On October 9, 2012, European Union (EU) Tax Commissioner, Algirdas Semeta, informed the EU-27 Finance Ministers that 11 Member States support the introduction of a common "EUwide" financial transactions tax (FTT) in their countries via enhanced cooperation. Therefore, the first hurdle to enhanced cooperation will soon be overcome, because before the FTT can be put in place at least nine Member States are legally required to formally send a letter to this effect to the Commission.

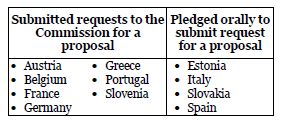

The Commissioner told the Economic and Financial Affairs (ECOFIN) Council that the 11 supporters are broken down as follows:

Support from 11 of the 27 EU Member States should be sufficient for this initiative to go forward, presumably with an FTT that is broadly based on stamp duty.

Next steps

To move the process ahead, the 11 EU Member States, all from Eurozone countries, must submit formal requests to the Commission, specifying the scope and the objectives of the enhanced cooperation. We understand that the scope and objectives of the EU-wide FTT are still unclear and unspecified, other than that they should be based on the Commission's original broad proposal for an EU-wide FTT.

EU Tax Commissioner Semeta aims to present the Commission's assessment of the participating Member States' requests, as well as a draft Council decision, for discussion at the next ECOFIN Council on November 13, 2012. The objective is to get authorization from the Council for the 11 Member States to go ahead under enhanced cooperation by December 2012, as agreed on June 28 and 29, 2012, by EU leaders in their Compact for Growth and Jobs. This would require an EU-27 qualified majority vote (in this case 74% of Member States' votes are needed, representing 62% of the EU's population) in the Council, after obtaining the consent of the European Parliament.

Formal requirements for enhanced cooperation are in Article 20 of the Treaty on European Union (TEU) and Articles 326 to 334 of the Treaty on the Functioning of the European Union (TFEU).

The likely effective date of the "EUwide" FTT is January 1, 2014.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.