![]() ,

Peter Vakof

,

Peter Vakof ![]() , Marie-Chantal Dréau,

Ray Haywood

, Marie-Chantal Dréau,

Ray Haywood ![]() ,

Sarah MacGregor

,

Sarah MacGregor ![]() and

James Pomeroy

and

James Pomeroy ![]()

Canada's Corruption of Foreign Public Officials Act ("CFPOA"), based on the Organization for Economic Co-operation and Development's ("OECD") Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, was brought forth to the Senate and received Royal Assent on December 10, 1998 in an attempt to ensure commercial fair dealing, government integrity and accountability, and the efficient and equitable distribution of limited economic resources. The CFPOA focuses on anti-bribery provisions that prohibit the promise, payment or giving of money or anything of value to any foreign official for the purpose of obtaining or retaining business or gaining an improper advantage.

The CFPOA rules apply to Canadian and foreign national individuals and corporations, where there is a substantial link between the offense committed and Canada. The CFPOA established criminal penalties for payments (or promises of payments) made by Canadian corporations or Canadian nationals, to foreign officials, or to any person for the benefit of a foreign public official, that could be considered bribes for any improper advantage in obtaining or retaining business. The penalties for individuals and corporations are as follows:

- Individuals: Indictable offense, as well as an extraditable offense (where an extradition treaty exists), punishable by up to 5 years imprisonment for individuals.

- Corporations: Indictable offense punishable by criminal fine for organizations. The quantum is at the discretion of the judge with no set maximum.

In addition to the financial ramifications, the consequences of CFPOA violations can extend to significant reputational damage with shareholders and in business relationships. Failing to have the appropriate anticorruption compliance policies and procedures in place can have an adverse effect on future joint ventures and acquisitions.

How does the CFPOA measure up against similar legislation in other jurisdictions?

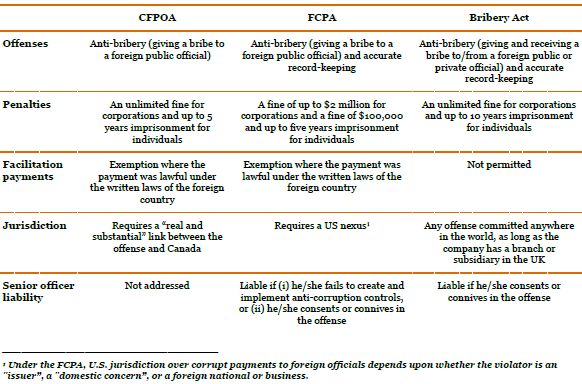

The CFPOA is a step in the right direction in the global fight against corruption. When comparing the CFPOA to the Foreign Corrupt Practices Act ("FCPA") of the United States ("US") and the Bribery Act of the United Kingdom ("UK"), it is clear there are some key differences in how each country is addressing corruption.

The following table summarizes the key differentiators between the CFPOA, the FCPA and the Bribery Act:

A Global Threat

Transparency International, a non-profit advocacy organization working to curb corruption in international business transactions, reported in its 2011 Corruption Perceptions Index, a total of 134 out of 183 countries (73.2%) scored less than 5 against a clean score of 10, and 72 countries scored less than 3 out of 10, indicating a high level of perceived corruption.

Multinational corporations are often faced with a variety of complexities ranging from cultural, legal, financial and accounting, to the obligations and responsibilities of those jurisdictions in which they have operations. With an increase in the number of Canadian companies with operations abroad, and the growing number of Royal Canadian Mounted Police ("RCMP") investigations into alleged bribery and kickback situations, considerable thought must be given to ensure companies are taking CFPOA compliance seriously. In April 2008, the RCMP established two International Anti-Corruption Units focused on the enforcement of CFPOA legislation and the number of investigations has increased significantly since this time.

Mitigating the Threat

As anti-corruption enforcement intensifies in Canada and the rest of the world, the onus of self-regulation and self-monitoring has been placed firmly on companies and their executives. Companies are paying higher costs for corruption, and a new layer of private litigation is emerging following the recent CPFOA charges. And yet, while some executives acknowledge these risks, they may still lack confidence in the strength of their corruption compliance programs.

With cross-border business becoming more integral to the growth of Canadian companies, there is much that companies can and should do to mitigate risks, particularly when carrying out due diligence before entering into business combinations and hiring third-party agents, consultants and suppliers. Also, companies need to prepare so that if corruption issues do arise, they are able to act swiftly and collaborate with regulators to minimize the potentially devastating effects that full-blown prosecutions can cause.

A compliance program is only as effective as the rigor with which it is monitored and enforced. Major areas of focus for companies should include the following:

- Establish a corporate policy against violations of the CFPOA;

- Demonstrate a strong tone at the top from senior management regarding the corporate policy;

- Develop compliance standards and procedures designed to reduce the prospect of violations of the anticorruption laws and the company's compliance code;

- Assign one or more senior corporate executives to be responsible and accountable for anti-bribery compliance;

- Create a system of financial and accounting procedures including internal controls to ensure books, records and accounts cannot be used for the purposes of bribery or concealing such bribery;

- Communicate and provide guidance and training to all employees, including the institution of appropriate disciplinary procedures to address violations of the anti-corruption laws and the company's Code of Conduct;

- Institute appropriate due diligence and compliance requirements pertaining to the retention and oversight of all agents and business partners; and

- Conduct periodic review and testing of the anti-corruption compliance code, standards and procedures, taking into account relevant developments and evolving international and industry standards.

How we can help

The Forensic Services group of PwC has extensive experience assisting clients with issues related to bribery and corruption. PwC's domestic and international network of Forensic professionals includes forensic accountants, certified fraud examiners, former financial regulators, former law enforcement officers, certified information system security professionals, computer science engineers, and asset recovery specialists. We have the technical skills, knowledge and hands-on experience necessary to assess the company's anti-corruption compliance program.

We have extensive experience gained from many years of anti-corruption investigations, worldwide compliance assessments and remediation assignments for multinational companies in a wide range of industries. We have worked with some of the largest companies in the world to assist them in responding to actual and suspected anticorruption violations related to the FCPA, UK Bribery Act, and other statutes. We have helped both to establish the nature and scale of the problem within those organizations, and also to enhance their anti-corruption programs and controls.

We have considerable experience assisting clients with CFPOA compliance and related issues, including:

- Backgrounds in investigation, forensic accounting, digital forensics, information security, regulatory, legal and law enforcement;

- A comprehensive understanding of local and regional culture, language, financial and regulatory systems;

- An international network of partners and staff who offer a unilateral advantage in investigating issues that extend across borders and the ability to provide our clients unprecedented global reach in a coordinated and expedited manner; and

- An international network of individuals experienced in performing computer forensics and in conducting cybercrime investigations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.