By W. David Montogmery1 and Sugandha D. Tuladhar2

Introduction

The United States (U.S.) has witnessed a significant shift in natural gas production in the past five years. Optimism about shale gas potential and accelerated recovery has created a shale gas boom. The belief that U.S. would continue to be a net importer of natural gas in the foreseeable future has completely changed. U.S. shale gas production has increased rapidly due to advances in hydraulic fracturing and horizontal drilling techniques that have reduced production costs. The full-cycle cost of shale gas production dropped by about 40% to 50% relative to the cost of conventional natural gas extraction in 2011.5 As a result, the outlook for natural gas production is more optimistic now than ever before. According to the latest Annual Energy Outlook 2013 (AEO 2013), the Energy Information Administration (EIA) projects the U.S. natural gas production will increase by about 40% by 2040 from its current level of 27.4 trillion cubic feet (tcf), mainly because of expected increases in shale gas production over the next two decades. Shale gas is projected to account for more than 50% of total U.S. natural gas production by 2040.

The shale boom has moved natural gas to center stage in energy policy debates. The potential for such a large supply of natural gas has generated interest in converting current regasification plants to liquefaction plants or even building new liquefaction plants to allow them to export liquefied natural gas (LNG) to international markets. NERA Economic Consulting (NERA), at the request of the U.S. Department of Energy, Office of Fossil Energy (DOE), conducted an objective and independent study (NERA Study) to assess the potential macroeconomic impacts on the U.S. economy of LNG exports.

This article summarizes the NERA Study by providing a brief overview of the study objectives, framework for the analyses, and some key findings.

NERA Study Objective

The primary objective of the NERA Study was to evaluate the macroeconomic impacts of different levels of LNG exports based on a study conducted by the U.S. EIA.6 We addressed the same set of 16 scenarios for LNG exports analyzed by EIA. These scenarios incorporated different assumptions about the U.S. natural gas supply and demand outlook and LNG export levels. Our U.S. natural gas outlook included a Business As Usual (BAU) baseline that is consistent with the Reference case of the AEO 2011; a High shale estimated ultimate recovery (EUR); and a Low EUR case based on AEO 2011. We also simulated macroeconomic impacts of other feasible LNG export scenarios by characterizing different international gas market conditions.

Study Approach

To conduct this study, we used our forward-looking dynamic computable general equilibrium model (NewERA model) of the U.S. economy. The NewERA model can be used to analyze impacts of command and control regulations, market-based policies, and trade policies such as LNG export policies on regional economies and economic sectors. Different types of policies could impact a sector in a variety of ways. When evaluating policies that have impacts on the entire economy (such as LNG exports) that cause changes in export revenues as well as changes in the natural gas market, one needs to use economic tools that capture the effects as they ripple through all sectors of the economy and take into account the associated feedback effects. The NewERA modeling framework takes into account interactions among all parts of the U.S. economy as well as changes in terms of trade and export revenues. The NewERA model is based on a unique set of databases constructed by combining economic data from the IMPLAN 2008 database and energy data from EIA's AEO 2011.

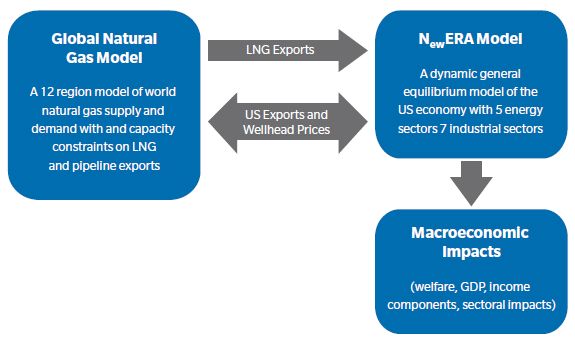

Figure 1: Linkages between the Global Natural Gas Model and the NewERA model

The The NewERA model is linked to NERA's Global Natural Gas Model (GNGM) through LNG export volumes and net-back prices. GNGM is a partial-equilibrium model designed to estimate the amount of natural gas production, consumption, and trade by major world natural gas consuming and/or producing regions. The model includes 12 regions that are largely adapted from the EIA International Energy Outlook (IEO) regional definitions, with some modifications to address the LNG-intensive regions. The model's international natural gas consumption and production projections for these regions are calibrated to the EIA's AEO and IEO 2011 Reference cases. The model maximizes the sum of consumers' and producers' surplus less transportation costs, subject to mass balancing constraints and regasification, liquefaction, and pipeline capacity constraints.

The GNGM is able to estimate the levels of LNG exports and net-back prices to the U.S. under different international markets dynamics. These outputs are exogenously linked to the macroeconomic model which projects the macroeconomic impacts on the economy. Figure 1 shows the linkages between the two models.

Major Findings of the Macroeconomic Study

We found that the U.S. would only be able to market LNG successfully with higher global demand or lower U.S. costs of production than in the Reference cases. The market limits how high U.S. natural gas prices can rise under pressure of LNG exports because importers will not purchase U.S. LNG exports if the U.S. wellhead price plus processing and transport costs rises above the cost of competing supplies.

Macroeconomic impacts of LNG exports are positive in all cases

There were net economic benefits to the U.S. economy across all the scenarios that we examined in which the global market would take LNG exports from the U.S. Moreover, for every one of the market scenarios examined, net economic benefits increased as the level of LNG exports increased. In particular, scenarios with unlimited exports always had higher net economic benefits than corresponding cases with limited exports. There was no "sweet spot," and no point where any "balance" was required to gain the greatest benefits.

In all of these cases, benefits that come from export expansion would more than outweigh the costs of faster increases in natural gas production and slower growth in natural gas demand, so that LNG exports have net economic benefits in spite of higher domestic natural gas prices. This is exactly the outcome that economic theory describes when barriers to trade are removed.

Net benefits to the U.S. would be highest if the U.S. becomes able to produce large quantities of natural gas from shale at low cost, if world demand for natural gas increases rapidly, and if LNG supplies from other regions are limited. If the promise of shale gas is not fulfilled and costs of producing natural gas in the U.S. rise substantially, or if there are ample supplies of LNG from other regions to satisfy world demand, the U.S. would not export LNG. Under these conditions, allowing exports of LNG would cause no change in natural gas prices and do no harm to the overall economy.There should be nothing surprising about the conclusion that the U.S. economy is better off with unrestricted trade in natural gas than with any restrictions because basic international trade economics principles makes this inescapable. This same conclusion is reached by other researchers have deep knowledge of the natural gas markets, despite many differences in details of the level of exports and price impacts.6

Impacts on the U.S. natural gas prices are moderate and will not rise to the Asian market prices

U.S. natural gas prices increase when the U.S. exports LNG. But the global market limits how high U.S. natural gas prices can rise under pressure of LNG exports because importers will not purchase U.S. exports if delivered prices from the U.S. rise above the cost of competing supplies. In particular, the U.S. natural gas price does not become linked to oil prices in any of the cases examined.

Natural gas price changes attributable to LNG exports remain in a relatively narrow range across the entire range of scenarios. Natural gas price increases at the time LNG exports could begin range from zero to $0.33 (2010$/Mcf). The largest price increases that would be observed after 5 more years of potentially growing exports could range from $0.22 to $1.11 (2010$/Mcf). The higher end of the range is reached only under conditions of ample U.S. supplies and low domestic natural gas prices, with smaller price increases when U.S. supplies are more costly and domestic prices higher.

In addition, U.S. natural gas prices will not rise to levels seen in the Asian markets, or even to the net-back price based on current Asian market prices. Our analyses show that there will always be a difference of $6 to $8 between the Asian prices and the U.S. prices, since that represents the cost of inland transportation, liquefying, shipping, and regasifying natural gas to get it from the U.S. to Japan or Korea. Even with no binding export limits, the U.S. natural gas price will still be below the import price in the Asian markets since Asian buyers have no incentive to buy natural gas in the U.S. if it is not cheaper than their prevailing domestic price by that amount.

Serious competitive impacts are likely to be confined to narrow segments of industry

Economists who analyze how changes in energy costs affect energy-intensive, trade-exposed industries have reached a consensus that only narrowly-defined segments of manufacturing are at risk from higher energy costs. These sectors have relatively small employment and value added compared to manufacturing as a whole, so that even large impacts on these narrow segments translate into negligible impacts on manufacturing and the overall U.S. economy. The only chemical sector that is held out as evidence of widespread harm from higher natural gas prices is the nitrogenous fertilizer industry, which employs an insignificant amount of labor. This subsector of chemicals is not typical of the chemicals sector as a whole; it is a unique outlier based on turning cheap natural gas into cheap fertilizer with low profit margins and little significance for the overall economy. Our analysis suggests that future output in these sectors would fall short of baseline levels by less than 1%.

Thus, the rationalizations offered for prohibiting or limiting LNG exports – that overall energy prices will increase or that certain narrow sectors need to be protected – do not stand up to economic analysis. Consistent with basic free trade principles, the range of aggregate macroeconomic results from this study suggests that LNG exports have net benefits to the U.S. economy as a whole and that trade restrictions would harm both the U.S. economy and its trading partners.

Footnotes

* This article is based on the study: W. David Montgomery, Robert Baron, Paul Bernstein, Sugandha D Tuladhar, Shirley Xiong, and Mei Yuan, "Macroeconomic Impacts of LNG Exports from the United States," NERA Economic Consulting, Washington DC, December 3, 2012. http://www.fossil.energy.gov/programs/gasregulation/reports/nera_lng_report.pdf

1 Senior Vice President, W.David.Montgomery@NERA.com, Tel: 1-202-466-9294

2 Corresponding author: Senior Consultant, Sugandha.Tuladhar@NERA.com, Tel: 1-202-466-9206

3 IHS Global Insight (2011): The Economic and Employment Contributions of Shale Gas in the United States prepared for America's Natural Gas Alliance. December 2011.

4 Effect of Increased Natural Gas Exports on Domestic Energy Markets, U.S. Energy Information Administration, January 2012. http://www.eia.gov/analysis/requests/fe/pdf/fe_lng.pdf

5 Charles Ebinger, Kevin Passy, and Govinda Avasaral "Liquid Markets: Assessing the Case for U.S. Exports of Liquefied Natural Gas," Energy Security Initiative at Brookings, The Brookings Institute, May 2012, Policy Brief 12-01.

Kenneth B. Medlock III, PH.D., "U.S. LNG Exports: Truth and Consequence," James A. Baker III Institute for Public Policy, Rice University, August 10, 2012.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.