M&A MARKET REVIEW AND OUTLOOK

Market Review

M&A activity rebounded significantly in 2010, ending the decline that began in 2008 and continued through 2009. Global M&A deal volume rose from 19,127 transactions in 2009 to 27,460 in 2010, a 44% increase. Similarly, global M&A deal value increased 81% to $2.03 trillion in 2010, up from $1.12 trillion in 2009. Although showing a marked improvement over the 2008 and 2009 numbers, M&A activity has yet to return to the record-setting level of 2007, which boasted 31,883 transactions and a $2.69 trillion deal value.

Average global deal size grew to $73.8 million in 2010, up from $58.4 million the prior year. In addition, the number of deals showed sequential quarterly increases throughout 2010, continuing a trend that began in the second quarter of 2009. Aggregate deal value rose in the first quarter of 2010, only to decline slightly in the next quarter before rebounding in the second half of the year.

In the United States, the volume of M&A activity increased 35%, from 6,853 transactions in 2009 to 9,238 in 2010. US deal value increased 57%, from $564.3 billion in 2009 to $887.3 billion in 2010.

In Europe, both deal volume and deal value increased even more dramatically from 2009 levels. Volume increased 59%, from 7,371 deals in 2009 to 11,736 in 2010, while total deal value increased 106%, from $379.0 billion to $780.5 billion.

The Asia-Pacific region also experienced significant growth in deal volume and value. The number of Asia-Pacific deals increased 27%, from 6,285 transactions in 2009 to 7,970 in 2010, while aggregate deal value jumped 112%, from $308.1 billion to $652.5 billion.

The increases in average deal size in 2010 were primarily due to the significant worldwide growth in the number of billion-dollar transactions, which doubled from 184 during 2009 to 368 during 2010. Aggregate global billion-dollar deal value increased 75%, from $721.1 billion in 2009 to $1.26 trillion in 2010. The number of billion-dollar transactions involving US companies experienced a 118% surge, rising from 79 in 2009 to 172 in 2010. The aggregate value of billion-dollar US deals increased 38%, from $420.3 billion in 2009 to $580.0 billion in 2010. The number of billion-dollar transactions involving European companies rose more than 80%, from 82 in 2009 to 148 in 2010, and aggregate deal value increased 113%, from $241.7 billion to $515.6 billion. Billion-dollar transactions involving Asia-Pacific companies increased 98%, from 55 deals to 109 deals, and aggregate deal value soared 157%, from $151.4 billion in 2009 to $388.8 billion in 2010.

Sector Analyses

Results varied across principal industry sectors in 2010. Most sectors, however, experienced increases in both deal volume and deal value:

- The global financial services sector saw a 61% increase in transaction volume, from 931 deals in 2009 to 1,497 deals in 2010. Aggregate global financial services sector deal value rose 27%, from $91.3 billion in 2009 to $116.3 billion in 2010. In the United States, financial services sector deal volume increased 51%, from 350 deals in 2009 to 528 deals in 2010. Aggregate deal value increased a modest 12%, from $35.5 billion to $39.6 billion. Aon's $4.7 billion acquisition of Hewitt Associates led all US deal activity within the financial services sector during 2010.

- The information technology sector experienced a rise in both deal volume and deal value, with the total number of IT deals increasing 37%, from 2,808 in 2009 to 3,836 in 2010. Global IT deal value increased 55%, from $71.3 billion in 2009 to $110.5 billion in 2010. US IT deal volume increased 34%, from 1,523 deals to 2,042 deals, while US aggregate IT deal value rose 44%, from $58.2 billion in 2009 to $83.6 billion in 2010. Intel's $7.3 billion acquisition of McAfee led all US deal activity in 2010 within this sector.

- The telecommunications sector also rebounded from the global decline in M&A activity during 2008 and 2009, with deal volume increasing 43%, from 569 deals in 2009 to 816 deals in 2010. Global telecommunications deal value increased more than 165%, from $60.2 billion in 2009 to $159.5 billion in 2010. US deal volume increased 42%, from 183 deals in 2009 to 260 in 2010. Accompanying the growth in deal volume, US aggregate telecommunications deal value more than tripled, rising from $18.1 billion in 2009 to $64.6 billion in 2010. Qwest Communications' acquisition by CenturyTel, valued at $10.5 billion, led the US telecommunications sector in 2010.

- Compared to the other principal industry sectors, the life sciences sector did not fare as well in 2010. Global M&A transaction activity in the life sciences sector increased 49%, from 700 deals in 2009 to 1,046 in 2010. Global life sciences deal value, however, was essentially unchanged, inching up from $166.9 billion to $167.8 billion. The US life sciences sector saw a 26% increase in deal volume, from 371 transactions in 2009 to 468 in 2010, while aggregate US life sciences deal value plunged 38%, from $152.7 billion to $94.3 billion. Merck's acquisition of Millipore, valued at $6 billion, was the largest deal of 2010 in the US life sciences sector.

- The M&A market for venture-backed companies saw a 30% increase in deal volume, climbing from 408 deals in 2009 to 531 deals in 2010. Total deal value increased 67%, from $23.2 billion in 2009 to $38.8 billion in 2010.

Outlook

Fueled by large cash holdings by strategic acquirers, M&A activity has continued to improve in 2011, despite growing uncertainty in economic conditions. Through June 30, 2011, transaction and dollar volumes were up across most regions and sectors, compared to the same period in 2010. Global M&A deal volume increased from 13,130 transactions in the first half of 2010 to 14,886 transactions in the first half of 2011, while aggregate deal value nearly doubled from $914.3 billion to $1.79 trillion.

US deal activity showed similar trends, with 5,077 transactions and an aggregate deal value of $928.9 billion in the first half of 2011 compared to 4,582 transactions with an aggregate deal value of $443.3 billion in the comparable period of 2010.

Expectations for the coming year are generally optimistic, particularly for deal activity by strategic acquirers who have stockpiled large cash balances. The outlook, however, is tempered by growing concern over the health of the US and world economies. Improvements in economic conditions and the continuation of low interest rates would help sustain the growth in the overall M&A market that has been seen over the past 18 months. Technology companies are likely to remain attractive targets.

Private equity activity continues to contribute to the strength of the M&A market. On the sale side, many private equity firms are looking to dispose of companies acquired in the past several years as original debt financings become due. On the buy side, private equity funds are encouraged by improved debt markets, though the terms of that debt are less attractive than those in place prior to 2007.

Overall, the extent to which 2012 deal activity surpasses the levels of 2010 and the first half of 2011 will depend on the strength of the economy as a whole.

SEC ADOPTS NEW GOLDEN PARACHUTE RULES

In January 2011, the SEC adopted rules implementing the three sayon- compensation advisory votes required by Section 951 of the Dodd-Frank Act. In addition to rules regarding "say-on-pay" (periodic, non-binding stockholder votes on executive compensation) and "say-on-frequency" (periodic, non-binding stockholder votes on the frequency of say-on-pay votes), the SEC adopted rules requiring expanded disclosure and stockholder advisory votes with respect to "golden parachute" arrangements.

Overview of New Requirements

The new golden parachute rules, which became effective for proxy statements and certain other SEC filings made on or after April 25, 2011, with respect to mergers, acquisitions, consolidations and sales or other dispositions of all or substantially all of a company's assets (collectively referred to as "Covered Transactions"), have two components:

- Item 402(t) of Regulation S-K sets forth disclosure requirements with respect to golden parachute arrangements in connection with a Covered Transaction.

- Rule 14a-21(c) under Regulation 14A of the Securities Exchange Act of 1934 requires a non-binding stockholder advisory vote with respect to golden parachute arrangements when stockholders are asked to approve a Covered Transaction—commonly referred to as a "say-on-parachutes" vote.

Golden parachute arrangements include any agreements or understandings, whether written or unwritten, between each named executive officer (NEO) and the acquiring company or the target company, concerning any type of compensation, whether present, deferred or contingent, that is based on or otherwise relates to a Covered Transaction.

While the required tabular presentation of golden parachute arrangements described below is new, similar information has long been required to be disclosed in merger proxy statements pursuant to Item 5 of Regulation 14A, "Interest of Certain Persons in Matters to Be Acted Upon."

Disclosure Requirements for Golden Parachute Arrangements

When a company engages in a Covered Transaction, new Item 402(t) requires the company to quantify and disclose all golden parachute arrangements between each NEO and the acquiring company or the target company. Item 402(t) requires this disclosure to be provided in a prescribed format in a new Golden Parachute Compensation table (shown below).

In combination with the table, the company must provide a description of the specific circumstances triggering payment, the payment mechanics, any material conditions or obligations to the receipt of payments, and any material factors related to each golden parachute agreement.

The Item 402(t) disclosure requirements are not limited to merger proxies for which the say-on-parachutes vote is required. Disclosure of golden parachute arrangements is also required for certain information statements on Schedule 14C, registration statements on Form S-4 and Form F-4, Rule 13e-3 going-private transactions, and third-party tender offers and Schedule 14D-9 solicitation/ recommendation statements. In addition, proxy or consent solicitations that do not contain merger proposals but pertain to other business being acted on, such as an acquiring company's solicitation seeking stockholder authorization to issue stock in a merger, trigger an obligation to provide the same disclosure that would be required if a merger proposal were being voted on by a company's stockholders.

Among the noteworthy aspects of the golden parachute disclosure requirements are the following:

- When a target company seeks stockholder approval of a Covered Transaction, Item 402(t) requires the target company to disclose any golden parachute arrangements that the target company has with both the NEOs of the acquiring company and the NEOs of the target company.

- If an acquiring company seeks stockholder approval in connection with a Covered Transaction, such as approval to issue the acquiring company's stock in a merger, then the acquiring company must also provide disclosure with respect to any golden parachute arrangements that the acquiring company has with both the NEOs of the target company and the NEOs of the acquiring company.

- Item 402(t) disclosure is not required with respect to bona fide post-transaction employment agreements to be entered into with an acquiring company in connection with a Covered Transaction.

- In the event that uncertainties exist as to the determination of the amounts payable under golden parachute arrangements, a company must make a reasonable estimate and disclose the material assumptions underlying the estimate, including forward-looking information as appropriate. Item 402(t) does not permit the disclosure of an estimated range of payments.

Say-on-Parachutes Vote Requirements

New Rule 14a-21(c) requires that, in proxy statements for meetings at which stockholders are asked to approve a Covered Transaction, companies must provide for a separate stockholder advisory vote on the golden parachute arrangements required to be disclosed under Item 402(t). Since the say-on-parachutes vote is advisory in nature, its outcome is not binding.

Companies should consider the following disclosure issues in connection with say-on-parachutes votes:

- Companies should disclose the effect of the outcome of the say-on-parachutes vote on the payments that may be made under the golden parachute arrangements. For example, this disclosure typically would include a statement to the effect that, regardless of the outcome of the say-on-parachutes vote, the company is contractually obligated to pay the compensation to NEOs disclosed in the proxy statement, subject to the conditions of the underlying golden parachute arrangements and the approval and completion of the Covered Transaction.

- To help stockholders understand why the new disclosure with respect to golden parachute arrangements is being provided, and why the say-on-parachutes vote is being solicited, companies may want to provide background information in the Q&A section of the proxy.

Implications for Annual Meeting Proxy Statements

Item 402(t) disclosure is not required in annual meeting proxy statements. Nonetheless, companies can voluntarily provide the enhanced Item 402(t) disclosure in their annual meeting proxy statements. If a company's golden parachute arrangements have been subject to a say-on-pay advisory vote as part of the company's annual meeting proxy, then a separate say-on-parachutes vote will not be required in connection with a subsequent Covered Transaction, subject to several important limitations:

- A say-on-parachutes vote is not required in connection with a subsequent Covered Transaction only with respect to the specific golden parachute arrangements that were previously the subject of a say-on-pay advisory vote.

- Any modifications to golden parachute arrangements that were previously the subject of a say-on-pay advisory vote, as well as any new golden parachute arrangements, will require a say-on-parachutes vote. Such modifications would include, for example, changes in compensation as a result of:

-

- a new NEO;

- additional grants of equity compensation in the ordinary course; and

- increases in salary.

- If a new say-on-parachutes vote is required for new or modified golden parachute arrangements, the company will need to provide two separate Golden Parachute Compensation tables so that stockholders can clearly evaluate the golden parachute arrangements that are subject to the new say-on-parachutes vote.

-

- The first table must show all golden parachute arrangements, including both the arrangements and amounts previously disclosed and subject to the say-on-pay advisory vote and the new or modified golden parachute arrangements.

- The second table must show only the new or modified golden parachute arrangements.

- While a new say-on-parachutes vote is generally not required solely due to updates to the Golden Parachute Compensation table that are necessary to reflect fluctuations in a company's stock price, if a change in a company's stock price results in a tax gross-up payment becoming payable, a new say-on-parachutes vote will be required.

- Item 402(t) disclosure voluntarily provided in an annual meeting proxy statement is subject to the say-on-pay advisory vote being held at such annual meeting.

Also, including the company's golden parachute arrangements as part of a say-on-pay advisory vote at an annual meeting may have an unintended signaling effect to the market regarding the company's future plans related to mergers or similar transactions.

To date, very few companies have voluntarily included Item 402(t) disclosure in their annual meeting proxy statements. In light of the limitations described above, we do not expect many companies will elect to provide Item 402(t) disclosure in connection with future annual meetings.

COUNSEL OF CHOICE FOR MERGERS AND ACQUISITIONS

Serving Industry Leaders In Technology, Life Sciences, Cleantech, Financial Services, Communications And Beyond

SPECIAL CONSIDERATIONS IN CALIFORNIA M&A TRANSACTIONS

In addition to the deal-structuring issues that typically arise in connection with any acquisition, M&A transactions involving a party incorporated or based in California raise a number of special issues and opportunities. Some of these issues affect permissible deal terms, deal structure and the manner in which a deal is consummated, and others apply generally to California employees.

Deal Lockups

Since the Delaware Supreme Court's decision in Omnicare in 2003 limited the ability of an acquirer to guarantee deal approval by means of voting agreements, private company acquisitions have routinely used simultaneous "sign-and-close" and "sign-and-vote" transaction structures. In the former, the closing occurs concurrently with the initial signing of the acquisition agreement. In the latter, stockholders provide their approval by written consent immediately after the definitive acquisition agreement is signed.

Although California courts have not considered deal lockups and it is unclear whether California would follow Omnicare at all, California law does provide more flexibility than Delaware law in the protocol for obtaining merger approval from stockholders.

Under Delaware law, stockholder written consents cannot be signed and delivered until after the merger agreement has been approved by the board and signed. This requirement inevitably means a delay between signing and the receipt of stockholder approval. The delay can be short—as little as a few hours, possibly less—but Delaware's strict sequencing requirement still creates a window of risk during which the transaction is not fully "locked up" and a competing bidder could derail it.

Unlike Delaware law, California law does not require a signed merger agreement to be adopted by stockholders, but only requires stockholder approval of the "principal terms" of the merger. Stockholder approval can occur before or after board approval of the merger and the signing of the merger agreement. Where the target is a California corporation, stockholder approval can proceed contemporaneously with the signing of the definitive agreement— and can even precede signing if the principal terms of the transaction do not change after stockholder approval.

Business Combinations

The California Corporations Code has a number of other provisions that may affect acquisitions and other business combination transactions:

- Section 1101 requires that, in a merger involving a California corporation, all shares of the same class or series of any constituent corporation be "treated equally with respect to any distribution of cash, rights, securities, or other property." This requirement is potentially stricter than the comparable rules in Delaware, which have been interpreted— at least in some cases—to allow different forms of payment to be made to different holders of the same class of stock, as long as equivalent value is paid and minority stockholders are not disadvantaged.

- Section 1101 also limits the ability of an acquirer in a "two-step" acquisition transaction (such as a tender offer followed by a second-step merger) to cash out untendered minority shares. If an acquirer holds between 50% and 90% of a California target's shares, the target's non-redeemable common shares and nonredeemable equity securities may only be converted into non-redeemable common shares of the surviving or acquiring corporation. This means that, in all-cash or part-cash two-step acquisitions of California corporations, the minimum tender condition needs to be 90%, which can be a difficult threshold to reach.

- With limited exceptions, Section 1201 requires that the principal terms of a merger be approved by the holders of a majority of each class of outstanding shares (unless a higher percentage is specified in the corporate charter). Therefore, the holders of any class of outstanding shares—including common stock, which generally is controlled by current and former founders and employees, rather than investors— can block or fail to approve a merger transaction even if such holders hold less than a majority of the total outstanding shares of the target. In contrast, Delaware law requires a merger to be approved by the affirmative vote of the holders of a majority of the outstanding stock entitled to vote on the matter; no class or series voting is mandated by statute.

- Section 1203 requires an "affirmative opinion in writing as to the fairness of the consideration to the shareholders" of the subject corporation in transactions with an "interested party." The statute is not confined to an opinion as to the fairness of the consideration "from a financial point of view"—the normal formulation in an investment banking fairness opinion—and it is unclear whether, and in what circumstances, a more extensive opinion may be required in a transaction subject to the statute. Section 1203 does not apply in acquisition transactions where the subject corporation has fewer than 100 stockholders, or the issuance of securities is qualified after a fairness hearing under California law, as discussed below.

- Several sections restrict dividends and distributions to stockholders, as well as redemptions and share purchases. In general, these provisions are more restrictive than the comparable provisions of Delaware law, and may require structural solutions where compliance does not meet business objectives (amendments to the California Corporations Code expected to go into effect on January 1, 2012, may provide some relief).

"Quasi-California" Corporations

Section 2115 of the California Corporations Code—the "quasi-California" corporation statute—purports to impose various California corporate law requirements on corporations incorporated in other states, including Delaware, if specified tests are met. The law applies to any company, other than a public company with shares listed on the Nasdaq Capital Market, Nasdaq Global Market, Nasdaq Global Select Market, NYSE or NYSE Amex, if that company:

- conducts a majority of its business in California (as measured by property, payroll and sales); and

- has a majority of its outstanding voting securities held of record by persons having California addresses.

If a corporation is subject to the quasi- California corporation statute, a number of California corporate law provisions apply—purportedly to the exclusion of the law of the corporation's jurisdiction of incorporation—including provisions that directly or indirectly affect M&A transactions. These California provisions, and their counterparts under Delaware law, address:

- stockholder approval requirements in acquisitions (which are generally more extensive than the approval requirements under Delaware law);

- dissenters' rights (which differ from Delaware law in a number of respects);

- limitations on corporate distributions (which are significantly more restrictive than under Delaware law);

- indemnification of directors and officers (which is more limited than in Delaware);

- mandatory cumulative voting in director elections (permitted but not required in Delaware); and

- the availability of the California fairness hearing procedure described below to approve the issuance of stock in an M&A transaction (an alternative to SEC registration that has no counterpart in Delaware law).

In 2005, the Delaware Supreme Court held that Section 2115 is invalid as applied to a Delaware corporation. Existing California precedent, however, upholds Section 2115, and no California appellate court has ruled on the matter since the Delaware decision. Unless and until Section 2115 is invalidated by the California Supreme Court, a non-California corporation acts at its peril in ignoring this statute, since its application to out-of-state corporations may depend on forum shopping and a race to the courthouse. Careful transaction planning is required if a non-California corporation is deemed to be a "quasi-California" corporation.

Fairness Hearings

In M&A transactions involving the issuance of stock, California law offers a relatively efficient and inexpensive alternative to SEC registration that still results in essentially freely tradable stock—a "fairness hearing" authorized by Section 3(a)(10) of the Securities Act of 1933. An acquirer that is eligible to use a fairness hearing can avoid the greater expense and delay associated with a subsequent SEC registration.

The fairness hearing procedure is available where either party to the transaction is a California corporation, or a quasi- California corporation as discussed above. Fairness hearings are also possible if a significant number of the target's stockholders are California residents, regardless of the parties' jurisdictions of incorporation, or if the issuer is physically located in California or conducts a significant portion of its business in California. There is no hard-and-fast rule as to how many target stockholders must reside in California before an acquisition can qualify for a California fairness hearing, but transactions have qualified when a significant minority of the target's stockholders have been California residents. There also is no definitive guidance on what constitutes conducting a significant portion of a company's business in California.

A fairness hearing is conducted before a hearing officer of the California Department of Corporations. The hearing officer reviews some of the disclosure documents, but there are few rules governing their content, and the documents—a notice to stockholders of the hearing, followed by an information statement—are much less extensive than a proxy statement or registration statement governed by SEC rules. At the conclusion of the hearing, and assuming that the hearing officer determines that the proposed transaction terms are fair, a permit is issued that "qualifies" the acquirer's securities for issuance in the transaction.

Fairness hearings are open to the public. It is possible, but unusual, for a competitor or another bidder to appear at the hearing and contest the fairness of the transaction—for example, by making a higher bid on the spot.

Non-Competition Agreements

Courts are sometimes reluctant to enforce non-competition agreements on the grounds that they are contrary to public policy. The enforcement of noncompetition agreements in California is particularly problematic, because a California statute provides that noncompetition agreements are unenforceable except in very limited circumstances, such as in connection with the sale of a business, and recent California court decisions have invalidated agreements prohibiting former employees from soliciting customers of a former employer.

In addition, California courts generally will not enforce a non-competition agreement governed by the laws of another state unless the non-competition agreement would be enforceable under California law. Since there is a reasonable possibility that a former employee against whom an out-of-state company seeks to enforce a non-competition agreement may be a resident of California at the time enforcement is sought, this limitation can prevent a company from enforcing in California an otherwise valid noncompetition agreement entered into when the employee resided in another state.

Stock Options

If any California residents are to receive options or other equity incentives, then the stock option or other equity incentive plan must comply with California law. Prior California requirements prescribing minimum vesting rates and mandating the delivery of annual financial statements to all participants were eliminated in 2007, but California still imposes several requirements that can limit a company's flexibility. For example, an option must be exercisable (to the extent vested) for at least six months following termination of employment due to death or permanent and total disability and, unless the optionee is terminated for cause, for at least 30 days following termination of employment for any other reason.

If a company does not wish to extend these rights to all plan participants, it can use a separate form of agreement containing the required provisions for California participants. California option and equity incentive plan requirements do not apply to a public company to the extent that it registers option shares with the SEC on a Form S-8.

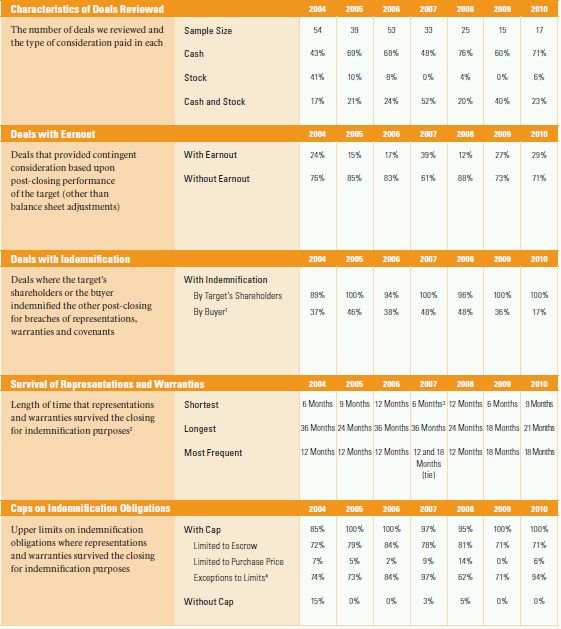

TRENDS IN VC-BACKED COMPANY M&A DEAL TERMS

We reviewed all merger transactions between 2004 and 2010 involving venture-backed targets (as reported in Dow Jones VentureOne) in which the merger documentation was publicly available and the deal value was $25 million or more. Based on this review, we have compiled the following deal data:

Footnotes

1 The buyer provided indemnification in 48% of the 2004 transactions, 25% of the 2005 transactions, 41% of the 2006 transactions, 53% of the 2007 transactions, 50% of the 2008 transactions, 40% of the 2009 transactions, and 80% of the 2010 transactions where buyer stock was used as consideration. In 65% of the 2004 transactions, 17% of the 2005 transactions, 35% of the 2006 transactions, 56% of the 2007 transactions, 25% of the 2008 transactions, 40% of the 2009 transactions, and 33% of the 2010 transactions where the buyer provided indemnification, buyer stock was used as consideration.

2 Measured for representations and warranties generally; specified representations and warranties may survive longer.

3 In two cases representations and warranties did not survive, but in one such case there was indemnity for specified litigation, tax matters and appraisal claims.

4 Generally, exceptions were for fraud, willful misrepresentation and certain "fundamental" representations commonly including capitalization, authority and validity.

5 Generally, exceptions were for fraud, willful misrepresentation and certain "fundamental" representations commonly including capitalization, authority and validity.

6 Another 13% of these transactions used a "hybrid" approach with both a deductible and a threshold.

7 Another 4% of these transactions used a "hybrid" approach with both a deductible and a threshold and another 4% had no deductible or threshold.

8 In 50% of these transactions in 2004, in 80% of these transactions in 2005, in 83% of these transactions in 2006, in 86% of these transactions in 2007, in 60% of these transactions in 2008, in 100% of these transactions in 2009, and in 67% of these transactions in 2010, buyer stock was used as consideration.

9 Generally, exceptions were for general economic and industry conditions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.