For a profitable business, a captive insurance company arrangement can be an effective and flexible business risk management tool that also provides potentially significant tax and asset protection benefits. This newsletter provides an overview of the benefits of a small casualty insurance company arrangement for a closely-held business.

TYPICAL CAPTIVE INSURANCE COMPANY ARRANGEMENT

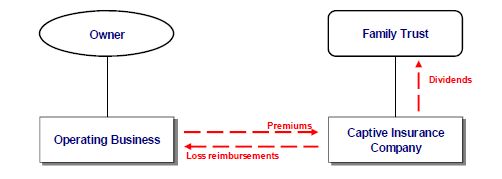

In a typical captive insurance company arrangement, a business owner forms and capitalizes a state licensed and regulated insurance company (the "Captive") which then issues to the business insurance policies covering risks that are not insured under the business's existing commercial insurance policies (such as deductibles and uninsured risks). The Captive might be owned by a trust for the benefit of the business owner's family.

The following diagram illustrates a typical captive insurance company arrangement.

The costs to form and operate a captive insurance arrangement include:

(a) the cost to capitalize the captive (which ranges between $100,000 and $500,000 for a typical structure, but can be as low as $25,000 for certain pooled insurance arrangements),

(b) expenses associated with identifying business risks that are appropriate to insure through the Captive and with setting reasonable premium rates for the insurance, and

(c) expenses for a third-party administrator to assist with the formation and ongoing administration of the Captive (e.g., administration of insurance policies in force, accounting for premium billings and collections and investment of capital and underwriting reserves, preparation and filing of annual reports and other regulatory filings, and other administration matters).

A captive insurance arrangement can be economically viable with annual premium volume of as little as $100,000.

Premiums paid to the Captive are invested during the policy period (along with the initial capital amount) in investments authorized by the applicable regulatory scheme, which generally requires highly liquid low-risk investments. Once the policy period for a pool of premiums expires, any underwriting profits can generally be distributed as a dividend or reinvested in less restrictive investment classes.

RISK MANAGEMENT BENEFITS

A captive insurance arrangement is first and foremost a powerful risk management tool. The Captive typically writes insurance policies covering risks of the operating business that are not currently being insured under the company's existing commercial insurance policies. Examples include loss of key vendors or major contracts, expenses to repair media reputational damage, adverse financial consequences of legislative and regulatory changes, and loss of franchise license or lease. Policies covering these risks are often not available in the commercial insurance market or may prove too costly to obtain. Many of the risks that should be considered for a captive can be found in the exclusions sections of the company's existing policies, and an uncovered loss is often the impetus for a business establishing a captive.

By obtaining coverage for these risks through the Captive, the company can more effectively identify its uninsured risks, institute loss prevention and containment measures for the risks as appropriate, and set aside assets to cover future losses and smooth the cash flow effects of a loss. A Captive has many advantages over insuring the risks in the traditional insurance market, including streamlining claims review and processing, insulating the company from wild swings in premium rates that can occur in the commercial insurance markets, avoiding or minimizing profit loads, broker commissions, and administrative costs associated with traditional insurance, and capturing for the company savings associated with investment of policy reserves and better than average claims experience. Analysis of these advantages can sometimes cause a company to reconsider whether some risks being insured through the traditional insurance market should instead be insured through a captive arrangement.

TAX BENEFITS

In addition to providing impressive risk management benefits, a small captive insurance company enjoys a significant income tax benefit. And, in the context of a closely held business, a captive insurance arrangement can also provide significant gift and estate tax benefits.

Income Tax Benefits

Assuming the Captive receives less than $1.2 million of net written premiums for the tax year, it is subject to tax only on its taxable investment income; its underwriting income is exempt from tax. This means that while the business obtains a deduction against ordinary income for the premiums paid to the Captive, the Captive is not subject to tax on the premium income. Business profits are effectively converted into nontaxable income. When the Captive's underwriting income is distributed to the family trust, the trust (or the grantor, if the trust is a grantor trust) is taxed on the income at qualified dividend rates.

If a business generates significantly more than $1.2 million in profits and premiums annually, it may be possible to use more than one small captive insurance company arrangement to maximize the income tax benefits of the arrangement.

Estate Tax Benefits

In addition to the income tax benefits described above, a small captive insurance company arrangement can also provide significant gift and estate tax benefits. Underwriting profits of the Captive, which would, in the absence of the captive arrangement, accrue to the business owner and be included in his or her taxable estate at death, now accrue to the family trust without incidence of gift or estate taxes and without using any of the business owner's annual or lifetime exclusion amounts. Depending on the profitability of the underlying insurance, the captive arrangement can move substantial assets from the business owner to his or her family free from gift and estate taxes and at deferred and reduced income tax rates. Structured properly, the family trust also may be able to take advantage of generation-skipping.

Note also that by having the family trust taxed as an intentionally defective grantor trust for income tax purposes, the business owner can effectively move additional assets to the trust by paying the income taxes due on income of the trust (i.e., dividends received from the Captive).

ASSET PROTECTION PLANNING

In a properly structured captive insurance arrangement, the premium dollars moved to the Captive, and the earnings on those premium dollars, are removed from the reach of creditors of the business and the owners, except to the extent the premiums and earnings are used to cover losses insured by the Captive. For the owners of a business operating in a high risk industry (like health care, chemicals, transportation, etc.), or for any business owner concerned about potential future creditor claims, the asset protection planning afforded by a captive can be a significant benefit.

CONCLUSION

For a profitable privately held business, a captive insurance arrangement can be a powerful risk management tool that provides significant income tax, estate and gift planning, and asset protection benefits. If you are an owner of, or advisor to, such a business, Strasburger lawyers can assist you in reviewing and implementing a captive insurance arrangement for the business if one makes sense.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.