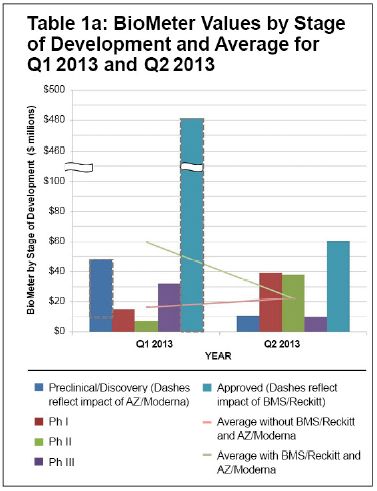

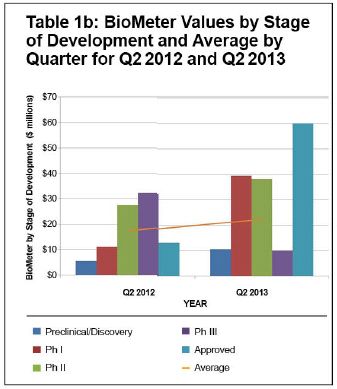

The average BioMeter value in the second quarter of 2013 was $22.2 million, an increase from the $16.3 million value in the first quarter (excluding BMS/Rickets and AZ/Moderna), and down from $59.4 million in the first quarter (including BMS/Rickets and AZ/Moderna). The increase was driven largely by increases in BioMeter value for Phase 1 and Phase 2 transactions. The BioMeter value for Phase 1 transactions increased to $39.3 million in the second quarter from $15.0 million in the prior quarter, driven largely by the MorphoSys/Celgene transaction for MOR202. Excluding that transaction, the BioMeter for Phase 1 transactions in the first quarter held relatively steady at $13 million. The BioMeter value for Phase 2 transactions increased to $38.1 million in the second quarter from $7.4 million in the first quarter, returning to more typical levels. The BioMeter value for pre-cinical and discovery transactions remained relatively constant at $10.5 million.

Compared to the second quarter of 2012, the average BioMeter also increased, with increases in pre-clinical and discovery ($10.5 million vs. $5.5 million), Phase 1 ($39.3 million vs. $11.1 million) and Phase 2 ($38.1 million vs. $27.5 million). With few reported Phase 3 and approved product transactions in either quarter, it is hard to draw conclusions about trends in value in those categories.

The second quarter of 2013 was also notable for the relative dearth of licensing and collaboration agreements for Phase 3 and approved products, with only one in each category that disclosed the value of up-front payments. This continues a trend observed starting at the end of 2012. The biotech IPO window of 2013 may contribute to this for the rest of 2013. One analysis of 2013 biotech IPOs has reported that nine companies that went public in the first half of 2013 were in Phase 2, and four were in Phase 1 or pre-clinical. Access to capital through the public markets will allow companies to fund later-stage trials themselves, rather than relying on pharma to carry those programs forward.

Overall, the number of transactions reporting up-front payments remained similar in the second quarter compared to the prior quarter and the same quarter in 2012, with an uptick in the number of pre-clinical and discovery transactions largely offsetting the decline in the number of Phase 3 and approved transactions compared to a year ago.

Collectively, these data suggest an improved licensing environment for products from early stage through Phase 2.

ABOUT MOFO BIOMETER

The MoFo BioMeter is an index that measures the health of the biotechnology industry. The BioMeter averages up-front payments in licensing, collaboration, and development agreements between biotechnology companies (broadly defined) and companies that pay for commercialization rights. We focus on upfront payments because they are the most concrete representation of the value of a development-stage asset, and also because in an era of constricted venture funding for unapproved therapeutics, up-front payments from collaboration agreements have become an increasingly necessary source of capital for companies to sustain their development efforts. The BioMeter also allows us to measure changes in the industry, or by sector, over time.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved