Estates leaving 10% or more to charity are set to benefit from a new reduced rate of IHT.

The 2012 Finance Bill includes legislation which will reduce the rate of IHT to 36% in cases where 10% or more of an estate is left to charity. The new rules will apply to cases where the person's death occurred on 6 April 2012 or after this date.

An estate will be divided into three components:

- the free estate

- jointly owned assets passing on survivorship

- settled property (certain life interests in trust).

Calculating whether more than 10% of the net estate has been left to charity will be applied to each section in turn, although there will be the option to combine and consider component elements together. For this purpose, net estate is defined as the value of the estate after deducting the nil-rate band and all reliefs and exemptions, except for charitable gifts.

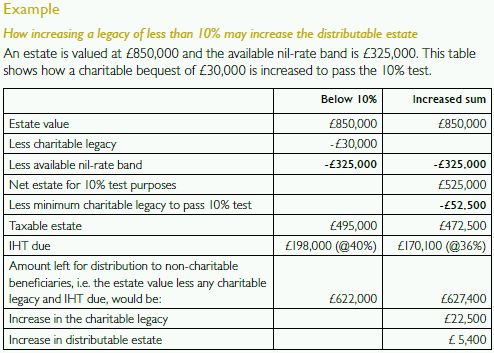

It may be that increasing a charitable legacy will produce a tax saving and increase the amount left to beneficiaries. Beneficiaries can backdate any charitable gifts using a deed of variation.

Based on the figures in the example below, the non-charitable beneficiaries would be better off by £5,400 as a result of the charities receiving an additional £22,500. The tipping point for this 'win-win' position is where the current level of proposed charitable legacies exceeds 4% of the value of the net estate.

There will therefore be an incentive for those who already have a reasonable level of provision in their wills for gifts to charity to increase the amounts or for their families to do so after death. On the other hand, a married couple might decide to defer such legacies so that they are only made out of the estate of the surviving spouse so as not to 'waste' the value for IHT-rate purposes.

IHT is a particularly emotive tax, although government statistics indicate that only 3% of estates were liable to pay tax in 2010/11. Nevertheless, it may be that some people would prefer to increase legacies to charity if it means reducing the size of their tax bill.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.