Canada was again an example of economic stability and strength amid global volatility in 2012. With its wealth of natural resources, well-capitalized financial institutions and relatively predictable political landscape, Canada remains a top destination for foreign investment. At the same time, Canadian companies and institutional investors, seeking greater diversification and a higher growth environment, have been increasingly looking abroad for investment opportunities. As mounting evidence points towards a gradual recovery in the global economy, there is no better time to discuss the M&A trends we see unfolding in 2013.

CANADA WILL STAND OUT IN A MODEST M&A RECOVERY

The total number and aggregate value of Canadian deals, and Canada's relative share of global M&A, increased in 2012. The number of deals over C$1-billion also increased, with 48 such deals valued at C$123.1-billion in aggregate announced in 2012, as compared to 34 deals valued at C$90.4-billion in 2011 (market statistics are from Bloomberg, except where otherwise noted). The year's highest-profile announced transactions included the C$19-billion acquisition of Nexen by China's CNOOC, the C$6.1-billion acquisition of Viterra by Glencore International and its partners, the C$5.5-billion acquisition of Progress Energy Resources by Malaysia's Petronas, and the C$3.8-billion acquisition of Provident Energy by Pembina Pipeline.

Many of the factors that contributed to the weaker global M&A environment are expected to extend into 2013. There are, however, reasons to believe that Canadian M&A will continue to strengthen. Mid-market transactions dominated the Canadian marketplace in 2012, representing approximately 93% of all M&A activity by deal volume, and we expect that the high level of mid-market activity will continue to bolster Canadian M&A in the coming year. Canada's financial sector is secure and the Canadian economy is expected to continue to grow steadily. The Governor of the Bank of Canada has indicated that no interest rate increases are imminent. Canada's Conservative majority government has worked to expand international trade agreements and, with the exception of control acquisitions in the energy sector by state-owned enterprises (SOEs), generally demonstrated an openness to foreign direct investment.

Canada's economic growth will continue to be closely tied to that of the United States. U.S. equity markets, a historical leading indicator of global M&A activity, rose with the announcement of QE3 and the Federal Reserve's pledge to keep interest rates at historic lows until the U.S. unemployment rate drops to 6.5%. With the conclusion of the U.S. presidential race, there was some hope that the country's long-term fiscal issues may be addressed in a credible way.

With the Canadian dollar continuing to hover near par with the U.S. dollar, the value of Canadian outbound M&A transactions as of December 31, 2012, was approximately 1.33 times that of foreign inbound activity. While Canadian businesses are looking at opportunities in emerging markets, over 56% of Canadian outbound M&A in 2012 still involved U.S. targets, such as the C$6.6-billion acquisition of Suddenlink by its management, BP Partners and the Canada Pension Plan Investment Board (CPPIB), the US$1.5-billion acquisition of CH Energy Group by Fortis, and the US$1.4-billion acquisition of Atlantic Broadband by Cogeco Cable.

ACTIVE COMPETITION ACT ENFORCEMENT EXPECTED

On September 26, 2012, the federal government appointed John Pecman as the Interim Commissioner of Competition and head of the Competition Bureau. Mr. Pecman is highly regarded both within the Bureau and among the competition law bar for his expertise and his transparent and balanced approach to enforcement. We expect active enforcement of the Competition Act to continue under Commissioner Pecman.

2012 saw a number of significant challenges by the Commissioner. When challenging a long-standing joint venture relationship between Air Canada and United Air Lines under the new collaborative horizontal agreements provision, the Commissioner also challenged a proposed deeper joint venture among Air Canada, United Air Lines and Continental Airlines (which had recently merged with United) under the Competition Act's merger provisions. The parties reached a settlement in late 2012 restricting joint venture co-ordination on 14 trans-border routes. The Commissioner also challenged the CCS Corporation/Complete Environmental merger, which was a non-notifiable transaction, after it had closed, alleging that the merger would likely prevent competition for hazardous waste disposal. The acquirer's internal documents, which referenced "price wars" and "direct competition" with the target, were a key element the Bureau used to demonstrate a likely substantial prevention of competition.

Commissioner Pecman confirmed in a recent speech given at Blakes (available at http://www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/02834.html) that promoting transparency will remain a Bureau priority in 2013. A number of draft pre-merger notification interpretation guidelines have been published for public consultation and a third hostile transaction interpretation guideline is expected to be published. As 2012 came to a close, the Bureau had an unprecedented number of contested cases in progress that will likely yield new M&A-related jurisprudence in the coming year.

Concern over regulatory issues is increasingly reflected in transaction documentation, as the degree to which each party bears competition approval deal risk is being more specifically delineated, including memorializing the buyer's obligation to offer a remedy to secure Competition Act clearance. In our upcoming fifth annual Blakes Canadian Public M&A Deal Study, we review the terms of the 50 largest friendly public deals in the 12-month period ended May 31, 2012. We found that 64% of the transactions included a Competition Act-related condition to closing and 12.5% of those transactions required the buyer to agree to offer to some kind of remedy if necessary to obtain Competition Act clearance, while 34.4% explicitly provided that the buyer was not required to agree to any remedy in order to secure approval.

FOREIGN INVESTMENT REVIEW WILL FOCUS ON SOEs

2012 ushered in a heightened interest in mergers and large-scale investment in Canada by foreign entities. In particular, there has been a perceived spike in proposed acquisitions in the natural resources sector by SOEs. Headline transactions in 2012 included CNOOC/Nexen, Petronas/Progress Energy, a joint venture between TransCanada and PetroChina to develop a C$3-billion oil sands pipeline, and a multibillion-dollar joint venture among Kuwait Petroleum, Spain's Repsol and Canada's Athabasca Oil in respect of certain Athabasca oil sands properties.

These high-profile proposed investments have sparked considerable political interest and debate, most notably around clarification of the "net benefit" criteria used by the Canadian government in its investment review process and their application in the context of SOE investments. Coincident with the approval of both the CNOOC/Nexen and Petronas/Progress transactions, on December 7, 2012, the government issued a long-awaited Policy Statement and Revised Guidelines for Investments by State-Owned Enterprises. Notable changes include clarification to the rules pertaining to reviewable investments by SOEs, lower review thresholds for SOE investments relative to non-SOE investments, and an expanded definition of "SOE." The clarifications did not, however, address non-SOE investments. In coming months, the government is expected to finalize announced changes to the Investment Canada Act that will significantly increase the financial threshold that non-SOE investors must cross before being subject to review and give the government new tools to enforce undertakings made by non-Canadians to secure investment approval.

CONTINUED INVESTMENT IN ENERGY, MINING AND AGRIBUSINESS

The Canadian deal landscape over the past several years has been dominated by M&A activity in the oil and gas and mining sectors. In addition to those deals discussed above, major transactions in the resource sector announced in 2012 included the C$1.9-billion acquisition of NAL Energy by Pengrowth Energy, the C$1.5-billion acquisition of Minefinders by Pan American Silver, and the C$608-million acquisition of Trelawney Mining and Exploration by IAMGOLD.

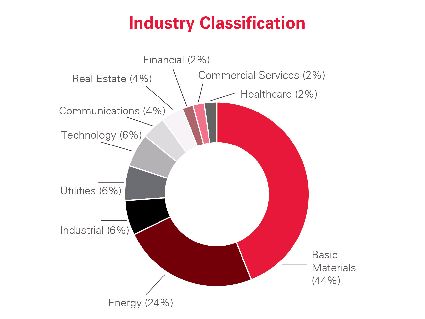

In our upcoming fifth annual Blakes Canadian Public M&A Deal Study, 68% of the 50 transactions reviewed occurred in the resource sector:

Asian demand for commodities continued in 2012. While evident in the high-profile Nexen and Progress Energy deals, Asia's focus on Canadian resources was also demonstrated by Mitsubishi's announced C$2.9-billion acquisition of a 40% interest in Encana's Cutback Ridge natural gas development, Sinopec's C$1.5-billion acquisition of a 49% equity stake in Talisman Energy's U.K. North Sea assets, and Toyota Tsusho's C$602-million acquisition of a royalty interest in Encana's U.K. coalbed methane resource asset. Despite the Canadian government's stand against further control acquisitions in the energy sector by SOEs, we expect Asian investment in Canadian resource companies through minority investments and joint ventures to be brisk in 2013.

In the agribusiness sector, Glencore's acquisition of Viterra made headlines in 2012. With the Canadian Wheat Board's monopoly over the marketing of wheat and barley set to expire in August, we should see further industry consolidation in 2013. Canada is a significant grain exporter, and we expect increased M&A activity along the entire length of the export supply chain, particularly among grain handlers and elevators.

CANADIAN PENSION FUNDS WILL BE ACTIVE AT HOME AND ABROAD

Canada is home to some of the largest and most acquisitive pension funds in the world, employing highly sophisticated internal deal teams executing direct investments. Canadian pension funds regularly co-invest alongside the most recognized U.S. private equity firms and have increasingly focused on deploying capital internationally. We expect that European and U.S. assets, particularly real estate and infrastructure, will remain attractive opportunities for Canadian pension funds in 2013. Notable 2012 transactions involving Canadian pension funds included the C$1.3-billion sale of Ontario Teacher's Pension Plan's interest in Maple Leaf Sports and Entertainment, CPPIB's C$1.1-billion acquisition of Tomkins' Air Distribution division from Onex Corporation, the sale of CPPIB's 15% interest in Progress Energy to Petronas, and the acquisition by CPPIB of significant minority stakes in five major Chilean toll roads from the Atlantia Group for C$1.1-billion.

TAX CHANGES MAY IMPACT ACQUISITIONS OF CANADIAN COMPANIES WITH FOREIGN OPERATIONS

In its March 2012 federal budget, the Canadian government proposed new rules intended to curtail a practice known as "foreign affiliate dumping." Broadly speaking, these rules were introduced to prevent foreign multinational corporations from achieving certain Canadian tax advantages by using their Canadian subsidiaries to hold investments in non-Canadian subsidiaries (foreign affiliates). The rules were enacted on December 14, 2012, and generally have effect from March 29, 2012.

These rules will potentially impact the traditional structure employed by a foreign corporate purchaser acquiring a Canadian company if the target has foreign affiliates. Typically, a foreign purchaser would incorporate a Canadian acquisition company to acquire the Canadian target. In order to fund the acquisition price, the Canadian acquisition vehicle is usually capitalized by the foreign purchaser with equity, or a combination of equity and debt. Under the proposed rules, if the fair market value of any shares of foreign affiliates owned by the target exceeds 75% of the fair market value of all of the target's assets, certain adverse tax consequences may arise. In other words, there may be unwelcome tax consequences if more than 75% of the value of the Canadian target is, generally speaking, derived from the target's foreign operations (a common scenario for many Canadian companies in the resource sector).

With careful advance planning, the risk of such consequences can, in many cases, be mitigated but will need to be considered early in the process when evaluating a Canadian acquisition.

PENSION FUNDS AND REITS WILL CONTINUE TO ADD TO THEIR REAL ESTATE PORTFOLIOS

In 2012, Canadian commercial real estate volume and activity levels returned to pre-recession levels. This was in stark contrast to the U.S., where deal volumes remained at approximately 50% of the market's peak. Despite a softening in the residential sector, Canadian commercial real estate continues to be seen as a safe haven, and 2012 prices exceeded pre-recession levels in a number of core markets. Canadian pension funds and real estate investment trusts (REITs), which already own many of the country's premier office and retail properties, have shown an eagerness to acquire and trade more premium commercial assets to capture steady cash flows and appreciation.

With REIT valuations approaching all time highs, Canadian grocer Loblaws recently announced that it was preparing to launch one of Canada's largest REITs with an expected real estate portfolio worth in excess of C$7-billion. Other representative transactions in the space include the C$4.4-billion hostile bid for Primaris REIT by a group led by KingSett Capital (the first ever hostile bid for a Canadian REIT), the C$1.3-billion acquisition of Scotia Plaza by H&R and Dundee REITs, and the C$318-million acquisition of Georgian Mall by RioCan REIT from Cadillac Fairview.

We expect that Canadian companies, institutional investors and REITs will continue to look south of the border for investment opportunities as U.S. real estate prices remain attractive and the market appears positioned for a rebound. In 2012, CPPIB entered into a joint venture agreement with the Westfield Group to acquire a US$1.8-billion equity interest in a U.S. regional mall portfolio, and Brookfield's real estate acquisitions have made it the largest commercial landlord in lower Manhattan.

HEDGE FUNDS WILL BE EMBOLDENED BY RECENT SUCCESSES

Hedge funds have become active in influencing Canadian corporate policy, engaging in proxy battles and even initiating take-over bids in an effort to put issuers in play. Investors are increasingly leveraging Canada's relatively liberal corporate laws, which permit shareholders holding 5% of the votes to call special meetings and seek to replace directors in an effort to force change and maximize value.

In the fall of 2011, Pershing Square, an activist U.S. hedge fund, acquired 14% of CP Railway and sought board representation and management changes. Pershing Square ultimately initiated a proxy contest in 2012 that was settled by agreement just prior to CP's scheduled annual general meeting. Pershing secured the election of seven directors on the 16-member CP board and the replacement of CP's acting CEO.

Separately, a highly publicized dispute at Telus was prompted by activist U.S. hedge fund Mason Capital. Mason objected to Telus' plan to collapse its dual-class share structure and attempted to requisition a shareholders' meeting to block the transaction. According to news coverage, Mason had a substantial short position in the non voting shares of Telus raising so called "empty voting" concerns. On appeal, the British Columbia court declined to address the empty voting issue, and Mason was successful in its argument that a shareholders' meeting could be properly requisitioned by the registered shareholder CDS (Canada's national security depositary, the equivalent of DTC in the U.S.) without disclosing the identity of the beneficial shareholder to the company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.