The UK Government has recently published further details on a package of tax, planning and community benefits to help kick-start shale gas exploration in the UK. These measures will be welcomed by those in (or looking to enter) the industry, since they are generally favourable and increase the levels of clarity and certainty – pre-requisites for an industry which relies on long-term investment.

The relevant documents published last week are a Government consultation regarding a specific tax regime for shale gas, and guidelines to local authorities for considering planning requests for onshore oil and gas exploration and extraction.

These measures have followed soon after studies showing that the UK's shale gas resources are much larger than previously anticipated (as covered in a previous alert), and can be seen as the "next step" in developing a thriving shale gas industry in the UK.

Tax Proposals

The UK Government has pledged to create the world's most generous tax regime for shale gas. Its main proposal is to cut the tax on a portion of the shale production to 30 per cent, compared with the 62 per cent currently paid by most oil and gas operators in the UK. It also proposes to maintain the time value of companies' losses for up to 10 years, so that their value does not diminish before they can be offset against future profits.

Although these proposals are still part of a formal consultation process, they have been influenced by informal discussions already held with the industry. They will be warmly greeted by shale gas operators, and we do not expect them to change significantly before they are introduced next year. The main development is likely to be announcing the amount of the production income exempt from the 32 per cent supplementary charge to tax, which will reflect a proportion of the capital expenditure incurred on a drilling and extraction site. The Government states that this amount may need to be higher during the industry's exploration phase, but it is seeking further views on the economics of shale gas projects before reaching a decision.

The Government recognises that shale gas is a new industry which will require substantial expenditure before profits are made. Companies will bear significant risk during the exploration phase and experience high on-going well intervention costs and longer payback periods than for conventional onshore oil and gas developments. The Government has therefore proposed a tax regime for shale gas which is broadly consistent with the approach taken by it on the challenging oil and gas fields in the North Sea. That approach has been credited with extending the economic life of those fields.

The consultation is open for responses until 13 September 2013, and the Government will publish a summary of responses to this consultation later in the year.

Planning and Community Proposals

The shale gas industry regards planning permission and public support as bigger obstacles to shale gas exploration in the UK than tax issues.

The recently published guidance for local authorities on the planning regime for onshore oil and gas should give the shale gas industry some transparency on the planning process that will be adopted. This guidance, in conjunction with the Environment Agency's plan to streamline and simplify the environmental permitting processes for shale gas developments (and thereby reduce the average timeframe from 13 weeks to less than a fortnight) further indicates the Government's push to develop the shale gas industry in the UK.

As part of the streamlining of the planning procedure, the guidance reiterates the National Planning Policy Framework position regarding information requirements for applications; these should be "proportionate to the nature and scale of development proposals and reviewed on a frequent basis", and supporting information should only be requested if it is "relevant, necessary and material" to a particular application.

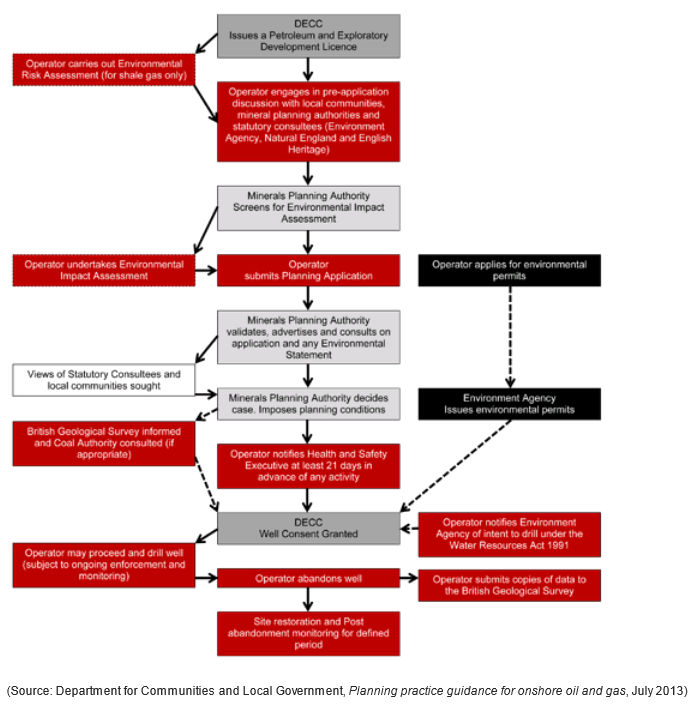

The guidance includes a flowchart, outlining the planning process that will apply for exploration. This flowchart is set out below.

An important aspect of the guidance is the separation between planning applications for exploration and those for extraction. It notes that exploration applications should be considered "on their own merits", without taking into account "hypothetical future activities for which consent has not yet been sought". Although this is likely to simplify the planning process for exploration, it does mean that a site that is granted planning permission for exploration will not be guaranteed planning permission for extraction.

However, the Government has sought to minimise this risk by emphasising the importance of oil and gas extraction to the UK economy. The guidance states that "great weight" should be given to the benefits of oil and gas extraction when local authorities are deciding whether or not to grant planning permission.

The guidance also indicates the roles that various bodies and government departments will have in the regulation of shale gas. As well as the Department for Communities and Local Government, which issued the guidance for local authorities, the Department of Energy and Climate Change is responsible for controls to mitigate seismic risks, the Health and Safety Executive is responsible for legislation concerning well design and construction, and the Environment Agency is responsible for environmental permitting.

Environmental Impact Assessments (EIAs) are also covered by the guidance; it states that EIAs will only be required if "the project is likely to have significant environmental effects". Although the guidance confirms that an EIA will not always be necessary, the Government is keen to ensure that any extraction operations are subject to mitigation measures to prevent, as far as possible, any adverse environmental impact of the operations. The guidance includes model planning conditions that local authorities can impose, such as prevention of water-system contamination, noise control and monitoring, and protection of wildlife, flora and fauna.

Conclusion

Notwithstanding the regulatory hurdles that shale gas exploration faces, the UK Government is giving every indication that it is encouraging shale gas exploration in the UK, as one of a number of potential electricity sources that can help the Government keep the lights on whilst lowering carbon emissions. The proposed tax regime should incentivise investment in the shale gas industry, whilst the planning guidance reiterates the Government's position that the UK will need energy from a variety of sources if it is to keep consumers happy during the transition to a low-carbon electricity market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.