NEWS FROM THE COURTS

Refinement re "Don't Ask, Don't Waive" Standstill Agreements

The Delaware Court of Chancery has issued another ruling on "Don't Ask, Don't Waive" standstill agreements. These provisions prohibit bidders from requesting a target to waive standstill restrictions in order to permit the bidder to submit a higher bid. Chancellor Strine found that Don't Ask, Don't Waive Standstills can be a breach of the board's fiduciary duties in an auction unless they are considered by the Board on an informed basis (for example, as part of a planned strategy to elicit a "best and final" offer from all bidders participating in an auction).

This ruling offers a helpful refinement of the state of the law following the Court of Chancery's November ruling in In Re Complete Genomics. As we reported in the last edition of the Ropes Recap, Vice Chancellor Laster's ruling in Genomics called into question the enforceability of Don't Ask, Don't Waive Standstills generally. However, Chancellor Strine read the Genomics ruling as fact-specific, and observed that "there is a role that bench opinions play, and I don't think it's to make per se rules." In Strine's view, Don't Ask, Don't Waive Standstills are potent enough in restricting the bidding process that they can easily cause a board to violate its fiduciary duties, but whether the board actually violated its duties is a fact-specific inquiry. For more in-depth information about this case from Ropes & Gray attorneys, see our January 8 Client Alert. (In Re Ancestry.com Inc. Shareholder Litigation, C.A. No. 7988-CS (Del. Ch. Dec. 17, 2012))

In a related development, the Superior Court of the State of Washington in Snohomish County denied a shareholder plaintiff's request for an injunction on a shareholder vote for a merger between Honeywell and Intermec. The Washington Court acknowledged the Delaware cases regarding Don't Ask, Don't Waive standstill provisions. However, instead of applying Delaware law, the Court conducted a fact-specific inquiry and ultimately concluded that the only parties who signed standstill provisions containing a Don't Ask, Don't Waive provision were not serious bidders and therefore were unlikely to have submitted subsequent higher bids. While this ruling was narrowly tailored, it does show the risk of inconsistent outcomes as complex corporate governance issues are adjudicated outside of Delaware. (In re Intermec, Inc. S'holder Litig., No. 12-2-01841-1 (Wash. Super. Ct. Mar. 15, 2013))

Proposed Delaware "Medium-Form Merger" To Create an Alternative to Top-Up Options

There is currently proposed legislation before the Corporation Law Section of the Delaware State Bar Association concerning amendments to the DGCL. Among these proposed amendments is the addition of a "medium-form merger" procedure which would obviate the need for a stockholder vote for a back-end merger following a public tender or exchange offer. Currently, the only way for a corporation to avoid the shareholder vote requirement is to undergo a short-form merger which requires the acquisition of 90% of the target's outstanding stock, which is often accomplished by the issuance of stock to the acquirer after the closing of the tender offer through a so-called "top-up option". The proposed legislation provides that stockholders of a target corporation whose shares are listed on a national securities exchange or held of record by more than 2,000 holders immediately prior to the signing of the merger agreement would not have to authorize the back-end merger if: (1) the merger agreement states it is governed by the new procedure and the merger is to be effected as soon as practicable following the consummation of a qualifying tender or exchange offer; (2) an acquirer consummates a tender or exchange offer for all of the outstanding stock of the target corporation, on the terms provided in the merger agreement, which would otherwise have been subject to a shareholder vote; (3) following the completion of the offer, the acquirer owns at least the percentage of the stock of the target corporation that would otherwise be required to approve the merger under the DGCL and the target's certificate of incorporation; (4) the acquirer is not an "interested stockholder" (as defined in Section 203 of the DGCL) of the target corporation; and (5) the shares of the target corporation that are canceled in the back-end merger are converted into the right to receive the same consideration paid for shares in the tender or exchange offer. The prohibition on the acquirer being an "interested stockholder" applies regardless of whether the target corporation has waived the Section 203 takeover defense, making this type of merger applicable only to true third-party merger scenarios. The effect of this legislation would be to eliminate the need to satisfy the short-form merger 90% ownership requirement to substantially reduce costs and delay associated with a stockholder vote and to eliminate the need for "dual-track" structuring in acquisitions, whereby acquirers undertake a friendly tender offer and commence the proxy solicitation / shareholder meeting process at the same time to try to speed up acquisition process. If enacted, the proposed amendment would become effective on August 1, 2013. (An Act to Amend Title 8 of the Delaware Code Relating to the General Corporation Law, § 6 (2013))

Court Rejects Settlement of Transatlantic Deal Litigation

On February 28, Chancellor Strine refused to approve a proposed settlement of the deal litigation challenging Alleghany Corporation's 2012 acquisition of Transatlantic Holdings, Inc. ("Transatlantic"). The litigation settled when Transatlantic agreed to make limited supplemental disclosures. The shareholders subsequently approved the transaction, with 99.85% of the voting shares voted in favor. Chancellor Strine had two major issues with the proposed settlement. First, plaintiffs' counsel was unable "to explain in any rational way why the disclosures that they had obtained were in any meaningful way of utility to someone voting on the merger." As a result he concluded that the supplemental disclosures were inadequate consideration for a class-wide release. Second, he concluded that the lead plaintiffs were inadequate class representatives. Both lead plaintiffs were individual shareholders, and neither held a substantial stake in Transatlantic (one lead plaintiff held only held two shares). Neither lead plaintiff could remember how, or even whether, they had voted on the transaction. Thus, Chancellor Strine stated that he did not "have any confidence . . . that there was a real plaintiff behind this monitoring counsel."

Chancellor Strine expressed sympathy for the defendants, whom he acknowledged faced an "imponderable situation" and had responded by issuing immaterial supplemental disclosures to settle unmeritorious claims. However, he noted that the court has a paramount duty to "look out for the class." This decision exemplifies the real concerns that many M&A defendants face when seeking to resolve deal litigation. There continues to be a real risk that the courts will not approve disclosure only settlement terms in some situations. (In Re Transatlantic Holdings, Inc. Shareholders Litigation, C.A. No. 6574-CS (Del. Ch. Feb. 28, 2013))

Chancery Confirms Contractual Waiver of Fiduciary Duties in Delaware Limited Partnerships

In Gerber v. EPE Holdings, the Delaware Court of Chancery dismissed an action that attempted to circumvent the provisions of a Delaware limited partnership agreement. The LP agreement provisions waived fiduciary duty claims in favor of explicit contractual obligations.

In 2009, the partnership, EPE, purchased units of another partnership, Tepco LP, for approximately $1.1 billion. The GPs of both EPE and Tepco were controlled by the same family. Just two years earlier, another entity controlled by the same family had purchased units of Tepco for a much lower per unit price. The sale to EPE implied a more than tripling in value of Tepco in that time. The plaintiff challenged the transaction on behalf of EPE unit-holders, alleging that EPE's purchase of Tepco units was at an inflated price that advantaged the controlling family, and claiming that the transaction was not "fair and reasonable" as required by the LP agreement. Defendants argued that the "fair and reasonable" standard was met by obtaining a "Special Approval" provided for in the LP agreement, in which three independent directors on a "Conflicts Committee" would approve the transaction. That committee was only required by the LP agreement to act "in good faith."

The Plaintiff argued that the Conflicts Committee could not have acted in good faith because, among other reasons, it failed to engage in any negotiation with the controlling family and did not obtain any independent financial analysis of the value of the units purchased. The Court rejected this claim, concluding that it was akin to imposing the statutory fiduciary duties that had been explicitly waived by the LP agreement. Instead the Court adopted a standard of subjective good faith—that is, it simply asked whether the Conflicts Committee believed that it was acting in the best interests of the partnership, but not whether the committee's actions were objectively reasonable. While a reasonableness standard might have led to deeper scrutiny of the committee's conclusions, the complaint lacked any basis suggesting subjective bad faith. Affirming the inherently contractual nature of limited partnership duties, the Court refused to impose the higher standard and dismissed the litigation. (Gerber v. EPE Holdings, C.A. No. 3543-VCN (Jan. 18, 2013))

No "Bundling" of Matters Submitted for Shareholder Vote

On February 22, 2013, five days before Apple's annual shareholders' meeting, the United States District Court for the Southern District of New York ruled in favor of David Einhorn, founder of the hedge fund Greenlight Capital, and enjoined Apple from holding a shareholder vote on a proposal to amend certain provisions of its certificate of incorporation. The Court held that, in "bundling" together separate amendments (including the elimination of the board's ability to issue blank check preferred stock and establishing a par value of Apple's common stock) into a single proposal on which shareholders must vote yes or no, Apple violated the SEC's rules prohibiting "bundling" matters put to a shareholder vote.

Exchange Act Rule 14a-4(a)(3) requires proxies to allow shareholders to vote separately on "each separate matter intended to be acted upon." Although the question of what constitutes a "separate matter" has been seldom litigated since the SEC promulgated the rule in 1992, an SEC release specified that "ministerial or technical matters" that do not alter substantive rights would not be considered separate matters. The District Court held that Apple's proposed amendments were not ministerial in nature. It placed special emphasis on Apple's proposal to eliminate "blank check" preferred stock. The court noted that because the "blank check" amendment was at the center of the dispute between Greenlight and Apple, it could infer the materiality of the amendment.

This lawsuit was part of Einhorn's campaign to persuade Apple to distribute some of its massive cash stockpile to shareholders through an issuance of perpetual preferred stock with a 4% annual yield (Einhorn called it the "iPref"). After his suggestion was rebuffed by Apple, Einhorn sued Apple to prevent it from putting the proposal to eliminate the "blank check" provision to a vote so that his iPref proposal would remain a possibility. After Apple's shareholder meeting passed with no vote on the proposal, Einhorn stopped pursuing his iPref proposal.

Einhorn's efforts can be considered part of a trend among shareholder activists who are pushing companies to distribute more cash to shareholders. In a 2010 survey of activist funds, over two-thirds of respondents named excessive cash on a company's balance sheet as their main target for activism. (Greenlight Capital, L.P. v. Apple, Inc., No. 13 Civ. 900 (S.D.N.Y. Feb. 22, 2013))

Contested Director Elections and Use of "Proxy Puts" to Entrench Incumbents

On March 8, 2013, the Delaware Court of Chancery enjoined an incumbent board from soliciting consent revocations in opposition to a consent solicitation launched by a hedge fund and concluded that the incumbent board had likely breached its fiduciary duties in refusing to "approve" the hedge fund's rival slate of directors solely for the purpose of the company's debt agreements in order to neutralize a "Proxy Put" clause in those agreements. TPG-Axon, a hedge fund that holds a 7% stake in Sandridge Energy, Inc. ("Sandridge"), initiated a consent solicitation to de-stagger Sandridge's board by amending the company's bylaws, remove the current directors and install its own slate. The incumbent board resisted that consent solicitation, and sought revocations from shareholders who had provided TPG-Axon with consents. In connection with that campaign, the incumbent board warned shareholders that the election of TPG-Axon's proposed slate of directors would constitute a "change of control" under Sandridge's debt agreements because it would involve the election of a new board not approved by the incumbent board. That would give Sandridge's lenders the right to put $4.3 billion worth of notes back to the company. An individual shareholder who supports the TPG-Axon consent solicitation filed suit against the incumbent board, claiming that the board breached its fiduciary duties by failing to approve the TPG-Axon slate; thereby creating a material economic risk to the company under the terms of the Proxy Put.

The court concluded that the incumbent board failed to articulate any proper basis not to approve TPG-Axon's slate of directors for the limited purposes of neutralizing the Proxy Put, which would not prevent them from continuing to contest the election itself. The incumbent board simply claimed that they were better qualified to run Sandridge than the insurgents. That is insufficient under the Court of Chancery's 2009 ruling in San Antonio Fire & Police Pension Fund v. Amylin Pharmaceuticals. An incumbent board cannot refuse to approve insurgent director candidates for indenture purposes unless it has a reasonable basis to conclude that they lacked the basic integrity or competence to serve as directors of a public company or had some improper purpose. The court concluded that the Sandridge board had merely used the Proxy Put to gain a strategic advantage in the election and, in doing so, had put Sandridge at economic risk. This failed the Unocal intermediate review standard under which defensive responses must not be disproportional to the threat posed.

The court observed that boards should only agree to Proxy Puts after robust bargaining and in exchange for real economic value to the company, and expressed skepticism that bondholders place much value on Proxy Puts in the first place. The opinion stated that independent directors should "police" credit agreement negotiations if they involve potentially entrenching provisions like a Proxy Put, to "ensure that the company itself is not offering up these terms lightly."

The injunction had an immediate impact. Five days after the opinion was issued Sandridge agreed to expand its board by four seats and fill those seats with TPG-Axon representatives. Additionally, Sandridge announced that it would decide whether to remove its CEO by June 30. If Sandridge does not terminate the CEO by that date, three of its existing directors will step down and TPG-Axon will name an additional board member. That would give TPG-Axon majority representation on the Sandridge board. (Kallick v. Sandridge Energy, Inc., C.A. No. 8182-CS (Del. Ch. Mar. 8, 2013))

No Assignment of IP Rights in Reverse Triangular Merger

On February 22, 2013, the Delaware Court of Chancery ruled that, under Delaware law, the acquisition of a company through a reverse triangular merger does not result in an assignment by operation of law or otherwise. In this case, the plaintiff, Meso Scale Diagnostics, alleged that the 2007 acquisition of BioVeris by Roche Diagnostics using a reverse triangular merger structure violated an anti-assignment provision in an agreement to which Meso Scale, Roche, and BioVeris were parties. The Court rejected Meso Scale's allegations, deciding that (1) under Delaware's doctrine of independent legal significance, the fact that an alternative deal structure (e.g., a forward triangular merger) would have triggered the anti-assignment clause did not have any bearing on the reverse triangular merger at issue and (2) under the "objective theory" of contract interpretation, the parties should have reasonably expected, consistent with the vast majority of commentary discussing reverse triangular mergers, that a reverse triangular merger does not constitute an assignment by operation of law. In reaching this decision, the Court of Chancery declined to adopt the U.S. District Court for the Northern District of California's holding in SQL Solutions v. Oracle Corp. (1991 WL 626458, at *1 (N.D. Cal. Dec. 18, 1991)) that, under California law, a reverse triangular merger constituted an assignment of the target company's license agreements where a party to the license agreement would be "adversely impacted." For more information, see our March 21 Client Alert (Meso Scale Diagnostics, LLC v. Roche Diagnostics GMBH, C.A. No. 5589-VCP (Del. Ch. Feb. 22, 2013))

Chancery Finds That Allegations of Disparate Treatment of Bidders State Claim for Bad Faith

The Delaware Court of Chancery has allowed a post-closing damages claim to proceed in the purchase of Novell by Attachmate. Plaintiffs alleged that the Novell board preferred Attachmate over an unnamed alternative bidder by providing Attachmate, but not the other bidder, with information about a potential (and lucrative) deal to purchase a portfolio of Novell's patents. Novell also permitted Attachmate to work with strategic partners but denied the same requests from the alternative bidders. While there may be justifiable reasons for differential treatment of bidders, the court determined that, in this case, the Plaintiffs had overcome the presumption that a fiduciary acts in good faith because the alleged disparate treatment went "so far beyond the bounds of reasonable judgment that it seems essentially inexplicable on any ground other than bad faith." (In Re Novell, Inc., S'holder Litig., No. C.A. 6032-VCN (Del. Ch. Jan. 3, 2013))

New York Court Refuses to Stay or Dismiss Case in Favor of Delaware Action

In a recent decision, Justice Kornreich of New York State Supreme Court refused to dismiss or stay a shareholder litigation challenging IntercontinentalExchange's acquisition of NYSE Euronext in favor of a first-filed parallel action in the Delaware Court of Chancery. In that decision, Justice Kornreich agreed that the New York and Delaware actions were substantially identical, and acknowledged that the first-filed complaint was filed in Delaware. However, in applying an analysis taken from New York's forum non conveniens statute (C.P.L.R. § 327(a)), Justice Kornreich concluded that the relevant factors of hardship to defendants, residence of the parties, jurisdiction and New York's nexus to the litigation all militated in favor of litigating in New York. In so concluding, Justice Kornreich noted that "this is a case about the future of the New York Stock Exchange, one of New York City's iconic institutions and the exchange at the heart of the international financial industry, to which no city is more important than New York." Justice Kornreich was unmoved by the fact that the Delaware action was technically first-filed, as the first Delaware complaint was filed the day on which the transaction was announced and deferring to that action over complaints filed in New York just days later would only "incentivize a race to the courthouse within hours of the announcement of every major corporate merger."

This decision essentially ignored the defendants' arguments that parallel track litigations in New York and Delaware would create an undue burden on the defendants and a risk of inconsistent judgments, and instead emphasized the importance of judicial collaboration in parallel litigation. Additionally, Justice Kornreich entered an order forcing the defendants to include the New York plaintiffs in all discovery negotiations in the Delaware action, and instructed the parties to cooperate on discovery issues. Ultimately, similarly to former Justice Cahn's opinion in In re Topps Co. Shareholder Litigation, this decision reads as a flag in the ground establishing the right of a New York court to adjudicate shareholder litigation challenging a transaction when the target corporation has a strong connection with New York, regardless of whether a parallel action proceeds in another jurisdiction. The opinion goes so far as to state that "[n]o judge in one jurisdiction, having found it appropriate to retain a case, has the ability to direct a judge in another jurisdiction, who has found it appropriate to do the same, to dismiss or stay his or her case." This sends a strong message that Justice Kornreich will not stand down in favor of the Delaware action, and thereby places the defendants in the difficult position of litigating parallel track actions simultaneously to potentially different results. Both the New York and the Delaware lead plaintiffs have filed motions in their respective forums seeking class certification. Interestingly, the New York Appellate Division, First Department, heard an emergency appeal of Justice Kornreich's order and issued, without opinion, a 60-day stay of the New York action in favor of the Delaware action. The order stays the New York action beyond the date for which Chancellor Strine had scheduled a preliminary injunction hearing in the Delaware Action – effectively deferring to Delaware on the issue of whether the transaction should proceed. The First Department's order obviously blunts the precedential impact of the trial court's opinion, and shows deference to Delaware as the appropriate forum for shareholder challenges to change in control transactions involving Delaware corporations. (Matter of NYSE Euronext/ICE Shareholders Litigation, Index No. 654496/2012 (N.Y.S. Sup. Ct. N.Y. Cty. Mar. 1, 2013))

Deference Given to Board's Sales Process & Focus on a Single Qualified Bidder

The Delaware Court of Chancery dismissed claims that a target company's board acted in bad faith, where the target conducted a year-long sale process but was alleged to have failed to adequately pursue an indication of interest from a strategic buyer for a higher price. In failing to credit the plaintiffs' allegations that a board consisting of a majority of disinterested directors ignored its Revlon duties, Vice Chancellor Noble adhered to the well-traveled principle of Delaware law that there is no single blueprint on how to sell a company, and noted that in this instance the target had legitimate concerns about antitrust and confidentiality issues associated with such proposed transaction as well as the seriousness of the strategic buyer. The Court distinguished this case from its decision last year in In Re Answers, in which the plaintiffs' allegations of a manipulated sale process survived a motion to dismiss, noting that the Answers plaintiffs alleged that a majority of the Answers board pushed through a deal with knowledge that its impending results would likely raise Answers' stock price above the deal price, thereby making such transaction less attractive. In contrast, the complaint in this case did not lead the Court to conclude that a majority of the board had acted in bad faith, as opposed to their good faith business judgment. (In Re BJ's Wholesale Club, Inc. Shareholders Litigation, C.A. No. 6623-VCN (Del. Ch. Jan. 31, 2013))

Need for Precision in Finders' Fee/Post-Transaction Employment Agreements

Boulden v. Albiorix, Inc. serves as a reminder that undocumented finders or post-transaction employment arrangements carry along with them the risk of prolonged litigation concerning their precise terms. In this case, Boulden purports to have researched and sourced an acquisition of a chemical plant for Janus Methanol A.G., an investor in the plant. In exchange, a Janus executive was alleged to have promised Boulden a 10% equity interest in the entity that would be formed to consummate the deal and to employ Boulden as President and C.E.O. of that new entity post-acquisition, but definitive documents regarding these arrangements were never executed. When the deal was complete, and after Boulden had worked to help complete the transaction, Janus failed to honor its purported promises. When Boulden sued, Vice Chancellor Noble of the Delaware Court of Chancery allowed Boulden's claims to continue past the motion to dismiss stage of litigation as a result of Boulden's complaint creating a genuine dispute of fact as to whether or not an oral contract actually existed and whether Boulden was entitled to recover on any non-contractual legal theories (such as promissory estoppel and unjust enrichment). (Boulden v. Albiorix, Inc., C.A. No. 7051-VCN (Del. Ch. Feb. 7, 2013))

Deference to Arbitrator's Findings/Risk of Using Independent Valuation Firm as a Contractual Remedy

On February 7, 2013, the Delaware Court of Chancery issued a Master's Report declining to overturn the decision of an arbitrator in a dispute over a post-closing working capital adjustment, despite the Master disagreeing with the arbitrator's interpretation of the contract. In the dispute, the parties to a stock purchase agreement disagreed about whether the SPA required that certain worker's compensation liabilities should be subtracted from working capital for purposes of adjusting the purchase price. In accordance with the SPA, the parties submitted the dispute to an independent accounting firm for resolution, and the firm decided in favor of the seller. The Master disagreed with the accounting firm's interpretation of the contract, but she determined that she must uphold the accounting firm's ruling, noting that, under Delaware law, the Court may overturn an arbitrator's decision only where the arbitrator has acted in "manifest disregard of the law." The Master further stated that a mere error in applying the contract is insufficient grounds for reversal, even where the issue concerns a contractual term that has an established meaning under Delaware case law. This case illustrates the risk of entrusting such disputes to an independent accounting firm, since the firm may not be sufficiently equipped to properly apply the law of contract interpretation to the negotiated terms of the agreement, leaving the losing party with no recourse. The outcome may have been different if the parties had sought judicial resolution of the competing contractual interpretations before engaging the accounting firm to resolve the dispute over the calculation. (Garda USA, Inc. v. SPX Corp., C.A. No. 7115-ML (Del. Ch. Feb. 7, 2013))

M&A Activity Involving Sub-State Government Entities Potentially Not Immune to Antitrust Scrutiny

The United States Supreme Court unanimously decided that the acquisition by a county hospital authority of another hospital in the same county was not immune from antitrust scrutiny under the state action doctrine, even though the hospital authority had been delegated broad powers under a state statute. As a result, merger and acquisition activity involving sub-state governmental entities that were previously thought to be immune from federal antitrust scrutiny may become subject to such scrutiny. For more in-depth information about this case, see our February 20 Client Alert. (FTC v. Phoebe Putney Health System, Inc., No. 11-1160 (Feb. 19, 2013))

Recent DOJ Antitrust Enforcement Actions under New AAG William Baer

For its first significant action under William Baer, the antitrust division of the Justice Department filed a complaint to enjoin the acquisition of Grupo Modelo S.A.B. de C.V. ("Modelo") by Anheuser-Busch InBev SA/NV ("ABI"), which currently has a non-controlling interest in Modelo. The proposed acquisition would consolidate the largest and third largest beer companies in the U.S. Within weeks of the suit, ABI offered to sell its rights to Corona and other Modelo brands in the U.S. to a large wine company, Constellation Brands, for $2.9 billion. The parties jointly requested a stay of litigation proceedings until March 19, 2013 to resolve the concerns raised in the DOJ's complaint. (Cmplt. in U.S. v. Anheuser-Busch InBev SA/NV and Grupo Modelo S.A.B. de C.V., No. 13 Civ. 00127 (Jan. 31, 2013 D.D.C.))

Deal Litigation Still Pervasive; Plaintiffs' Firms Launching New Attacks on Disclosures in Annual Meeting Proxies

On February 28, Cornerstone Research issued its annual review of shareholder litigation involving mergers and acquisitions. This report, authored by Robert Daines of Stanford Law School and Olga Koumrian of Cornerstone, evaluated trends and developments in M&A-related shareholder litigation filed in 2012. The report concluded, unsurprisingly, that almost all public company transactions of any material size spark shareholder litigation: suits were filed in 96% of transactions valued over $500 million, and in 93% of transactions valued over $100 million. Those actions were typically resolved prior to any injunction hearing, and were customarily settled for supplemental public disclosures. Delaware continues to be the prime locus of M&A-related shareholder suits. According to the study 39% of such suits were filed in Delaware in 2012 as compared with 32% in 2011 and 25% in 2010.

The Cornerstone report also identified a new trend in which repeat player plaintiffs' class action firms filed lawsuits challenging annual proxy votes. These lawsuits seek to enjoin such votes because of allegedly insufficient disclosures regarding executive compensation. These suits have met with minimal success to the extent they have been litigated through an injunction hearing, with courts expressing skepticism regarding plaintiffs' ability to demonstrate irreparable harm with respect to advisory "say-on-pay" votes. However, at least one plaintiff obtained a preliminary injunction on the grounds that additional shares issued in connection with the company's executive compensation plan were dilutive to existing shareholders. That injunction catalyzed a number of quick settlements in which the defendant company agreed to provide additional disclosures regarding executive compensation. For more in-depth information about this report and the recent rise in suits challenging annual proxy disclosures regarding executive compensation, see our March 1 Client Alert. (Shareholder Litigation Involving Mergers & Acquisitions, Robert M. Daines & Olga Koumrian, February 28, 2013)

NOTABLE PENDING DEALS

Heinz acquisition by Berkshire/3G

Shareholder vote on merger set for April 30. Holders of Heinz shares as of March 18 are entitled to vote on the previously announced merger agreement, dated as of February 13, 2013, providing for the acquisition of Heinz by an investment consortium comprised of Berkshire Hathaway and an investment fund affiliated with 3G Capital. The parties have received early termination of the waiting period under the HSR Act, which satisfies one of the conditions to closing. Heinz shareholders will receive $72.50 in cash for each share of common stock they own, in a transaction valued at $28 billion, including the assumption of Heinz's outstanding debt. The deal is expected to close late in the second quarter of 2013 or in the third quarter.

Dell acquisition by its founder/Silver Lake Partners (with competing bids received)

Competing bids by Blackstone and Carl Icahn received during the go-shop. After consultation with its independent financial and legal advisors, Dell's special committee determined that both proposals could reasonably be expected to result in superior proposals, as defined under the terms of the existing merger agreement. Therefore, each of the Blackstone and Icahn groups is an "excluded party" and the special committee has said that it intends to continue negotiations with both to see if they will in fact lead to a superior proposal. Mr. Dell and Silver Lake plan on taking complete control of Dell, while Blackstone and Icahn are each contemplating leaving some portion of the company in public shareholders hands.

T-Mobile –MetroPCS merger

Shareholder vote on merger set for April 12. T-Mobile USA, Inc. and MetroPCS Communications, Inc. announced that they have now received all regulatory approvals in connection with the proposed combination of T-Mobile USA, a wholly-owned subsidiary of Deutsche Telekom, and MetroPCS. On March 20, the Committee on Foreign Investment in the U.S. advised Deutsche Telekom and MetroPCS that it has determined that there are no unresolved national security concerns with the deal and that it has concluded its review. This concludes all regulatory approval the parties were seeking prior to closing.

Royal Pharma tender offer for Elan

On February 25, Royalty Pharma announced a tender offer to acquire Elan Corp, plc, for the equivalent of $11 USD per share and Elan ADS. The offer represents an approximate 12.6% premium to the closing price per share of Elan stock on the NYSE as of February 14, 2013. The offer is subject to, among other things, (i) no extraordinary transactions by Elan apart from the completion of the Tysabri sale, (ii) the completion of the Tysabri sale with no material changes from the terms announced on February 6, 2013, (iii) unanimous recommendation of the offer by the directors of Elan and (iv) firm, irrevocable undertakings to accept the offer or to vote in favour of the scheme of arrangement from each of the directors of Elan. On March 4, the board of Elan approved a cash dividend policy linked directly to the long term performance of Tysabri. The press release also said that Elan would begin a $1 billion share repurchase program with a portion of the Tysabri payment.

LONDON UPDATE

Restrictive Covenants in Purchase Agreements

Pursuant to English common law, restrictive covenants (on sellers in the context of a share sale agreement and otherwise) are potentially void as an unlawful restraint of trade. They are enforceable only if they are in the public interest and go no further than is necessary to protect the legitimate business interests of the beneficiary of the covenant. In addition, where UK and EC competition rules apply, guidance states that non-compete restrictions can be justified for a period of up to three years where both goodwill and know how are transferred, but only two years where it is solely goodwill.

In situations where UK and EC competition law is not relevant, the English High Court has now held that a restrictive covenant on a founder seller of a company that, in the absence of breach, would last for a minimum of eight and a half years, was enforceable. It was not an unreasonable restraint of trade: there was substantial goodwill in the target business, for which the buyer had paid substantial consideration; the clause had been fully negotiated on a level playing field; and the buyer's view that the seller would be a formidable competitor and that any such competition would have a materially detrimental impact on the business was reasonable. The case clearly turned on its own facts, but shows that courts will entertain long period of restriction, if justified in the circumstances. (Cavendish Square Holdings BV and another v El Makdessi [2012] EWHC 3582 (Comm).)

Warranty or Representation?

The English High Court has ruled that where the warranties given in a share sale agreement are expressed to be warranties and not representations, and this distinction is supported by an interpretation of the sale contract as a whole, there is no sustainable argument for construing the warranties as representations. In such circumstances, a breach of an express warranty would not support an action for negligent misrepresentation.

Why is this of interest? In the case under consideration, which related to the breach of certain accounts warranties, the claimant's remedy for the breach was confined to damages for breach of contract (to put it in the position that it would have been in had the warranties been correct). It was not able to recover a significantly higher level of damages on the basis of misrepresentation (to restore it to the position that it was in prior to entering the contract, which, in the case in point, might reflect or even exceed the consideration paid for the company). The difference in the level of possible awards was estimated to be more than £10 million.

This decision does run counter to another decision of the High Court in recent years, and so may be open to further debate. What the decision does underline, however, is the need to be mindful of the distinction between warranties and representations when negotiating a sale contract under English law. The parties to a sale contract should be clear as to whether or not statements of fact that have been made by a seller are intended to be actionable as representations as well as warranties, and to ensure that the drafting of the contract, including the "entire agreement clause" and "remedies clause," reflects a position that is consistent throughout. (Sycamore Bidco Ltd v Breslin and another [2012] EWHC 3443(Ch).)

VAT on Acquisition Costs

The Court of Appeal has refused BAA's appeal in a case about the VAT on the professional fees incurred by the consortium vehicle in the takeover of BAA by the Ferrovial consortium back in 2006. The company formed by the consortium had become part of the BAA VAT group on completion and sought to reclaim VAT on the professional fees on connection with the bid. The principles are the same as when a company is formed for the purpose of making a private acquisition, and we have traditionally used grouping as a method of enabling VAT to be reclaimed on fees on acquisition costs. In the BAA case, HMRC sought to deny the claim on the basis that the bid vehicle (ADIL) had never carried on an economic activity, its only purpose being to acquire the shares of BAA in the bid. BAA had won in the First Tier Tribunal on the basis that ultimately ADIL would take over the management of the group. However, the Upper Tier Tribunal allowed HMRC's appeal. BAA's appeal to the Court of Appeal has now been refused.

This case stresses the importance of VAT planning up front on European acquisitions. VAT rates in Europe are high (20% in the UK and as much as 25% in some other countries), so if VAT becomes an absolute cost for clients, the sums involved are significant. Early planning can ensure that these costs are recoverable as far as possible. (BAA Ltd v HMRC [2013] EWCA Civ 112)

ASIA UPDATE

Suit Reveals Risk of U.S. Deal Litigation For Non-U.S. Companies

On December 19, 2012, Focus Media Holding Limited ("Focus Media Holding"), the Cayman Islands organized parent company of Focus Media, a large Chinese digital media network operator, announced its entry into a $3.7 billion take-private acquisition agreement with a consortium of buyers led by The Carlyle Group and Focus Media Holding's Chairman and CEO.

A Focus Media Holding shareholder filed suit in the United States District Court for the Northern District of California seeking to enjoin the transaction and alleging typical shareholder plaintiff claims under Section 14(a) of the Securities Exchange Act concerning Focus Media Holding's allegedly inadequate proxy disclosure. However, instead of also alleging parallel Delaware fiduciary duty claims, the shareholder restyled those claims under Section 92 of the Cayman Islands Companies Law (the "Companies Law"). The shareholder plaintiff claims that Focus Media Holding and its directors violated the Companies Law by pursuing a plan to sell the company at an inadequate price via an unfair process (including the use of allegedly preclusive deal protection measures), which improperly failed to protect shareholder value. As such, the plaintiff alleges that the board's conduct was "detrimental or otherwise oppressive" to the Focus Media Holding's shareholders. This conduct allegedly violates the Companies Law, which grants a court broad discretion to thwart such "detrimental" conduct by, among other things, canceling any transaction if the court concludes that doing so would be just and equitable. This case has not produced any rulings, but demonstrates that M&A plaintiffs' counsel are becoming increasingly creative, and have appropriated foreign laws when they serve as a potential basis for seeking an injunction. Additionally, the suit reveals the increased risk of injunction or modification of a deal facing acquirers of Asian companies even where the company is organized outside the U.S. (Cmplt. in Iron Workers Mid-South Pension Fund v. Focus Media Holding Limited et al., No. 13 Civ. 0827 (Feb. 22, 2013 N.D. Ca

DEAL STAT SNAPSHOT

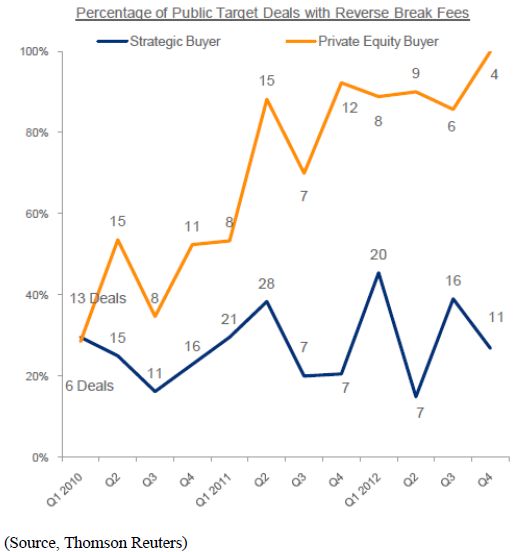

The recent Dell/Silver Lake merger agreement included a $750 million reverse break-up fee, an example of the growing prevalence of this feature, especially in private equity-led transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.