Previously published on June 26, 2012.

Keywords: HSR report, antitrust enforcement, mergers and acquisitions, FTC, DOJ

The latest update from the US federal antitrust enforcement agencies is in, and it shows that in fiscal year 2011, there was a significant increase in merger activities and continued aggressive antitrust enforcement by the Obama administration. Parties considering mergers and acquisitions should expect this aggressive enforcement policy to continue in 2012. In particular, the report shows:

- A significant increase in Hart-Scott-Rodino (HSR) filings, continuing a trend from the low point in 2009 after the economic downturn;

- The Obama administration continues to investigate a higher percentage of mergers than did the previous administration; and

- As has been the case since 2009, once a full investigation is opened, there is a high likelihood that the investigation will result in the government challenging the transaction.

On June 13, 2012, the Federal Trade Commission (FTC) and the Antitrust Division of the US Department of Justice (DOJ) published their Hart-Scott-Rodino Annual Report for the period of October 1, 2010 through September 30, 2011 (HSR Report). The report summarizes actions undertaken by the agencies with regard to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) during that period.

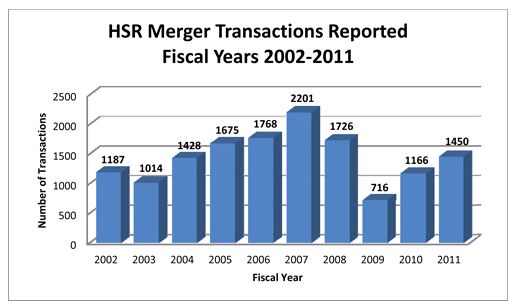

The report shows that the number of transactions reported pursuant to the HSR Act's premerger notification requirements continue to rebound from their 2009 lows. In fiscal year 2011, 1,450 transactions were reported, an increase of 24.4 percent from the 1,166 transactions reported in 2010, and a 102.5 percent increase from the 716 transactions reported in 2009. However, the number of transactions reported in fiscal year 2011 still marks a 51.8 percent decline from the 2,201 transactions reported in 2007, before the economic downturn.

The HSR Report also shows the increased antitrust scrutiny of mergers and acquisitions under the Obama administration. While most transactions reported under the HSR Act are cleared to move forward within the initial 30-day HSR waiting period, if either the FTC or the DOJ determines that further inquiry is necessary, either is authorized to issue a request for additional information and documents commonly referred to as a Ssecond request. In fiscal year 2011, of the 1,450 transactions reported under the HSR Act, the agencies issued a second request in 4.1 percent (58 transactions) of all reported transactions, which is similar to the percentage of second requests issued in fiscal years 2009 and 2010. By comparison, second requests averaged approximately 3.0 percent of reported transactions in fiscal years 2002-2008.

Of the 58 transactions subject to a second request in fiscal year 2011, 37 of them (63.8 percent) were challenged by the agencies in enforcement actions that resulted in the transactions being enjoined, the parties agreeing to a divestiture (or to another remedy) to obtain agency approval or the parties abandoning the transaction. While this percentage is down somewhat compared to fiscal year 2010, it remained higher than it was from 2003 to 2007, when it averaged less than 40 percent.

It is important to note that most HSR filings are cleared relatively quickly with no enforcement action being taken. In particular, in 61 percent of the filings submitted in fiscal year 2011, the parties requested and the agencies granted early termination of the 30-day HSR waiting period. Further, as noted above, fewer than 5 percent of filings result in a second request. Nevertheless, given the trend toward the agencies challenging a high percentage of transactions in which a second request is issued, parties to transactions that potentially raise antitrust issues should consult with counsel well in advance of submitting their filing so they are best positioned to address agency concerns during the initial 30-day period and avoid issuance of a second request, if possible.

The full text of the Annual Report is available at: http://www.ftc.gov/os/2012/06/2011hsrreport.pdf

Learn more about our Antitrust & Competition and Corporate & Securities practices.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2012. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.