead to higher profits for Canadian exporters, which may spur more interest in those companies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.