THE CHANGING REIT LANDSCAPE

The UK Real Estate Investment Trust ("REIT") regime launched on 1 January 2007, and immediately saw a number of the UK's largest listed property companies convert to REITs. The following five years have seen further REIT conversions as well as the launch of a number of start-up REITs. As at 1 December 2011 there were 24 UK REITs.

Significant changes to the REIT regime were announced in the 2011 Budget and draft legislation containing the detailed provisions was published on 6 December.

The proposed changes to the REIT regime are far-reaching and will significantly increase the attractiveness of the regime to a wider pool of property investors and providers of capital. The changes are aimed at reducing barriers to both entry and investment in REITs.

Although the new rules will not take effect until the Finance Bill becomes law (expected July 2012), those considering REIT conversion in light of the proposed changes will now be able to plan ahead with greater certainty.

The proposed changes to the REIT regime will benefit many Those expected to benefit most significantly from the proposed changes include:

All existing and future REITs

- The abolition of the 2% entry charge for companies entering the regime will significantly reduce the cost of entering the REIT regime, and may also result in more properties being acquired and sold within corporate wrappers.

- Allowing cash to be a 'good' asset for the purposes of the balance of business assets test will make it easier for start-up REITs to raise funds to be spent over time. It will also make it easier for existing REITs to raise additional capital from shareholders.

Institutional investors

- The new diverse ownership rule for institutional investors will enable small 'clubs' of diversely-owned institutions to form REITs, where this previously may not have been possible (although the REIT's shares will still need to be 'traded' on a recognised stock exchange).

Start-up and closely held/family owned property

companies

- The proposed three year grace period for new REITs to meet the non-close company requirement will enable property companies to build sufficient reputation to attract new shareholders without prejudicing their ability to enter the REIT regime at the beginning of the three year period.

AIM and PLUS market (and EU equivalent) traded

companies

- Relaxation of the requirement for a REIT to be listed on a 'recognised stock exchange' will enable AIM and PLUS market (and EU equivalent) traded companies to obtain REIT status without requiring e.g. a full London listing.

Offshore property companies

- The abolition of the 2% entry charge for companies entering the regime may make the 'on-shoring' of UK properties that are currently held offshore (and already outside the scope of Capital Gains Tax) much more attractive.

KEY BENEFITS OF REIT STATUS

REIT status affords a number of commercial and tax benefits, including:

Access to the global REIT "brand"

REITs are recognised globally as tax efficient structures for investment in real estate. As at September 2011, there were 35 countries worldwide that have REIT or 'REIT-like' regimes in place. They are known and understood by both investors and analysts worldwide.

Attractors of international capital

REITs have a proven track record of attracting international capital. There are significant investment pools and fund allocations specifically designated for investment in REITs, and conversion to REIT status can often unlock new sources of funding.

A liquid and publicly available source of property investment

Depending on what exchange a REIT is listed on, the REIT regime provides a method by which investors can tap into a liquid and publicly available source of property investment.

REITs may be attractive to investors for the following reasons:

- Easier access to property investment compared to purchasing a property directly.

- Indirect investment into property through a readily tradable investment asset, as compared to direct investment into property, which is generally illiquid.

- Diversity of investments across a range of property assets.

- Access to parts of the property sector that private investors cannot usually access e.g. shopping centres or industrial property.

- Regular income returns.

- Lower transaction costs, i.e. 0.5% stamp duty on shares compared to 4% SDLT on property.

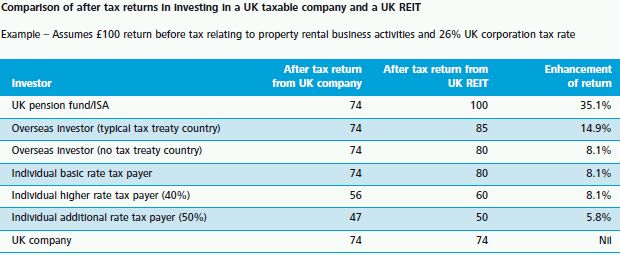

Improved after-tax returns for shareholders

The broad intention of the REIT regime is to replicate the tax treatment of a direct investment in property. REIT status therefore effectively removes the traditional 'double-layer' of taxation, where profits are taxed at both the property company and shareholder levels.

Instead, tax is generally only payable at the shareholder level, giving improved after-tax returns for shareholders.

Effective elimination of latent capital gains

On entering the REIT regime any latent capital gains on rental properties are effectively eliminated. In addition to the obvious tax benefits of exemption from corporation tax on capital gains, this may have the following additional benefits:

- Likely to reduce or potentially eliminate any discount to net asset value caused by latent capital gains.

- REITs often have a competitive advantage on corporate acquisitions, as other non-REIT bidders may have to discount their purchase price for latent capital gains. This benefit can potentially be shared with the vendor to increase their post-tax proceeds and reduce the REIT's purchase price.

- REITs are able to make commercial decisions in a tax-exempt environment, based on the commercial performance of individual assets (without having regard to which assets would give rise to taxable capital gains on disposal).

OVERVIEW OF THE UK REIT REGIME

The summary below represents a broad overview of the UK REIT regime. It reflects proposals set out in draft legislation published on 6 December 2011, which may ultimately be enacted differently.

A UK REIT is a UK tax resident company, that carries on a 'property rental business', meets the various conditions for REIT status, and has given notice that it wishes to enter the UK REIT regime. For the purposes of the REIT regime, a 'property rental business' excludes the letting of owner-occupied buildings.

A REIT may be either a single company REIT, or a group REIT. A group REIT will include, broadly, the principal company of the REIT and all of its 75% subsidiaries. There are specific anti-avoidance rules that prevent groups deliberately manipulating their structures to include or exclude companies from the REIT group where this is done to enable certain REIT conditions to be met. REITs may also give notice for joint ventures in which they hold at least a 40% beneficial interest to become proportionately part of the REIT.

REITs do not need to be pure property companies and some of the existing REITs are hybrid businesses such as self-storage.

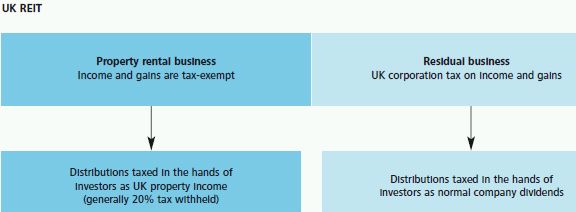

Property rental business profits and gains

REITs are exempt from UK corporation tax on rental profits and capital gains arising from their property rental business.

Distributions to investors derived from tax-exempt rental profits or gains are generally subject to basic rate withholding tax at 20% except, for example, where paid to a pension scheme or UK resident company. Overseas investors may be able to reclaim part (or all) of the withholding tax under a tax treaty.

Investors are taxed on such distributions of tax-exempt profits and gains at their normal tax rate on income (as profits and gains of a UK property business, rather than as a normal dividend receipt), with a credit for any tax withheld. However, they will be taxed as a dividend under tax treaties.

To ensure a regular flow of income is subject to tax at the investor level, REITs are required to distribute 90% of their tax-exempt rental profits (calculated on a tax basis). This distribution requirement does not include capital gains which can be retained within the REIT. (However, note that investors are also taxed at the income rate if they do receive exempt capital gains as distributions.) They can satisfy this 90% distribution requirement using stock dividends.

Residual business profits and gains

Any income and gains which are not derived from property rental activities are part of the residual business and will be subject to UK corporation tax in the normal way. This would include property trading activities, development and asset management fees and capital gains on disposals of shares. Distributions of profits and gains from the residual business will represent normal company dividends in the hands of investors when distributed.

The majority of REITs will therefore have both a tax exempt business and a smaller residual taxable business.

CONDITIONS

There are a number of conditions that a company (or principal company of a group REIT) needs to satisfy in order to become a REIT and remain within the regime. The conditions are broadly as follows:

Company conditions

The company (or principal company of a group REIT) will need to satisfy the following conditions:

- Tax resident in the UK only.

- Not an open-ended investment company.

- Listed/traded on a 'recognised stock exchange' (see below).

- Not a close company (see below). " One class of ordinary shares. " No 'non-commercial' loans.

The current listing requirement includes most major 'main' markets, including London, Channel Islands, Luxembourg, New York, Euronext etc. With effect from July 2012, this requirement is expected to be relaxed, by replacing it with a requirement to be 'traded' on such an exchange. This change will allow AIM and PLUS market (and overseas equivalent) traded companies to obtain REIT status.

The 'close company' condition currently prevents the principal company of a group REIT from, broadly, being under the control of five or fewer persons. Certain exemptions are currently available, for example where at least 35% of whose shares are held by the 'public' (as defined, which includes persons holding 5% or less of the shares and in certain circumstances shares held by registered pension schemes) and are subject to dealings.

However, the usual close company exemption for companies that are themselves controlled by non-close companies is currently disapplied for the purposes of the REIT regime (such that a company owned by a small club of institutional investors would likely not meet the close company condition).

With effect from July 2012, the close company condition will be relaxed with the introduction of two new rules:

- A diverse ownership rule will be introduced for institutional investors. This will recognise the fact that such shareholders are themselves diversely owned and will enable small 'clubs' of (and potentially individual) institutions to hold REITs. The draft legislation adopts a 'white list' approach to the new diverse ownership rule for institutional investors. The list currently includes sovereign wealth funds and UK pension schemes, insurance companies, unit trusts and open-ended investment companies (and each of their overseas equivalents). Furthermore, secondary powers will give Treasury the flexibility to revise this list from time to time by regulation.

- A three year grace period for new REITs to meet the non-close company requirement will enable property companies to build sufficient reputation to attract new shareholders without prejudicing their ability to enter the REIT regime. If the close company rules are not met by the end of the grace period, there will be no further penalty other than a loss of REIT status.

However, the new 'traded' requirement as currently drafted could get in the way of institutional investors forming REITs and could limit the potential scope of the new fixed three year grace period.

Property rental business conditions

- The REIT must hold at least three properties and, of these, no single property can exceed 40% of the total value of the properties in the property rental business.

- At the beginning of each tax accounting period, at least 75% of the REIT's gross assets (on an IFRS accounting basis) must relate to the property rental business. With effect from July 2012, it is expected that cash and cash equivalents will be regarded as a 'good' asset for the purposes of this test.

- In each tax accounting period, at least 75% of the REIT's accounting profits (on an IFRS accounting basis) must relate to the property rental business.

Distribution conditions

- The REIT must distribute 90% or more of its tax-exempt income profits (not capital gains) by the filing date of the company's tax return (usually twelve months after each accounting period end). This condition can also be met by way of stock dividends.

Other considerations

There are other aspects that a REIT needs to consider, including:

- There are restrictions whereby a penalty tax charge is payable by a REIT if it pays a dividend to a corporate shareholder who is beneficially entitled to 10% or more of the REIT's dividend payments or share capital, or controls 10% or more of the voting rights of the REIT. It is normally possible to structure around this 10% limitation using HMRC approved methods.

- REITs are required to maintain a profit:financing cost ratio of greater than 1.25:1, otherwise a tax penalty may arise. With effect from July 2012, the definition of "financing costs" will be amended to clarify that it is interest paid on excessive borrowings that will be measured in the test, rather than the total accounting finance costs incurred in borrowing.

- Properties that are part of the tax-exempt business and are redeveloped and sold may fall outside of the exempt activities and into the residual business if the redevelopment costs exceed 30% of the fair value of the property (at the later of entry date or acquisition) and the disposal is within three years of practical completion of the development.

Breach of conditions

If a REIT breaches one or more of the REIT regime conditions, the penalty can range from automatic expulsion from the regime to additional tax liabilities for the REIT.

ENTRY AND CONVERSION CHARGE

In order to enter the regime the company must give notice in writing to HMRC specifying the date from which the REIT regime is to apply and whether it will be a company REIT or a group REIT.

On entering the REIT regime the rental properties are treated as sold and immediately reacquired at market value. The gains or losses arising on these deemed disposals are ignored for tax purposes. Instead, an entry charge is currently payable and is calculated as 2% of the market value of the rental properties as at the date of entry.

The entry charge can be paid upfront or it can be settled in four REIT instalment payments over four years. However, if paid in instalments, the conversion charge will increase to 2.19% in total.

With effect from July 2012, this 2% entry charge is expected to be abolished.

FACTORS TO CONSIDER WHEN DECIDING WHETHER TO BECOME A REIT

Entering the REIT regime will impact the whole business of the company. Therefore, companies will need to carefully consider a number of factors before deciding whether to become a REIT.

The factors may include:

- The cost of the 2% entry charge (which is expected to be abolished from July 2012) compared to the ongoing benefit of tax exemption, together with costs of complying with the listing requirement.

- The requirement for diversity of ownership.

- Implications of complying with the company, distribution, balance of business and interest cover conditions and tests.

- Whether the company needs to increase operational efficiency in order to provide attractive income yields to investors.

- Whether the company's existing reporting tools provide the outputs that will be required as a REIT (monitoring of conditions, accurate forecasting, accounting information etc).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.