INTRODUCTION

Remove the blindfold

How is tax planning possible when you don't know what tax laws will look like in three months? Without legislative action, the new year is scheduled to bring dramatically higher taxes through both Medicare tax increases and the expiration of dozens of important tax cuts. With the election complicating the outlook and Congress in gridlock, you may feel as if you're doing tax planning with your eyes closed. Grant Thornton is offering to take off your blindfold.

There is opportunity in the uncertainty, but preparation is the key. You need to understand the various scenarios and crunch the numbers now, so that you have strategies to put into action when it's time to act. What will Congress do? Is this the year to turn tax planning on its head and accelerate tax and recognize gain before rates go up? Is it time to take advantage of a historic estate planning opportunity?

Whether you're managing the rates on your income and investments, the taxes on your privately held or pass-through business, or the income of executives and shareholders at your company, this guide will answer as many questions as possible. We'll cover what's new this year and offer the following help:

- Planning for tax increases: Look to Chapter 2 for a special section on the tax increases scheduled for 2013 and a discussion of whether it is time to turn tax planning on its head.

- Tax law changes: We've dedicated Chapter 1 to cover the most important tax changes for you and your business, and we've highlighted Tax law change alerts throughout the guide.

- Action opportunities: We've highlighted our top 14 Action opportunities, strategies you can put into play right now.

- Business perspective: We know you don't look at your tax situation as just an individual taxpayer, but also as a shareholder, owner, employee or executive. We've added sections throughout the guide that focus on tax opportunities from the Business perspective.

Caution: As always, our guide will help show you how to invest tax-efficiently for education and retirement and transfer your wealth to loved ones. But this guide simply can't cover all possible strategies, and when this guide went to print, legislation was pending that could affect many of the strategies and issues covered here. We've tried to point out within the guide those areas where legislation could make a difference, but you should check for the most up-to-date tax rules and regulations before making any tax decisions. Contact your local Grant Thornton professional to discuss your particular situation.

CHAPTER 1 - TAX LAW CHANGES: WHAT'S NEW THIS YEAR?

Very few tax changes have taken effect this year, as Congress remained deadlocked for much of the year over what to do about the avalanche of tax changes scheduled for 2013. Lawmakers did agree to extend 2011 payroll tax relief to cover all of 2012, but had otherwise failed to address most of the top tax priorities as this guide went to print. Congressional leaders are promising to address much of the unfinished tax agenda after the November elections, but in the meantime, 2012 has left us with no alternative minimum tax (AMT) relief and the expiration of a number of popular short-term tax provisions known as extenders.

Payroll tax relief

Lawmakers managed to extend a 2011 provision reducing the individual share of Social Security under the Federal Insurance Contributions Act (FICA) from 6.2% to 4.2% through the end of 2012. Social Security tax is imposed on wages up to an annually adjusted cap that reached $110,100 in 2012, so taxpayers at or above the wage cap receive a $2,202 tax cut from the provision.

The reduction in FICA taxes also applies to the self-employment tax, reducing the combined rate on self-employment income up to the $110,100 wage cap from 15.3% to 13.3%. This does not reduce the amount of self-employment taxes allowed as an above-the-line income tax deduction, which will continue to be calculated as one-half of 15.3% of self-employment income.

Alternative minimum tax

As this guide went to print, lawmakers were still promising to retroactively provide an AMT "patch" for 2012, but if they don't, the AMT exemption will plummet to $45,000 for joint filers and $33,750 for single filers. Millions more taxpayers will be subject to the AMT. Check with your local Grant Thornton tax professional for an update on legislation to increase the exemption in 2012.

Extenders

The popular temporary tax provisions known as extenders include dozens of tax provisions that expired at the end of 2011. When this guide went to print, lawmakers had proposed to extend these provisions retroactively for 2012, but they appeared unlikely to actually pass legislation until after the election when they reconvene to consider the 2001 and 2003 tax cuts and the AMT. If these provisions are not extended, both businesses and individuals would face significant tax increases in 2012. Key individual tax extenders that are currently expired include:

- election to deduct state and local sales taxes,

- above-the-line tuition deduction,

- $250 above-the-line teacher expenses deduction,

- tax-free charitable distributions from individual retirement accounts (IRAs),

- withholding exception for interest-related dividends of regulated investment companies (RICs), and

- estate tax look-through for RIC stock held by nonresidents.

BUSINESS PERSPECTIVE

What's new this year

The economic outlook for many businesses may have picked up, but the legislative well has finally run dry. Lawmakers in 2012 failed to provide any new stimulus tax incentives for the first time in years, and as this guide went to print, had also failed to agree on extending popular business provisions, including the research credit that expired at the end of 2011. The biggest changes this year for businesses actually came from outside the legislative arena, with the IRS imposing new rules on businesses and the Supreme Court upholding the 2010 health care reform legislation and its related tax provisions.

Business extenders

Many valuable business provisions commonly known as extenders also expired at the end of 2011. A failure to extend them for 2012 could be especially damaging for businesses, which often count on specific tax incentives included in the legislation. Major business provisions that have currently not been extended for 2012 include:

- research credit;

- 15-year cost recovery for qualified leasehold improvements, qualified restaurant buildings and improvements, and qualified retail improvements;

- new markets tax credit;

- Subpart F exception for active financing income;

- look-through treatment for payments between related controlled foreign corporations under foreign personal holding company income rules; and

- alternative fuel credit (including propane used in forklifts).

As this guide went to print, lawmakers were still pledging to extend many of these provisions retroactively for all of 2012. Contact a Grant Thornton professional to discuss the outlook for any specific extender provision that your business uses.

Expensing business investments

The amount of new equipment your business can expense under bonus depreciation rules and Section 179 has fallen this year. You were allowed to fully expense eligible property placed in service during 2011 under 100% bonus depreciation, but property placed in service in 2012 will qualify for only regular bonus depreciation, which allows you to deduct half of the cost of the property while the rest is depreciated using normal rules. This still provides an incentive for investment, especially because bonus depreciation is scheduled to expire altogether for property placed in service in 2013 (certain long-production-period property like airplanes have later deadlines for placing property in service). To qualify for bonus depreciation, property must generally have a useful life of 20 or fewer years under the modified accelerated cost recovery system (MACRS). The amount of business investment that you can expense under Section 179 has also fallen from $500,000 to $139,000 for tax years beginning in 2012 (with the phaseout dropping from $2 million to $560,000). As this guide went to print, lawmakers were discussing adjustment to these expensing provisions for 2012 and 2013, so check with a Grant Thornton professional for the latest update.

Health care legislation survives Supreme Court challenge

The health care reform legislation enacted in 2010 was upheld up by the Supreme Court almost in its entirety, meaning employers will have to comply with several new health benefit requirements taking effect this year and over the next several years, as well as many requirements that have already taken effect. For the first time this year, employers must report the cost of health coverage to their employees on Form W-2. For plan years beginning in 2013, employers must limit employee contributions to a health care flexible spending arrangement (FSA) to $2,500, and summaries of benefits and coverage must be provided to employees for plan years in which open enrollment begins on or after Sept. 23, 2012. For taxable years beginning after Dec. 31, 2012, employers will no longer be allowed to deduct the portion of retiree prescription drug coverage that is subsidized by the federal government. New Medicare taxes that were part of the health care legislation will also take effect in 2013, and the "pay or play" penalties for not offering adequate health coverage to employees are scheduled to take effect in 2014. See Chapter 7 for more information on the health care changes.

New 'repair' regulations for deducting or capitalizing costs

The IRS this year issued new regulations that dramatically alter the rules for determining when your business can deduct repair and maintenance costs or whether costs must be capitalized to tangible property. Taxpayers may benefit from accounting method changes under the new rules, so contact your local Grant Thornton tax professional for more information.

Organizational actions affecting basis

The IRS in late 2011 released the new Form 8937 for corporations to use in reporting organizational actions that affect the basis of their stock, which is now required for 2012. Corporations must generally either file the form with the IRS within 45 days of any action taken in 2012 or post the information on their public website. If the information is not posted to the website, corporations must also furnish a statement to all shareholders by Jan. 15, 2013.

CHAPTER 2 - PLANNING FOR POTENTIAL TAX INCREASES IN 2013: IS IT TIME TO TURN INCOME TAX PLANNING ON ITS HEAD?

As this guide went to print, large tax increases were still scheduled to take effect in 2013 without congressional action, raising questions over how to approach year-end tax planning in 2013. Which taxes are actually scheduled to go up, and what's Congress really going to do about them? How do you decide whether to reverse normal tax strategy and accelerate income? What specific issues and planning ideas do you need to know about?

The decisions you make about your business now may have a tremendous impact on your tax obligations in the future, but you need to approach these questions cautiously. First, you need to understand exactly which taxes are scheduled to increase and by how much, and how those increases would actually affect you. Next, you need to understand how likely it is these tax increases will actually occur. And finally, you need a plan to act once the outlook crystalizes. That's why it is prudent to prepare now but wait to act until the legislative outlook becomes clearer.

Which taxes are actually scheduled to increase?

Both payroll and income taxes are scheduled to increase starting Jan. 1, 2013. Without legislative action, the 2001 and 2003 tax cuts would expire, and new Medicare taxes enacted as part of the health care reform legislation would take effect. The expiration of the 2001 and 2003 tax cuts would erase scores of benefits, including:

- rate cuts across all income brackets;

- the full repeal of the personal exemption phaseout (PEP) and "Pease" phaseout of itemized deductions;

- the top rate of 15% for capital gains and qualified dividends; and

- marriage penalty relief and the $1,000 refundable child tax credit.

In addition, there are two new Medicare taxes. First, the rate of the individual share of Medicare tax will increase from 1.45% to 2.35% on earned income above $200,000 for single and $250,000 for joint filers. The 1.45% employer share will not change, creating a top rate of 3.8% on self-employment income. In addition, investment income such as capital gains, dividends and interest will be subject for the first time to a 3.8% Medicare tax to the extent income exceeds $200,000 (single) or $250,000 (joint). The good news is that the new tax on investment income will not apply to distributions from qualified retirement plans or active trade or business income, but the bad news is that there is no cap on Medicare taxes.

With tax increases coming from two places, the top combined rates on income would skyrocket without legislative action: up to 23.8% for capital gains, 43.4% for dividends and interest, and 41.95% for earned income.

Estate and gift

In addition, the transfer tax rules agreed to in late 2010 are scheduled to expire at the end of the year. The current rules generally reunite the estate and gift taxes with the following rules:

- 35% rate

- $5.12 million exemption

- Portability of estate tax exemption amounts between spouses

If no legislation is enacted, the estate, gift and generation-skipping transfer (GST) taxes will all revert to the rules in place in 2000, with a top rate of 55% and an exemption of just $1 million (see chart below).

What's actually going to happen?

No one expects all the tax increases to occur exactly as scheduled. As this guide went to print, both Republicans and Democrats had proposed separate one-year extensions of the 2001 and 2003 tax cuts with two big differences:

- Republicans propose extending the current transfer tax rules, while Democrats could not agree on how to address estate and gift taxes.

- Democrats propose allowing the 2001 and 2003 tax cuts to expire for taxable income above specific thresholds ($200,000 minus the standard deduction and a personal exemption for single filers and $250,000 minus the standard deduction and two personal exemptions for joint filers).

Under the Democratic bill, capital gains and dividends above these income thresholds would be subject to a top rate of 20%, and the phaseouts for personal exemptions and itemized deductions would be reinstated beginning at these thresholds. Neither the Republican nor Democratic proposals would postpone or repeal the new Medicare tax, though Republicans have voted to repeal the Medicare tax in other legislation meant to unwind health care reform.

It is difficult to predict a final outcome. As this guide went to print, no legislation was expected until after the election, when lawmakers are likely to return for a lame-duck session. The results of the election will have an impact, but a bipartisan compromise will still be needed. If re-elected, President Obama will likely still need to deal with a Republican Congress. If Republicans take both chambers and the White House, they will likely need to negotiate with Democrats in the Senate to overcome procedural hurdles.

For now, lawmakers on all sides appear to have settled on an extension for just one year — meant to provide time and leverage for a potential tax reform effort in 2013. Democrats currently appear committed to campaigning on a promise to roll back the tax cuts above the $200,000 and $250,000 thresholds, but there may be room for negotiation in a lame-duck session. Several Democratic lawmakers had previously floated the idea of extending the 2001 and 2003 tax cuts on income up to $1 million. While an extension of at least most of the 2001 and 2003 tax cuts appears likely, the repeal of the new Medicare tax may be an uphill battle, as neither side has linked it to the 2001 and 2003 tax cuts.

So what does this actually mean for tax planning?

There is definitely an important opportunity for estate and gift tax planning. Interest rates are at near-historic lows, and the values of many assets have declined with the struggling economy — perfect conditions for property transfers. For more information on leveraging favorable tax rules and economic conditions, see Chapter 11. With the prospect of income tax increases also looming, taxpayers may also be tempted to accelerate tax into 2012 by deferring deductions and recognizing income. But a careful analysis of several factors should come first, and there are many reasons why accelerating tax is a bad idea.

First, determine whether tax increases will apply to you. Tax increases are unlikely to affect any income below the income thresholds of $200,000 (single) or $250,000 (joint), and taxes may not increase at all. Accelerating tax in 2010 provided little or no benefit when the tax cuts were extended. That's why it will be prudent to prepare now but act only when the legislative outlook becomes clearer.

If you're subject to the alternative minimum tax (AMT), you may not benefit from any acceleration in tax. In addition, remember you may be in a lower tax bracket at retirement, and you need to consider transfer tax consequences. Triggering gain can backfire if an asset otherwise would have received a step up in basis at death. You also need to compare the actual rate change to the time value of money. The tax increases would affect many types of income in many different ways. When thinking about accelerating tax, it will be important to understand exactly how much tax would be paid in the future and how long you otherwise could have deferred the tax. Even at today's low interest rates, the time value of money will still make deferral the best strategy in many situations. You probably do not want to trigger gain on property you would otherwise have held onto for years just to avoid a capital gain rate increase from 15% to 20%. Economic considerations should always come before any tax-motivated sale.

Specific issues and ideas to consider

Once you understand how the tax increases would affect your particular situation, there are several specific issues and planning opportunities to consider before the end of the year. Even if it appears unwise to accelerate tax, you want to carefully evaluate your typical year-end decisions. You may be able to control the timing of many types of ordinary income, including self-employment income, and retirement plan distributions.

You may also be able to affect tax by timing how you exercise options. The spread between the exercise price and the fair market value of nonqualified stock options (NSOs) is ordinary income when exercised and the holding period for long-term capital gain treatment begins. If you do not plan to hold incentive stock options (ISOs) long enough to qualify for capital gain treatment, you can exercise them and sell the stock before rates increase. You can also consider a conversion from a 401(k) or traditional individual retirement account (IRA) to a Roth IRA now, while tax rates are low. Tax will be owed on the amount of the conversion now in exchange for no tax on future distributions if the conversion is made properly and certain other conditions are met.

The easiest income to control is capital gains. You can trigger gain and pay tax on stock and other securities without changing position. There is no wash sale rule on capital gains, so stock can be sold and bought back immediately to recognize the gain. But if much of your net worth is tied up in one asset because you're deferring the tax bill on a large gain, this might be a good time to reallocate that equity. Turning over assets besides securities will likely involve higher costs and more complications. Strategies that seek to recognize gain but allow you to retain some control or use of the assets must satisfy rules that determine whether ownership has indeed been transferred effectively. You may also consider electing out of the deferral of gain recognition available in an installment sale. Deferred income on most installment sales can be accelerated by pledging the installment note for a loan.

BUSINESS PERSPECTIVE

Specific issues and ideas to consider

The tax increases scheduled to take effect in 2013 without legislative action come primarily from the individual side of the tax code, so partners and shareholders in pass-through businesses would be directly affected. But the tax increases would also affect the executives and owners of other privately held businesses and even public companies.

Compensation

Businesses and employees may have competing interests. High-income employees may want to recognize income before tax increases take effect, if they take effect, while owners of the business that employs them may want to save compensation deductions for the following year.

Year-end bonuses will be important. Typically, employers seek to deduct bonuses in the year they are earned, even if they are paid the following year. That strategy can be reversed. If a deduction will be more meaningful in 2013 for the owners of a business, accrual method taxpayers may consider purposely postponing when they will satisfy the "all events" test in Section 461, which determines when a liability is taken into account. Accrual method taxpayers can also postpone the deduction to 2013 by paying the bonus more than 2½ months after the end of the year.

But employers seeking to offer employees a chance to avoid a potential tax increase should take care not to give employees a choice on the timing of pay, because under the constructive receipt doctrine, this will likely cause taxation on the first date the compensation is available, regardless of the employee's choice.

Business-level deductions and income for pass-throughs

S corporation shareholders and partners in a partnership are taxed on business income at the individual level, so recognizing business income and deferring business deductions could accelerate taxes for owners. Many businesses have the power to control the timing of deductions and income based on the regulatory tests that determine when income is recognized or liabilities are taken into account. But be careful with accounting method changes and other depreciation decisions that can delay deductions, as well as decisions on advanced payments that can accelerate income. These decisions will continue to delay deductions and accelerate income incrementally in future years, and it is NOT likely that there are many situations where this will help.

S corporation opportunities

Special opportunities exist for converted S corporations. Normally, distributions from a profitable S corporation are considered to come first from the income passed through to shareholders and taxed at their level. To prevent double taxation, these distributions are considered nontaxable to the extent they do not exceed the amount in the S corporation's accumulated adjustment account. An S corporation, however, may elect to treat the distribution as first coming out of accumulated earnings and profits, and thus as taxable. If insufficient cash is on hand, an election to make a "deemed" distribution is available under the S corporation regulations.

Special considerations for Medicare tax

The new Medicare tax on investment income includes an exception for active trade or business income and gain on the sale of trade or business assets or S corporation shares. Owners in pass-through businesses should start thinking of strategies to deal with the Medicare tax before it takes effect in 2013. If it is possible to reorganize business interests and activities so that they meet the test for active rather than passive income, without causing income to be considered self-employment income, this may save taxes in the future.

C corporation shareholder strategies

C corporations will not face any tax increases at the entity level, but shareholders will be concerned with the tax on distributions and the capital gains rate on their ownership interests. While publicly held C corporations cannot realistically tailor action to suit thousands of shareholders in different positions, privately held corporations should have opportunities.

The easiest way to allow shareholders to recognize income while the dividend rate is 15% is to simply pay dividends now. But many corporations will not be ready to distribute earnings. Instead, consider distributing dividends to shareholders with shareholders immediately recontributing the dividend to the corporation — or issuing a note to shareholders. Mere bookkeeping entries may not be sufficient to accomplish the actual distribution and trigger the tax. Care should be exercised to ensure the dividend will be respected for tax purposes. It is also important to remember that distributions in excess of earnings of profit will reduce basis, which may be more valuable in the future if capital gains rates increase.

Corporate restructuring transactions can also be used to increase basis or trigger gains and dividends for shareholders. Transferring assets to a corporation in a transaction designed to fail tax treatment under Section 351 can trigger gains in assets and provide a step up to full market value in tax basis that the corporation then amortizes or depreciates. A transaction qualifying as a "cash D reorganization" under Section 368(a)(1)(D) can be used to trigger taxable income as a dividend or capital gain to shareholders.

CHAPTER 3 - GETTING STARTED: INDIVIDUAL TAX RATES AND RULES

Whether you're an executive, partner or owner, your business income is eventually taxed at the individual level. That's where tax planning needs to start. Different types of individual income are taxed in different ways, and you want to start by looking at ordinary income. Ordinary income includes things like salary and bonuses, self-employment and business income, interest, and retirement plan distributions.

Ordinary income is taxed at different rates depending on how much you earn, with rates increasing as income rises. These tax brackets, along with many other tax preferences, are adjusted for inflation annually. After historically low inflation over the past several years, the tax brackets were modestly adjusted for 2012. See the following charts for a full breakdown of the tax brackets for ordinary income in 2012 and the 2012 values for a number of other tax items.

The top tax rate that applies to you is usually considered your marginal tax rate. It's the rate you will pay on an additional dollar of income. But unfortunately, the tax brackets for ordinary income don't tell the whole story. Your effective marginal rate may differ significantly from the stated rate in your tax bracket. Hidden taxes that kick in at higher income levels when you reach the top tax brackets can drive your marginal tax rate higher. These hidden taxes largely include phaseouts of many tax benefits at high income levels.

Fortunately, two of the most costly phaseouts do not apply in 2012. The personal exemption phaseout (PEP) and "Pease" phaseout of itemized deductions will not affect your 2012 return, and you can enjoy these tax preferences in full this year. They are, however, scheduled to return in 2013 without legislative action.

You want to avoid early withdrawals from tax-advantaged retirement plans, such as 401(k) accounts and individual retirement accounts (IRAs). Distributions from these plans are treated as ordinary income, and you'll pay an extra 10% penalty on any premature withdrawals (generally, withdrawals taken prior to reaching age 59½). This can raise your effective marginal federal tax rate to as high as 45% on the income. Generally, distributions must be made after reaching the age of 70½ to avoid penalties.

ACTION OPPORTUNITYLeverage above-the-line deductionsNearly all of the tax benefits that phase out at high income levels are tied to adjusted gross income (AGI). The list includes personal exemptions and itemized deductions (except in 2010–2012), education incentives, charitable giving deductions, the AMT exemption, the ability to contribute to some retirement accounts and the ability to claim real estate loss deductions. These AGI-based phaseouts are one of the reasons that above-the-line deductions are so valuable. They are not subject to the AGI floors that hamper many itemized deductions. They even reduce AGI, which provides a number of tax benefits. Most other deductions and credits reduce only taxable income or tax itself, without affecting AGI. Above-the-line deductions that reduce AGI could increase your chances of enjoying other tax preferences. Common above-the-line deductions include traditional IRA and health savings account (HSA) contributions, moving expenses, self-employed health insurance costs and alimony payments. Remember that HSAs can no longer be used to pay for over-the-counter drugs unless you have a prescription, and penalties for improper expenditures have increased from 10% to 20%. Save on taxes by contributing as much as possible to retirement vehicles — such as IRAs and SEP IRAs — that provide above-the-line deductions. Don't skimp on HSA contributions either. When possible, give the maximum amount allowed. Even if you withdraw the full amount that was contributed to pay medical expenses, at least you have effectively moved those medical expenses "above the line." And don't forget that if you're self-employed, the cost of the high-deductible health plan tied to your HSA is also an above-the-line deduction. |

Payroll taxes take a bite

Employment taxes, often called "payroll taxes," are imposed against earned income under the Federal Insurance Contributions Act (FICA) and the Self-Employment Contributions Act (SECA). Earned income generally comprises wages, salaries, tips and self-employment income.

There are two components to employment taxes: Social Security and Medicare. Generally, FICA requires matching contributions from the employer and the employee for both Social Security and Medicare taxes. Social Security taxes are imposed up to a wage cap that is adjusted for inflation each year and is $110,100 in 2012. Medicare taxes are uncapped.

If you are employed and your earned income consists of salaries and bonus, your employer will withhold your share of employment taxes and pay them directly to the government. If you are self-employed, you must pay both the employee and the employer portions of employment tax, though you can take an above-the-line deduction for the employer's portion of the tax.

Payroll taxes are scheduled to become even more costly in 2013. The health care reform bill enacted in 2010 is scheduled to increase the employee share of Medicare tax in 2013 from 1.45% to 2.35% on any earned income above $200,000 (single) or $250,000 (joint). In addition, a Medicare tax on unearned income will be imposed for the first time. Income such as interest, dividends and capital gains above the $200,000 and $250,000 thresholds will be subject to an additional 3.8% Medicare tax beginning in 2013. This new employment tax on unearned income will not apply to distributions from IRAs and other qualified plans, which may provide an additional incentive to maximize contributions to those plans. See the chart above for the employment tax rates under current law.

ACTION OPPORTUNITYMake up FOR an estimated tax shortfall with increased withholdingIf you're in danger of being penalized for underpaying tax throughout the year, try to make up the shortfall through increased withholding on your salary or bonuses. Paying the shortfall through an increase in your last quarterly estimated tax payment can still expose you to penalties for underpayments in previous quarters. But withholding is considered to have been paid ratably throughout the year. So a big bump in withholding on high year-end wages can save you in penalties when a similar increase in an estimated tax payment might not. Save on taxes by contributing as much as possible to retirement vehicles — such as IRAs and SEP IRAs — that provide above-the-line deductions. Don't skimp on HSA contributions either. When possible, give the maximum amount allowed. Even if you withdraw the full amount that was contributed to pay medical expenses, at least you have effectively moved those medical expenses "above the line." And don't forget that if you're self-employed, the cost of the high-deductible health plan tied to your HSA is also an above-the-line deduction. |

TAX LAW CHANGE ALERTPayroll tax holiday for 2012Lawmakers extended a reduction in the individual share of Social Security under FICA from 6.2% to 4.2% through the end of 2012. Social Security tax is imposed on wages up to an annually adjusted cap that reached $110,100 in 2012, so taxpayers at or above the wage cap received a $2,202 tax cut from the provision. The reduction in FICA taxes also applies to the self-employment tax, reducing the combined rate on self-employment income up to the $110,100 wage cap from 15.3% to 13.3%. This does not reduce the amount of self-employment taxes allowed as an above-the-line income tax deduction, which will continue to be calculated as one-half of 15.3% of self-employment income. |

Paying your tax

Although you don't file your return until after the end of the year, it's important to remember that you must pay tax throughout the year with estimated tax payments or withholding. Any shortfall will generate a nondeductible penalty generally equivalent to an interest charge.

If your AGI is more than $150,000, you generally can avoid penalties by paying at least 90% of your 2012 tax liability or 110% of your 2011 liability through withholding and estimated taxes (taxpayers with $150,000 or less in AGI need pay only 100% of 2011 liability). If your income is irregular because of bonuses, investments or seasonal income, consider the annualized income installment method. This method allows you to estimate the tax due based on income, gains, losses and deductions through each estimated tax period.

Leveraging deductions and managing tax burden

2012 presents a unique challenge. Deferring tax is a traditional cornerstone of good tax planning, meaning you'd want to accelerate deductions into the current year and defer income into next year. But many tax benefits in place right now are scheduled to disappear in 2013. You may be asking yourself if this is the year to reverse your tax strategy and accelerate income and defer deductions. To help you decide what kind of strategy to use in 2012, we present a more detailed discussion on this issue in Chapter 2.

Exercise caution. Legislative action will likely make a big difference in this area, as will your personal situation. Income acceleration can be a powerful strategy, but it should be used only if you are comfortable with your own political analysis and are prepared to accept the consequences if you are wrong. There are many reasons to believe that existing tax benefits scheduled to expire in 2012 will be extended, at least for taxpayers with incomes below $200,000 (single) or $250,000 (joint). Even if some of the tax cuts expire in 2013, the time value of money will still make deferral the best strategy in most cases.

ACTION OPPORTUNITYBunch itemized deductions to get over AGI floorsTiming significantly affects your itemized deductions, because many of those deductions have AGI floors. For instance, miscellaneous expenses are deductible only to the extent they exceed 2% of your AGI, and medical expenses are deductible only to the extent they exceed 7.5% of your AGI. (This floor is scheduled to increase to 10% for taxpayers under age 65 beginning in 2013.) Bunching these deductions into a single year may allow you to exceed these floors and save more. Miscellaneous expenses that you may be able to accelerate and pay now include:

Bunching medical expenses is often easier than bunching miscellaneous itemized deductions. Consider scheduling your nonurgent medical procedures and other controllable expenses in one year to take advantage of the deductions. Deductible medical expenses include:

In extreme cases — and assuming you are not subject to the AMT — it may even be possible to claim a standard deduction in one year while bunching two years of itemized deductions in another. Keep in mind that medical expenses aren't deductible if they are reimbursable through insurance or paid through a pretax HSA or flexible spending arrangement (FSA). The AMT can also complicate this strategy. For AMT purposes, only medical expenses in excess of 10% of your AGI are deductible. |

Whether it eventually makes more sense for you to defer or accelerate your taxes, there are many items for which you may be able to control timing:

Income

- Consulting income

- Other self-employment income

- Real estate sales

- Other property sales

- Retirement plan distributions

Expenses

- State and local income taxes

- Real estate taxes

- Mortgage interest

- Margin interest

- Charitable contributions

Remember that prepaid expenses can be deducted only in the year they apply. So you can prepay 2012 state income taxes to receive a 2012 deduction even if the taxes aren't due until 2013. But you can't prepay state taxes on your 2013 income and deduct the payment on your 2012 return. And don't forget the AMT. If you will be subject to the AMT in both 2012 and 2013, it won't matter when you pay your state income tax, because it will not reduce your AMT liability in either year.

CHAPTER 4 – AMT: THE HIDDEN TAX

The alternative minimum tax (AMT) can feel like a penalty for success. It's a hidden surprise lurking in the tax code for high-income taxpayers. Originally conceived to ensure all taxpayers paid at least some tax, it was never indexed for inflation and has long since outgrown its initial purpose. The AMT is essentially a separate tax system with its own set of rules. How do you know if you will be subject to the AMT? Each year you must calculate your tax liability under the regular income tax system and the AMT, and then pay the higher amount.

The AMT is made up of two tax brackets of 26% and 28%. Many deductions and credits are not allowed under the AMT, so taxpayers with substantial deductions that are reduced or not allowed under the AMT are the ones stuck paying. Common AMT triggers include the following:

- State and local income and sales taxes, especially in high-tax states

- Real estate or personal property taxes

- Investment advisory fees

- Employee business expenses

- Incentive stock options

- Interest on a home equity loan not used to build or improve your residence

- Tax-exempt interest on certain private activity bonds

- Accelerated depreciation adjustments and related gain or loss

differences on disposition

TAX LAW CHANGE ALERTAMT exemption plummets for 2012 without LegislationThe AMT includes a large exemption, but this exemption phases out at high-income levels and was never indexed for inflation. For many years, Congress has increased this AMT exemption legislatively with a temporary "patch," but it had not enacted a patch for 2012 when this guide went to print. Without AMT relief, millions more taxpayers will be subject to the AMT in 2012. Legislation remains likely in this area. Both Republicans and Democrats have proposed identical AMT relief for 2012 and are promising to enact it before the end of the year, so check with your local Grant Thornton tax professional for a legislative update. But remember that Congress increases the exemption amount only with each year's "patch," while the phaseout of the exemption and the AMT tax brackets remain unchanged (see charts for a full breakdown). |

ACTION OPPORTUNITYAccelerate income to 'zero out' the AMTYou have to pay the AMT when it results in more tax than your regular income tax calculation, typically because the AMT has taken away key deductions. The silver lining is that the top AMT tax rate is only 28%. So you can "zero out" the AMT by accelerating income into the AMT year until the tax you calculate for regular tax and AMT are the same. Although you will have paid tax sooner, you will have paid at an effective tax rate of only 26% or 28% on the accelerated income, which is less than the top rate of 35% that is paid in a year in which you're not subject to the AMT. If the income you accelerate would otherwise be taxed in a future year with a potential top rate of 39.6%, the savings could be even greater. But be careful. If the additional income falls into the AMT exemption phaseout range, the effective rate may be a higher 31.5% (because the additional income will be reducing the amount of exemption you can use). The additional income may also affect other tax benefits, so you need to consider the overall tax impact. |

Proper planning can help you mitigate, or even eliminate, the impact of the AMT. The first step is to work with your local Grant Thornton tax professional to determine whether you could be subject to the AMT this year or in the future. In years that you'll be subject to the AMT, you want to defer deductions that are erased by the AMT and possibly accelerate income to take advantage of the lower AMT rate.

Capital gains and qualified dividends deserve special consideration for the AMT. They are taxed at the same 15% rate under either the AMT or regular tax structure, but the additional income they generate can reduce your AMT exemption and result in an effective rate of 20.5% instead of the normal 15%. So consider your AMT implications as part of your tax analysis before selling any stock that could generate a large gain.

TAX LAW CHANGE ALERTMore-generous AMT credit set to expire in 2013If you have to pay the AMT, you may be able to take advantage of an AMT credit that will become less generous in 2013. You can qualify for the AMT credit by paying AMT on timing items such as depreciation adjustments, passive activity adjustments and incentive stock options. Most individuals paying the AMT do not have AMT credits and will not benefit, but you may have earned credits if you've had business income from a partnership, S corporation, sole proprietorship or Schedule C business. In 2012, AMT credits at least four years old are refundable and can be taken in 50% increments over a period of two years, even in years when the AMT continues to apply. There is no longer adjusted gross income (AGI) phaseout for this benefit. If you haven't kept careful records of your credits because you assumed you would continue to be subject to the AMT and unable to use them, consider reviewing your prior-year returns to determine if you can benefit, because the credit is about to become less generous. Without legislative action, this AMT credit will no longer be refundable in 2013. |

CHAPTER 5 – INVESTMENT INCOME: MANAGING THE TAX IMPACT OF INVESTMENT DECISIONS

Your portfolio may finally be starting to recover, just in time for the new tax increases scheduled to take effect in 2013 without legislative action. It's now more important than ever to make sure you aren't solely focusing on economic decisions, but are also considering taxes. The tax treatment of investment income should always factor into your investment decisions, but especially now that the legislative outlook for preventing tax increases in 2013 is so uncertain. A little upfront consideration may save a lot in the long run.

Start by understanding the different types of investment income. Income such as dividends and interest arises from holding investments, while capital gains income results from selling them. And while investment income is often treated more favorably than ordinary income, the rules are complex. Long-term capital gains and qualifying dividends can be taxed as low as 15%, while nonqualified dividends, interest and short-term capital gains are taxed at ordinary income tax rates as high as 35%. Special rates also apply to specific types of capital gains and other investments, such as collectibles and passive activities.

But more importantly, the top tax rates on investment income are scheduled to change dramatically over the next several years unless Congress acts. If the 2001 and 2003 tax cuts expire as scheduled at the end of 2012, the top long-term capital gains rate would increase from 15% to 20% for property held more than a year and 18% for property held more than five years. Dividends would be taxed as ordinary income at a top rate of 39.6%. Yet, it gets worse! Those rates don't include a new Medicare surtax on investment income such as dividends, capital gains and interest. This surtax, enacted in the 2010 health care legislation, will add a 3.8% tax on investment income such as capital gains, dividends and interest to the extent income exceeds $200,000 for single filers or $250,000 for joint filers (see chart below).

A detailed discussion of whether 2012 is the year to accelerate your investment income and pay tax can be found in Chapter 2, but your investment planning should go well beyond this one-time decision. The various rules and rates on investment income offer many opportunities for you to manage your tax burden. Understanding the tax costs of various types of investment income can also help you make smart tax decisions. And it starts with understanding all the investment income tax rules. But remember that tax planning is just one part of investing. You must also consider your risk tolerance, desired asset allocation and the fit between the investment and your financial and personal situation.

Managing capital gains and losses

To benefit from long-term capital gains treatment, you must hold a capital asset for more than one year before it is sold. Selling an asset you've held for a year or less results in less-favorable short-term capital gains treatment. (In 2013, assets held more than five years would be subject to a separate capital gains rate of 18% unless legislation changes these rules.) Several specific types of assets such as collectibles have special, higher capital gains rates, and taxpayers in the bottom two tax brackets enjoy a zero rate on their capital gains and qualified dividends in 2012.

Your total capital gain or loss for tax purposes generally is calculated by netting all the capital gains and losses throughout the year. You can offset both short- and long-term gains with either short- or long-term losses. Taxpayers facing a large capital gains tax bill often benefit from looking for unrealized losses in their portfolio so that they can sell the assets to offset their gains. But keep the wash sale rule in mind. You can't use the loss if you buy the same — or a substantially identical — security within 30 days before or after you sell the security that creates the loss.

There are ways to mitigate the wash sale rule. You may be able to buy securities of a different company in the same industry or shares in a mutual fund that holds securities much like the ones you sold. Alternatively, consider a bond swap. Bond swaps are a way to maintain your investment position while recognizing a loss. With a bond swap, you sell a bond, take a capital loss and then immediately buy another bond of similar quality from a different issuer. You'll avoid the wash sale rule because the bonds are not considered substantially identical.

It may prove unwise to try to offset your capital gains at all. Up to $3,000 in net capital loss can be claimed against ordinary income each year (with a top rate of 35% in 2012, scheduled to increase to 39.6% in 2013), and the rest can be carried forward to offset future income.

Recognizing gain in 2012

More importantly, the long-term capital gains tax rate in 2012 is just 15% but could increase to 20% in 2013 if Congress doesn't act (with an 18% rate for assets held more than five years). It may be time to consider selling assets with unrealized gains now to take advantage of the current low rates, but there are many reasons you do not want to accelerate gain, and deferral is still a powerful strategy. In Chapter 2, we provide a detailed discussion on whether 2012 is the year to accelerate income and recognize gains.

ACTION OPPORTUNITYDon't fear the wash sale rule to accelerate gainsRemember, there is a wash sale rule only for losses, not gains. You can recognize gains any time by selling your stock and repurchasing it immediately. This may be helpful if you have a large net capital loss you don't want to carry forward or you want to take advantage of today's low rates. If your rates do indeed go up, waiting until after 2012 to pay tax on unrealized gains could result in a larger tax bill. |

No legislation had been enacted when this guide went to print, but remember, the 15% rate could be extended beyond 2012, especially to the extent the net capital gain does not push taxable income over certain high-income thresholds.

If you do determine now is the time to realize gains, it's relatively painless to recognize gains on publicly traded securities without changing your position, by selling the stock and buying it back immediately.

Regardless of whether you want to accelerate or mitigate a net capital gain, the tax consequences of a sale can come as a surprise, unless you remember the following rules:

- If you bought the same security at different times and prices, you should identify in writing which shares are to be sold by the broker before the sale. Selling the shares with the highest basis will reduce your gain or increase your losses.

- For tax purposes, the trade date and not the settlement date of publicly traded securities determines the year in which you recognize the gain or loss.

Reconsidering deferral

Deferring taxes is normally a large part of good planning, but it needs to be approached cautiously this year. Even with the possibility of capital gains rates increasing in 2013, the time value of money may still make deferral the best option for many taxpayers. If you believe your rates will increase, consider adjusting the strategies you're using to defer gain, such as an installment sale or a like-kind exchange.

Most commonly used in real estate transactions, like-kind exchanges under Section 1031 allow you to exchange similar property without incurring capital gains tax. Under a like-kind exchange, you defer paying tax on the gain until you sell your replacement property.

An installment sale allows you to defer capital gains on most assets other than publicly traded securities by spreading gain over several years as you receive the proceeds. If you're engaging in an installment sale, consider creating a future exit strategy. You may want to build in the ability to pledge the installment obligation. Deferred income on most installment sales can be accelerated by pledging the installment note for a loan. The proceeds of the loan are treated as a payment on the installment note itself. If Congress enacts legislation that increases the capital gains rate in the future (or makes clear that the scheduled increase will occur), this technique can essentially accelerate the tax on the proceeds of the installment sale.

Mutual fund pitfalls

Investing in mutual funds is an easy way to diversify your portfolio, but it comes with tax pitfalls. Typically, earnings on mutual funds are reinvested. Unless you (or your broker or investment adviser) keep track of these additions to your basis and you designate which shares you are selling, you may report more gain than required when you sell the fund.

It is often a good idea to avoid buying shares in an equity mutual fund right before it declares a large capital gains distribution, typically at year-end. If you own the shares on the record date of the distribution, you'll be taxed on the full distribution amount even though it may include significant gains realized by the fund before you owned the shares. Worse yet, you'll end up paying taxes on those gains in the current year — even if you reinvest the distribution in the fund and regardless of whether your position in the fund has appreciated.

Small business stock comes with tax rewards

Buying stock in a qualified small business (QSB) provides several tax benefits, assuming you comply with specific requirements and limitations. QSB stock must be original-issue stock in a C corporation with no more than $50 million in assets and must meet several other tests.

TAX LAW CHANGE ALERTFull gain exclusion for QSB stock expiresYou'll never have to pay a dime of tax on gain from QSB stock purchased in 2011, but this special provision has now expired. QSB stock acquired in 2012 is again subject to the regular rules, which allow you to exclude half of the gain if you hold it for more than five years and meet all the tests. Unfortunately, you must use a 28% rate for this calculation, meaning the exclusion gives you an effective rate of 14% — not much better than the current 15% rate. QSB stock may be more attractive in future years if the 15% rate reverts to 20%. You can also roll over QSB stock without realizing gain. If you buy QSB stock with the proceeds of a sale of QSB stock within 60 days, you can defer the tax on your gain until you dispose of the new stock. The new stock's holding period for long-term capital gains treatment includes the holding period of the stock you sold. |

There are other tax benefits for small business stock that meets separate eligibility requirements. If you sell small business stock under Section 1244 (generally stock in a domestic corporation with no more than $1 million in capital) for a loss, you can treat up to $50,000 ($100,000, if married filing jointly) as an ordinary loss, regardless of your holding period. This means you can use it to offset ordinary income such as salary and interest taxed at a 35% rate (or a 39.6% rate in future years if tax rates increase without legislative action).

Rethinking dividend tax treatment

The tax treatment of income-producing assets can affect investment strategy. Qualifying dividends generally are taxed at the reduced rate of 15% in 2012, while interest income is taxed at ordinary income rates of up to 35%. In 2013, dividends and interest would both be taxed at ordinary income rates of up to 39.6%, plus a 3.8% Medicare tax for high-income taxpayers. Legislation is likely to address these tax increases, so check with your local Grant Thornton tax professional for an update.

As long as dividends remain at a lower rate than ordinary income, dividend-paying stocks may be more attractive from a tax perspective than investments such as CDs and bonds. But there are exceptions. Some dividends are already subject to ordinary income rates. These include certain dividends from:

- money market mutual funds,

- mutual savings banks,

- real estate investment trusts (REITs),

- foreign investments,

- regulated investment companies, and

- stocks — to the extent the dividends are offset by margin debt.

Some bond interest is exempt from income tax. Interest on U.S. government bonds is taxable on your federal return, but generally exempt on your state and local returns. Interest on state and local government bonds is excludible on your federal return. If the state or local bonds were issued in your home state, interest also may be excludable on your state return. Although state and municipal bonds usually pay a lower interest rate, their rate of return may be higher than the after-tax rate of return for a taxable investment.

Planning for passive losses

There are special rules for income and losses from a passive activity. Investments in a trade or business in which you don't materially participate are passive activities. You can prove your material participation by participating in the trade or business for more than 500 hours during the year or by demonstrating that your involvement represents substantially all of the participation in the activity.

The designation of a passive activity is important, because generally passive activity losses are deductible only against income from other passive activities. The passive activity test will also become more important in 2013 when the new 3.8% Medicare tax on investment income becomes effective, because active trade or business income that is not subject to self-employment tax is exempt. You can carry forward disallowed losses to the following year, subject to the same limitations. There are options for turning passive losses into tax-saving opportunities.

For instance, you can increase your activity to more than 500 hours so that the losses will not be passive. Alternatively, you can limit your activities in another, profitable business to fewer than 500 hours or invest in another income-producing business that will be passive to you. This will allow the other businesses to give you passive income to offset your passive losses. Finally, consider disposing of the activity to deduct all the losses. The disposition rules can be complex, so consult with a Grant Thornton tax professional.

Rental activity has its own set of passive loss rules. Losses from real estate activities are passive by definition unless you're a real estate professional. If you're a real estate professional, you can deduct real estate losses in full, but you must perform more than half of your personal services annually in real property trades and businesses and spend more than 750 hours in these services during the year.

If you participate actively in a rental real estate activity but you aren't a real estate professional, you may be able to deduct up to $25,000 of real estate losses each year. This deduction is subject to a phaseout beginning when adjusted gross income (AGI) reaches $100,000 ($50,000 for married taxpayers filing separately).

Leveraging investment expenses

You are allowed to deduct expenses used to generate investment income unless the expenses are related to tax-exempt income. Investment expenses can include investment advisory fees, research costs, security costs (such as a safe deposit box) and most significantly, investment interest. Apart from investment interest, these expenses are considered miscellaneous itemized deductions and are deductible only to the extent they exceed 2% of your AGI.

Investment interest is interest on debt used to buy assets held for investment, such as margin debt used to buy securities. Payments a short seller makes to the stock lender in lieu of dividends may be deductible as an investment interest expense. Your investment interest deduction is limited to your net investment income, which generally includes taxable interest, dividends and short-term capital gains. Any disallowed interest is carried forward for a deduction in a later year, which may provide a beneficial opportunity.

If you don't want to carry forward investment interest expense, you can elect to treat net long-term capital gain or qualified dividends as investment income in order to deduct more of your investment interest, but the capital gain will be taxed at ordinary income rates. Remember that interest on debt used to buy securities that pay tax-exempt income, such as municipal bonds, isn't deductible. Also keep in mind that passive interest expense — interest on debt incurred to fund passive activity expenditures — becomes part of your overall passive activity income or loss, subject to limitations.

Unused investment interest expense can be carried forward indefinitely and may be usable in later years. Many taxpayers elect to treat qualified dividends and long-term capital gains as investment income in order to deduct unused investment expenses. It may make more sense to forgo this opportunity in 2012 and just carry forward your unused investment interest expense into 2013 in case tax rates increase as scheduled.

CHAPTER 6 – EXECUTIVE COMPENSATION: THINKING THROUGH YOUR OPTIONS

Executive compensation deserves special attention in 2012 because it is often deferred into future years and tax rates are scheduled to increase in 2013. With that in mind, you've got to think beyond salary, fringe benefits and bonuses. You need to make sure you have a grip on the tax consequences of more-complex pay plans, such as stock options, deferred compensation plans and restricted stock.

Benefiting from incentive stock options

Stock options remain one of the most popular types of incentive compensation, and incentive stock options (ISOs) deserve special attention in your tax planning. If your options qualify as ISOs, you can take advantage of favorable tax treatment.

ISOs give you the option of buying company stock in the future. The price (known as the "exercise price") must be set when the options are granted and must be at least the fair market value of the stock at that time. The exercise price is customarily set at exactly the fair market value. Therefore, the stock must rise before the ISOs have any value. If it does, you have the option to buy the shares for less than they're worth. ISOs have several tax benefits:

- There is no tax when the options are granted.

- There is no tax when the options are exercised.

- Long-term capital gains treatment is available if the stock is held for more than one year after exercise. (If the stock isn't held for at least two years after the option's grant date and at least one year after the exercise date, the increase in value over the exercise price as of the exercise date is taxed as ordinary compensation income rather than as a capital gain.)

There is potential alternative minimum tax (AMT) liability when the options are exercised. The difference between the fair market value of the stock at the time of exercise and the exercise price is included as income for AMT purposes. The potential AMT liability on this bargain element is a problem because exercising the option alone doesn't generate any cash to pay the tax. If the stock price falls before the shares are ultimately sold, you can be left with a large AMT bill in the year of exercise even though the stock actually produced no income. The AMT credit can help with this, but it is scheduled to be less generous in 2013 (see Chapter 4 for more information regarding the AMT credit). Talk to a Grant Thornton professional if you have questions about AMT-ISO liability.

As noted previously, if the stock from an ISO exercise is sold before certain holding period requirements are met (referred to as a "disqualifying disposition"), the gain is taxed at ordinary income tax rates. The employer is entitled to a compensation deduction for ISOs only if the employee makes a disqualifying disposition.

If you've received ISOs, you should decide carefully when to exercise them and whether to sell immediately or hold the shares received from an exercise. Acting earlier can be advantageous in some situations:

- Exercise earlier to start the holding period for long-term capital gains treatment sooner.

- Exercise when the bargain element is small or the market price is low to reduce or eliminate AMT liability.

- Exercise annually and buy only the number of shares that will achieve a break-even point between the AMT and regular tax.

- Exercise and sell the stock this year if you don't plan to hold the stock long enough to qualify for capital gains treatment and want to make sure you pay an ordinary income tax rate of no more than 35%.

But be careful, because exercising early accelerates the need for funds to buy the stock. It also exposes you to a loss if the value of the shares drops below your exercise cost and may create a tax cost if the exercise generates an AMT liability. Tax planning for ISOs is truly a numbers game. With the help of a Grant Thornton professional, you can evaluate the risks and crunch the numbers using various assumptions.

ACTION OPPORTUNITYConsider an 83(b) election on your restricted stockWith an 83(b) election, you immediately recognize the value of the restricted stock as ordinary income when the stock is granted. In exchange, you don't recognize any income when the stock actually vests. You recognize gain only when the stock is sold, and it is taxed as a capital gain. |

Considerations for restricted stock

Restricted stock, which is granted subject to vesting, provides different tax considerations. The vesting is often based on time but can also be based on company and/or individual performance.

Normally, income recognition is deferred until the restricted stock vests. You then pay taxes on the fair market value of the stock as of the vesting date at the ordinary income rate. There is an election under Section 83(b), however, to recognize ordinary income when you receive the stock rather than waiting until it vests. This election must be made within 30 days after receiving the stock and can be very beneficial in certain situations.

So why make an 83(b) election and recognize income now, when you could wait to recognize income when the stock vests? Because the value of the stock may be much higher when it vests and because tax rates on ordinary income may increase. The election could make sense if the income at the grant date is negligible or if the stock is likely to appreciate significantly before income would otherwise be recognized. In these cases, the election allows you to convert future appreciation from ordinary income to long-term capital gains income.

The biggest drawback may be that any taxes you pay because of the election can't be refunded if eventually you forfeit the stock or the stock's value decreases. But if the stock's value decreases, you can report a capital loss when you sell the stock.

Understanding nonqualified deferred compensation

Nonqualified deferred compensation (NQDC) plans pay executives in the future for services being performed now.

But they don't have the restrictions of qualified retirement plans such as 401(k) plans. Specifically, NQDC plans can favor certain highly compensated employees and can offer executives an excellent way to defer income and tax.

There are drawbacks, however. Employers cannot deduct any NQDC until the executive recognizes it as income, and NQDC plan funding is not protected from an employer's creditors. Also, employers must be in full compliance now with IRS rules governing NQDC plans under Section 409A. The rules are strict, and the penalties for noncompliance are severe. If a plan fails to comply with the rules, plan participants are taxed on vested plan benefits immediately with interest charges and an additional 20% tax.

Executives generally must make an initial deferral election before the year in which they perform the services for the compensation that will be deferred. So an executive who wanted to defer some 2012 compensation to 2013 or beyond generally must have made the election by the end of 2011. Additionally, the following rules apply:

- Benefits must be paid either on a specified date according to a fixed payment schedule or after the occurrence of a specified event — defined as death, disability, separation from service, change in ownership or control of the employer, or an unforeseeable emergency.

- The decision about when to pay the benefits must be made at the same time the election to defer the compensation is made.

- Once that decision is made, the timing of benefit payments can be delayed, but generally cannot be accelerated.

- Elections to delay the timing or change the form of a payment must be made at least 12 months in advance of the original payment commencement date.

- New payment dates must be at least five years after the date the payment would have been made originally.

It is also important to note that employment taxes generally are due when the benefits become vested. This is true even though the compensation isn't actually paid or recognized for income tax purposes until later years. Employers can postpone the payment of these payroll taxes only when the value of the future benefit payments cannot be ascertained, which is often the case when the plan defines the future benefit using a formula rather than basing the benefit on an account balance. But you may want to pay your payroll taxes now, before the new Medicare tax becomes effective in 2013.

ACTION OPPORTUNITYAccelerate Medicare tax on NQDCEmployers may want to go ahead and pay payroll taxes on NQDC rather than postpone them when the value of the future benefit payments cannot be ascertained. Employees with earned income exceeding $200,000 (single filers) and $250,000 (joint filers) would then avoid the increase in Medicare taxes from 1.45% to 2.35%. Employers can withhold an executive's portion of the tax from the executive's salary or ask the executive to write a check for the liability. Employers can also pay the executive's portion, but this must be reported as additional taxable income. |

BUSINESS PERSPECTIVE

Setting up your plan

You're facing a new set of executive compensation challenges. Much of the economy has started to rebound, and you need to make sure your plan can still attract, retain and motivate top employees, who may suddenly have more options. But at the same time, the fallout from the financial crisis has created a regulatory and legislative feeding frenzy on executive pay and governance. Regulators, shareholder advocacy groups and lawmakers are challenging traditional performance objectives and the associated risks.

Dealing with underwater stock options

Historically, stock options have played a big role in most compensation programs, making up the lion's share of equity compensation granted to employees and executives. Even with the economy engaged in a slow-burning recovery, many companies are still likely dealing with depressed stock prices. When company stock goes through the floor, stock options are left underwater — meaning the stock is worth less than the exercise price of the option.

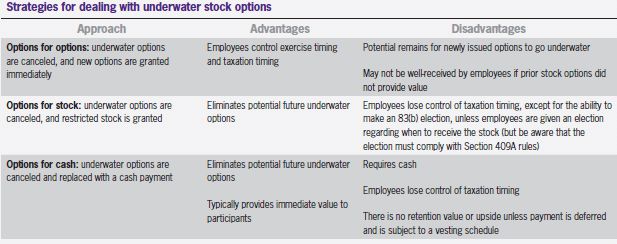

These options no longer provide any meaningful retention or performance incentive for employees, as the stock value would have to rise significantly before the options are "in the money." Underwater options are a big problem when they threaten to drive away top talent. The following table depicts various viable approaches to address underwater options.

TAX LAW CHANGE ALERTNew executive compensation rules now in effectThe sweeping financial reform bill (Dodd-Frank Wall Street Reform and Consumer Protection Act) enacted in 2010 provided for the gradual implementation of a number of strict new rules. The honeymoon is over, and the following new executive compensation restrictions on public companies have all taken effect:

|

Encouraging performance with restricted shares

Restricted stock is granted subject to vesting and has emerged as a useful tool for providing executive compensation and long-term incentives. In the past, restricted stock was often considered a giveaway by investors and shareholder activists. But the vesting of restricted stock does not have to be based on time — it can instead be linked to company performance. In the brave new world of executive compensation, performance shares can be a key component to linking pay to shareholder interests.

Performance shares link the vesting of restricted stock to company performance. This strategy has become more popular in the down economy as companies seek ways to motivate their employees with noncash awards. As discussed earlier, restricted stock also gives employees the option to control taxation with a Section 83(b) election or to elect when to receive the stock. And the strategy benefits from a number of potential approaches to develop meaningful but achievable performance goals that motivate participants and drive shareholder value:

- Market performance: based on meeting a specified target such as stock price

- Operational performance: based on specified operational goals such as increasing operating profits

- Absolute performance: based on absolute performance such as targeted growth or return percentage

- Relative performance: vesting occurs if performance measures are above those of a peer group

- Balanced scorecard: considers both quantitative and qualitative or strategic performance

- Corporate focus: vesting occurs only if corporate goals are achieved

- Business unit focus: vesting conditions are specific to individual business units

ISO employer costs and benefits

The tax benefits of ISOs for employees (discussed earlier) make them a very attractive form of compensation for the executives receiving them. But they can be less useful to the employer because of the following:

- The employer receives no income tax deduction for ISOs unless the employee makes a disqualifying disposition.

- There is a per-employee limit of $100,000 on the amount of ISOs that can first become exercisable for the employee during any one year. The limit is based on the value of stock at the grant date.

To qualify as ISOs, employers must meet the following strict requirements for stock options:

- The exercise price cannot be less than the fair market value of the stock at the time the option is granted.

- The option term cannot exceed 10 years from the date the option is granted.

- The option is exercisable only by the executive and cannot be transferred to anyone else except upon the executive's death.

- At the time the option is granted, the executive cannot own more than 10% of the total combined voting power of all classes of stock of the employer, unless:

-

- the exercise price is at least 110% of the fair market value on the grant date, and

- the option term does not exceed five years.

- The option plan must be approved by the employer's stockholders within 12 months before or after the date the plan is adopted.

Finally, ISOs may be granted only to employees. ISOs may not be granted to individuals such as board members or independent contractors.

Privately held business strategies

Privately held businesses often face different executive compensation challenges. Many owners and shareholders want to give key employees and managers the benefits of equity ownership without actually giving up any actual equity share.

If you have a privately held business, consider a phantom stock plan or performance-based cash as a solution. These offer opportunities for your company to share the economic value of an equity interest without the equity itself. A typical phantom stock plan simply credits selected employees with stock units that represent a share of the firm's stock. Essentially, it is a promise to pay the employee the equivalent of stock value in the future. Alternatively, a stock appreciation right (SAR) can be issued to provide an employee with a payment equal to only the appreciation in the stock value between the date the right is granted and some future date, rather than the full value of the stock.

You can value your stock by a formula or by formal valuation. The phantom stock or SAR can be awarded subject to a vesting schedule, which can be performance- or time-based. A phantom stock plan must comply with restrictions on nonqualified deferred compensation unless the employee is paid for the value of the phantom stock shortly after vesting. The same holds true for SARs, but unlike phantom stock, SARs can meet certain other conditions that exempt them from the restrictions on nonqualified deferred compensation.

Performance-based cash similarly promises employees a cash bonus in the future for time-based or performance goals. If you have a partnership, be careful about granting a profits or "carried" interest. Congress recently abandoned legislation that would raise taxes on the carried interests in a partnership, but it could be revived in the future.

CHAPTER 7 – BUSINESS OWNERSHIP: UNDERSTANDING THE BENEFITS AND BURDENS

Whether you're an executive, shareholder or owner in a privately held business or public corporation, you're undoubtedly worried about your entity-level tax burden. Business tax planning can be complex, especially in the current environment. While the soft economy is beginning to perk up, all the short-term tax incentives lawmakers enacted in recent years to spur growth are winding down. On top of that, tax increases are scheduled for 2013 unless there is legislative action, and many provisions from the 2010 health care legislation are becoming effective.

To assess the outlook for your business taxes this year and over the next several years, you need to start with an understanding of different business structures.

Tax treatment of business structures

Business structures generally fall into two categories: C corporations and pass-through entities. C corporations are taxed as separate entities from their shareholders and offer shareholders limited liability protection. See the following chart for C corporation income tax rates.

ACTION OPPORTUNITYConsider converting to an S corporationThe benefit of a single level of taxation is so significant that any privately held company should at least consider the advantages of converting or organizing as an S corporation. A conversion is made with a simple election for tax purposes and doesn't affect the liability protection of a corporation. But there are many things to consider first. You must satisfy many requirements to qualify for S corporation status. An S corporation can have no more than 100 shareholders, can have only a single class of stock issued and outstanding, and can be owned only by individuals and certain other entities. The definition of an eligible shareholder has expanded over the years to include estates and certain trusts and tax-exempt organizations. Members of a family can also be considered a single shareholder. Unfortunately, when a C corporation converts to an S corporation, it generally must pay a built-in gains tax on any appreciated assets sold in the first 10 years after the conversion (if the asset was held when the corporation converted). Lawmakers reduced the 10-year holding period for dispositions in 2009 through 2011, but this relief has expired for 2012. There have been legislative proposals to extend the reduced holding period, so check with your local Grant Thornton tax professional for a legislative update. |