FOREWORD - CAUSE FOR OPTIMISM

Sorry, but if you were planning to list your law firm on the London Stock Exchange this October, you will have to wait until the new year, as the implementation of certain aspects of the Legal Services Act (LSA) have been delayed.

For the vast majority of law firms, the most pressing issue arising from the LSA will be who takes on the role of the COLP (Compliance Officer for Legal Practice) and COFA (Compliance Officer for Finance and Administration) – a particular concern if it's you who is taking on one of these roles!

For all professional practices there are the wider challenges of operating in an environment that is, as our economist Philip Lawlor reports later, suffering from a shortfall in demand.

Despite all of this, you will see that our 17th annual survey of the legal market gives cause for optimism as many firms appear to have taken the necessary steps to prepare themselves for the uncertainty ahead.

However, ensuring your business is fit for purpose is an ongoing challenge and this newsletter provides some insight into managing partner performance, the risks of fraud, the pensions 'time bomb', outsourcing, succession planning and funding. It also includes – I am delighted to say – a guest article by Mike Littlewood, head of professional services at RBS.

I hope you enjoy this issue.

Giles Murphy

THE CHANGING SHAPE OF PRACTICE - ANNUAL LAW FIRM SURVEY RESULTS

By Giles Murphy

Our 17th annual survey of the legal sector explores issues and trends affecting law firms and the legal market. This year, 126 of the UK's top 250 law firms took part, including two-thirds of the top 100, along with half of the UK's top 10 firms. Practices were represented by their managing partners, finance directors or similar

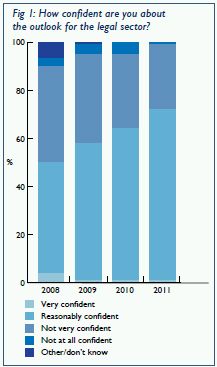

Confidence rises

Firms appear to have turned a corner, with business confidence returning to the sector. This year, almost three-quarters of respondents are confident about the year ahead (64% last year), with this rise in optimism supported by a drop in the proportion of those who are not confident. These are the most encouraging results we have received since 2007 and with the economy arguably facing uncertain times again, it suggests that law firms are now better prepared for the challenges ahead.

Key issues facing individual law firms

While the strength of the economy is naturally the overriding issue for both the sector and individual firms, practices are focusing on how to adapt to the changing environment, the performance of the partners and increasing levels of competition.

Running on corporate lines

Firms may operate as LLPs (80% in our survey), but they are increasingly looking to adapt their business structures to enhance the level of cash ultimately received by the partner. Recent rises in both the top rate of income tax and national insurance have resulted in growing interest in strategic tax planning and over half (55%) of participating firms have introduced a service company or are in the process of doing so. A further quarter are looking into this, suggesting that this has become routine practice within just a few years.

While the introduction of a corporate partner or member is considered to be more controversial, over a third of participating firms are looking into this and 10% have organised this change (or are in the process of doing so).

Full distribution of profits is increasingly cited as a thing of the past and our survey reveals that 29% of firms are retaining additional funds within their practice, and a further 25% are considering this. It is worth noting that in the corporate world it is accepted practice to hold back some profits to reinvest in the business and this is clearly becoming increasingly common among law firms.

There are fewer capital calls on partners than last year, with 14% of responding firms organising this and an additional 10% keeping this option under review.

It has long been the ambition of junior lawyers to become equity partners at their firm, and while this may still hold true, there is also a significant number going the other way. 30% of firms are de-equitising partners, with a further 20% considering this. Against this backdrop of fundamental change, almost two-thirds of respondent firms are either in the throes of reorganising their management structure or considering it. This is a similar proportion to last year.

For the first time, our survey asked about discretionary profit share and comments suggest that lockstep could be losing ground in favour of discretionary allocation. While almost three in four firms (71%) currently allocate less than a quarter of profits on a discretionary basis, this looks to be an area of change since one in three respondents expect to see a rise in the proportion of profits distributed on a discretionary basis.

Consolidation

For many years we have seen a high expectation of consolidation and this shows no sign of changing, with 80% believing merger activity will increase. While actual merger activity has been relatively low, a resounding 60% of respondents expect the Legal Services Act to be a catalyst for merger. Many participants added that there are a range of drivers at play, which for all firms centre on financial pressures and the need to manage costs, benefit from economies of scale and (arguably) the security of being part of a larger business.

SLOW PROGRESS? AN UPDATE ON THE LEGAL SERVICES ACT

By Nick Learoyd

The SRA continues to make progress despite delays in introducing the Legal Services Act.

One could be forgiven for thinking that four years later, the structures envisaged in the Legal Services Act 2007 might have been put in place. But despite earlier assurances by the key bodies involved, including the Ministry of Justice (MoJ), the Legal Services Board (LSB) and the Solicitors Regulation Authority (SRA), law firms will not be able to apply to become alternative business structures from 6 October 2011, as originally planned.

The fact that no revised date has been set is clearly frustrating, but this is because the MoJ needs to bring forward legislation to enact the Statutory Instrument. This will need to be scheduled into the parliamentary timetable, the consensus being that it might happen in late autumn.

SRA: encouraging engagement

The assumption remains that the LSB will formally appoint the SRA as the licensing authority, having already approved its application. Subject to parliamentary timetabling, the SRA should be open to receiving applications in early 2012.

In the meantime, the SRA has set up its alternative business structure team and issued significant guidance on the expected process and requirements. For firms with concrete plans, the SRA is actively encouraging engagement at this early stage. These discussions remain informal, but early engagement allows firms to address some of the SRA's potential issues and concerns and may, in turn, speed up their formal application come 2012.

Outcomes-focused regulation

Outcomes-focused regulation is a principles-based system that does away with many of the prescriptive detailed rules under the old code of conduct and allows firms to develop their own systems and controls to reflect the needs of the firm's clients and practice.

Despite the slippage in the alternative business structure timetable, the SRA continues to press ahead with the new outcomes-focused regulation, issuing the new SRA Handbook for implementation on 6 October 2011.

COLP and COFA

Chief among the structural changes required under the new code is the need for all law firms to appoint compliance officers for both legal practice (COLP) and finance and administration (COFA). The COLP will be responsible for ensuring that the firm complies with the terms and conditions of being an authorised body together with its statutory obligations. The COFA will ensure that the firm is compliant with SRA Accounts Rules. Both the COLP and COFA will be required to record any compliance failures and make these records available to the SRA, as well as to report any material non-compliance as soon as practicable.

The COLP must be a lawyer, but not necessarily a principal, while the COFA may be a non-lawyer. Firms will need to consider carefully these appointments to ensure that the relevant individuals carry sufficient authority within the firm to fulfil their respective roles. The SRA must approve appointments and, for most firms, nominations must be made by 31 March 2012.

OPTIONS FOR FUNDING

By Peter Thorpe

Peter Thorpe explores the funding routes available to partners of professional firms.

Partners in professional firms have traditionally used two methods to finance their firms: injecting funds as capital and leaving in the firm undrawn tax reserves and profits from previous years.

Obstacles to partner financing

Historically, capital account balances have remained broadly fixed with additional funding requirements being satisfied by the cashflow thrown off from increasing profits. However, with declining profitability and clients paying later the result has been depleted current account balances. This has led to pressure on cashflow and the need to consider alternative or additional sources of financing from third parties.

Following the financial crisis, lenders have become more risk averse, or more realistic, depending on your viewpoint (see next article), when it comes to lending to professional practices. Those banks that are agreeing to lend are offering reduced facilities at higher rates, often requiring security and/or personal guarantees from partners. In some cases, stringent financial covenants are also being put in place and, if breached, could result in facilities being withdrawn immediately.

Where funding is required for fixed asset purchases the firm may want to consider some form of finance lease arrangement to help procure the necessary equipment.

Increasing partners' capital

Most of the main banks offer professional practice loan facilities to partners. Partners can borrow a sum of money on a personal basis, which is then injected into the firm as capital. The partner generally repays the loan to the bank periodically from assigned profits, thereby maintaining the partner's capital interest. If the loan and subsequent capital injection is structured correctly, the interest payments will qualify for tax relief.

There is no requirement for capital to be injected in profit-sharing ratios. In fact, in some firms it is based on a fixed amount depending on the 'grade' of the partner. However, if the basis for injecting capital is to differentiate from the profit-sharing arrangements, the firm may wish to consider paying notional interest on capital balances as a first draw on profits to provide greater equity between the partners.

As an alternative, partners may be allowed to build up their capital by restricting the level of drawings. Clearly, this will provide the firm with capital over a period of time, and its projections will need to be reviewed to determine whether this is acceptable.

Looking ahead

With any funding requirement, it is essential that the firm prepares cashflow projections to demonstrate how much funding is needed over a certain period of time and how volatile this requirement is. This should be the case whether the firm is looking to the partners, the bank or, after the implementation of the Legal Services Act, a third-party equity provider.

BUILDING TOMORROW - BANK FINANCE FOR PROFESSIONAL FIRMS

By Mike Littlewood at RBS

Having recently joined RBS as head of professional services, Mike Littlewood gives his take on the sector.

To ensure our professional services proposition is appropriate for our clients, at RBS we continue to focus on the three key industries: law, accountancy and real estate services.

Each of these sectors is facing significant but different challenges. For example, the legal market is dealing with the dual impact of a static, at best, UK market and the now delayed arrival of changes to the Legal Services Act. The outcome of these market changes is yet to be seen, although an increased level of consolidation seems likely.

Other outcomes will almost certainly transpire. For example, cost management in legal services has become a source of competitive advantage. Law firms will invest in technology to manage the more repetitive elements of their work and to explore the possibility of outsourcing to low-cost providers.

In a slightly different vein, my colleagues working in the accountancy and real estate sectors note the pace of international change in their sectors and the increasingly connected nature of their clients' needs in a global marketplace. It is clear that as a bank, we must constantly review our range of products and services to keep them fresh and maintain a high level of creativity in product development.

Access to finance

Unsurprisingly, funding issues are a key discussion point across the professional services industry. A major change that we have observed recently is a shift from the traditional on-demand overdrafts to a more certain funding option of a two to five-year revolving credit facility. The potential downsides, such as additional costs for non-usage fees and covenant and performance checking every quarter, are generally seen as a small price to pay for the certainty of bank funding.

The security required for such banking facilities will always be a subject for deep discussion. Limited guarantees from equity partners may be appropriate and the use of debentures has certainly increased. But these are by no means 'must haves' in any bank funding discussion.

As with any corporate lending proposition, an important consideration will be the balance between what the equity partners have invested in the business and the level of debt the bank is being asked to provide. Innovative lending solutions are always a challenge with what is fundamentally quite a simple business model. Nevertheless, we expect to see the availability of more external capital, although it is difficult to gauge the speed of this change. In addition, debt capital markets will continue to play a role in certain circumstances and may increase in frequency if significant merger activity takes place.

Keeping pace with developments

There is much discussion in the sector about how professional firms are funded and we have placed ourselves firmly in the centre of these discussions. We are informed and inspired, and seek to continue helping clients achieve their commercial objectives.

THE GENERATION GAME

By Richard Green

Professional firms need a robust succession plan to continue growing, says Richard Green.

Professional firms should recruit and develop talented, young people and have an effective succession plan in place if they are to carry on growing and enable older partners to retire.

Gone are the days when partners can wait until they are ready to retire and then sell the firm to a third party for significant sums of money. This approach rarely works anyway because once clients know the plan, they have little incentive to stay with the firm, making it difficult for the business to achieve its financial goals and enact its sale plans. Moreover, and certainly in today's economic environment, larger firms might be prepared to pay a small earn-out or take over the business, but at no real value.

It's all in the planning

An effective succession plan tends to be reflected by the age profile of the partners. A spread of ages across the firm's various specialisms is usually a good sign. More often than not however – and in law firms especially – there is a 'top-heavy situation', meaning a lot of partners aged 45 to 55 are holding fairly senior positions.

In the past, set retirement ages made it easier to put a programme in place for retiring partners to scale down their workload and pass on expertise and client responsibilities. But with no default retirement age the situation is now trickier.

Some retiring partners have successfully opted to work part-time, scaling down their responsibilities and commitments. This may work for some disciplines but not others. An alternative approach is to increase holidays gradually. This will mean a reduced income, but the business gets used to managing without the outgoing partner.

Balancing a partner's income with the needs of the business can pose a significant dilemma. The retiring partner's view of what he or she is worth to the business may differ from what the managing partner or managing board think. What is crucial is that the firm has in place clear objectives for all partners, but particularly those nearing retirement so that an objective assessment of the partner's contribution can be made.

Paving the way for the future

For those coming up through the ranks there may be issues in relation to income needs and capital. Essentially, can they afford to buy into the business? And what are the capital values?

Property can be an issue. The cost of coming into the business can be high, as individuals may need to buy into the property. For this reason, it may be necessary to separate property from the normal trading business so that it doesn't impede partners from coming into the firm.

Using third parties

As the time line moves to the right, it is important to implement your succession plans. It might be worth considering outside assistance, especially when tackling more difficult concerns, as it will help depersonalise any issues between partners.

If partner succession issues aren't addressed, people joining the partnership may feel there is a block and simply move elsewhere. This could end up stifling the business and preventing growth.

ROUTES TO OUTSOURCING

By Ian Cooper

Ian Cooper looks at outsourcing models in the legal services space.

Should we or should we not outsource? If we do, should we outsource our legal processes and our back-office functions?

These are some of the key questions facing professional firms driven by fee pressures and concerns that a strategy needs to be formulated in advance of a surge in new market entrants. While each outsourcing model may have particular characteristics, a number of common models have emerged covering both legal processes and back-office functions.

Legal processes

The 'best friend' relationship

This is often seen as a two-way relationship between a larger and smaller UK firm. Bigger, more risky or technical work is passed to the larger firm while secondary, more cost-conscious work is given to the smaller firm. Similarly, a niche firm will look to offer specific specialist services not provided by its 'best friend'.

These relationships are not without their issues, for example, will this be a formal, exclusive, contractual relationship or will it operate on a more informal basis? And how will the benefits be monitored?

National partners

Professional firms in London, in particular, and the South East may partner with regional firms and pass on work that can be carried out at a lower cost.

As well as selecting the partner firm, the arrangement will need to be structured for the benefit of both firms.

Overseas opportunities

Outsourcing overseas is arguably an option only when it comes to more basic legal processes. Countries worth considering include Africa (the same time zone but significantly cheaper), Australia (the 12-hour time difference makes overnight response and working possible), Argentina, China, India, the Philippines and South Korea.

Key issues for the UK firm will inevitably be maintenance and control of the client relationship to the extent that the client sees no change to service quality or key relationships. More complex issues may arise, such as breach of client confidentiality, ethical standards, data security, liability of service providers and client privilege when looking at different overseas jurisdictions.

Business processes

Few firms have been immune to the unrelenting pressure on profitability and the desire to maintain, even improve, profitability. There is growing recognition that internal cost cutting alone is unlikely to provide the efficiencies and cost savings demanded and that other options will need to be considered.

Support services

The legal press shows evidence of firms transferring their support staff to outsourcing companies. This offers cost savings and, more importantly, allows these firms to focus on their core legal services while releasing them from managing support services.

New income streams

Similarly, there has been an emergence of service companies, predominantly for transfer pricing benefits. But this raises the question of income lines that might be generated by supporting other smaller local firms, for instance, with training, template documentation, printing and bulk purchasing.

Teaming up

This search for efficiencies continues with a number of firms joining forces to purchase non-legal services. Each firm takes responsibility for negotiating the purchase of one service for all firms in the buying group. Inevitably, we are also likely to see non-competing firms seeking to share one office to create a 'one-stop' service referral centre, not restricted to legal services.

This suggests that interesting times are ahead, with the only certainty being change.

PENSIONS TIME BOMB

By Mike Fosberry

Partners at risk of exceeding the lifetime allowance should act now, warns Mike Fosberry.

The reduction in the lifetime allowance from £1.8m to £1.5m from 6 April 2012 means some partners could end up with a 55% tax charge on benefits over this amount unless they take urgent steps to register for 'fixed protection'.

Who will be affected?

Under current pension rules, the value of an individual's pension arrangements must be measured against a lifetime allowance. If the value exceeds the lifetime allowance, a 55% tax charge is levied on the excess.

The lifetime allowance for the current tax year to 5 April 2012 is £1.8m, but it will reduce to £1.5m from 6 April 2012. It is quite possible that the new £1.5m threshold will be in place for a while, drawing more and more people into the 55% tax net.

The new limit does not apply to those who elected for 'enhanced protection' before 2006. But it will potentially affect everyone else, including individuals who are already taking pension income through drawdown rather than an annuity purchase.

This could be a ticking time bomb for young partners in their 30s or 40s in particular. Their pension savings may be below the £1.5m mark right now, but this may not be the case by the time they retire. It may be a good idea for these individuals to elect for fixed protection now and consider other investments for building up their retirement funds.

What should you do if you might be affected?

There are three key ways in which people can take advantage of the current higher lifetime allowance.

- People can still elect for fixed protection for funds up to £1.8m and avoid the 55% tax rate. Any election must be made by 5 April 2012. From this date, individuals who take this route will have to stop all pension contributions.

- Another option for those aged 55 or more is to start drawing benefits before 6 April 2012, while the current £1.8m lifetime allowance is still in place. If pension income is taken through drawdown rather than by purchasing an annuity, it may still be worth considering fixed protection in order to keep the current lifetime allowance when the value is measured against the lifetime allowance at age 75.

- An alternative is to make extra contributions before 5 April 2012 and then take up one of the above options. Given that individuals can now get tax relief on contributions of up to £50,000 per year and, in addition, can carry forward unused contribution allowances from the previous three years, maximising contributions now and then electing for fixed protection or taking benefits may prove valuable for high earners.

What next?

Before taking action, partners should review their total pension investments. This can be a complex and lengthy process, so it is important to start now or risk losing out substantially.

Anyone who elects for fixed protection will not be building up funds through their pension in future. So thought needs to be given as to where future retirement savings should be invested.

IS YOUR HOUSE IN ORDER?

By David Alexander and Dawn Baker

David Alexander and Dawn Baker examine recent trends in fraud and bribery in professional firms.

It's a sad fact that professional firms are not immune to fraud – especially given the financial pressures brought on by today's difficult economic environment.

Fraudulent activities

In the last two years several high-profile cases have been reported in the media. These have included £600,000 in fraudulent legal aid claims, the facilitation of multi-million pound mortgage frauds, and a £250,000 client money fraud and false accounting case to save a failing legal practice. Yet these headline-grabbing cases are just the tip of the proverbial iceberg, with most frauds going unreported.

The sluggish UK economy continues to ply pressure on professional firms, with partners just as likely to inflate their results to protect profit share as they are to put their hands in the till. In its 2010 survey, the Association for Certified Fraud Examiners identified the manipulation of results as the most financially damaging type of fraud suffered by businesses.

The UK Bribery Act – the new 'gold standard'?

The long-awaited UK Bribery Act came into force on 1 July 2011, replacing the US Foreign Corrupt Practices Act as the 'gold standard' in anti-bribery legislation.

The act is wide reaching, for example, money does not need to have changed hands for an offence to be committed; the mere intent to pay or receive a bribe is sufficient.

Recent cases in the legal sector have included bribing government offices to obtain a US$6bn engineering and other contract (the Tesler case) and accepting a bribe from a lawyer in return for giving false evidence.

As well as the offences of bribing and being bribed, the act introduces a new 'corporate' offence. Where bribery takes place within a commercial organisation, including a professional firm, the organisation could face unlimited fines and, arguably, irreparable damage to its reputation – unless it is able to prove that adequate anti-bribery procedures were in place and a rogue employee committed the offence.

Ignore at your peril

Unless a business is a major household name, it is tempting to think that the chances of being prosecuted are slim and to adopt a business-as-usual approach. This is a high-risk strategy.

The Serious Fraud Office will rely on organisations reporting instances of bribery, whether inside or outside their organisation. In addition to a fine, a successful prosecution could have a nasty sting in the tail in line with the Proceeds of Crime Act and Money Laundering Regulations.

The Proceeds of Crime Act is not just about depriving convicted drug dealers of their ill-gotten gains. It relates to the proceeds of any crime, including those from a criminal offence under the Bribery Act.

Professional firms need to act now to ensure they have adequate systems and controls in place to prevent bribery by employees and agents, and to protect themselves from the new corporate offence of failing to prevent bribery.

PARTNER PERFORMANCE - FINANCIAL MEASURES

By Rachel Stone

In the first of a four-part series, Rachel Stone focuses on the financial measures used to assess a partner's contribution to the firm.

In the last issue of Professional practices news, we considered a model for balancing the various performance priorities of the partner role. This month, we look at the first of these priorities – financial measures – in more detail.

The financial priorities of many partners focus on one core measure – chargeable or billable hours. We often speak to partners who believe their entire contribution to the practice can be measured using this one indicator, and that this should form the basis for all decisions about promotions, profit share and future reward.

However, more and more firms are now looking to build a smarter set of financial indicators that recognise the practical challenges of building and maintaining a profitable flow of client work.

Core financials for every partner

The classic measures of billable hours and billable value are still relevant. But this is tempered by a clear understanding that an hour on the clock does not necessarily translate into an hour's value in the bank.

Alongside chargeable hours should be a set of measures, made up of basic financial disciplines, to turn hours worked into profitable income for the firm. This will usually include:

- raw data in terms of total chargeable hours and a corresponding financial value for both partner and team

- information on the amount of potential chargeable time that is actually billed to the client

- write-off information at both initial billing stage and if a bill is subsequently challenged by the client

- an assessment of amounts billable under contingent fee arrangements to the risk and cost of the project

- management of work in progress – how quickly work on the clock is billed to the client and the daily cost of any delay.

Measuring partner profitability

On top of this basic information, there is a set of helpful questions that may be asked of each partner in terms of profitability.

- Is work being done at the most appropriate and cost-effective level or does the partner want to keep it for him/herself?

- Is the partner busy while his/her staff are under used?

- Is the partner keeping a close eye on lock up and looking for every opportunity to use upfront payments, interim billing and close project management to make sure the money is coming in at the

- earliest point? " Is the partner charging at a rate that allows for a reasonable level of profit to be generated on each job or does he/she tend to under price?

- How does the partner plan for additional client requirements? Is there a danger of unrewarded 'scope creep' that eats into potential profit?

It is easy to forget that many senior professionals and partners have little or no financial education and are not aware of how some of these key measures and ratios could help them generate more profit for themselves and their team.

Next time, we'll consider how you can focus partner attention on measures concerning client retention.

ECONOMIC OUTLOOK

By Philip Lawlor

As the UK economy loses momentum, Philip Lawlor looks at why growth is so lacklustre and where we go from here.

For a professional firm the health of the economy will often determine the current focus of the business, as well as its appetite for risk and growth. With the UK economy losing momentum, many firms remain under pressure.

The growth projections of 1.7% (2011) and 2.5% (2012) used by the Government in the March Budget are now looking optimistic. The International Monetary Fund has revised its estimates for UK growth to just 1.1% this year and 1.6% next year. There are also questions over the sustainability of the current fiscal austerity programme. The deterioration in sentiment regarding the status of the UK economy has contributed to UK gilt yields hitting their lowest level since the 19th century.

Structural headwinds

The UK economy is facing several structural headwinds. Consumption expenditure, which constitutes two-thirds of the economy remains very fragile and is unlikely to rebound sharply. It has been impacted by sustained erosion in real disposable income and a deteriorating labour market (the unemployment rate has increased to nearly 8%). The Coalition Government's fiscal austerity programme has yet to impact on unemployment, although it has had a significant effect on confidence. Ultimately, recessions are about the incremental impact of purchase decisions being postponed, which is directly linked to confidence.

The credit culture that spanned the 1980s to 2008 resulted in household debt as a percentage of disposable income growing from 85% in 1985 to 180% in 2007. Consumers are no longer spending more than they earn – instead they're focused on reducing their debt. This is expected to continue for a while. So the decline in consumer lending is perhaps as much about a lack of enthusiasm for credit as an unwillingness by banks to lend. The housing market also remains moribund.

Net exports have failed to accelerate and with Government expenditure in contraction mode, corporate capital expenditure is the only visible source of growth stimulus.

Impact of inflation

Inflation has clearly been a major problem over the last 18 months, eroding disposable income and undermining the credibility of the Monetary Policy Committee (MPC). Earlier this year the markets exerted pressure on the MPC to raise interest rates, which governor of the Bank of England and chairman of the MPC, Mervyn King, resisted. He argued correctly that as most of the inflation was due to rises in commodity prices and VAT, a rate rise would have little impact. The MPC could have raised rates to push sterling higher and counter imported inflation, but this would have killed off the nascent recovery in the manufacturing sector. Importantly, there is no evidence of longer-term inflationary expectations ratcheting upwards.

What next?

The August MPC minutes indicated mounting concern over the direction of the economy and revealed that for the first time since May 2010, no member voted for a rate hike. Consideration was also given to whether there was a case for extending quantitative easing. Ultimately, the case was not quite strong enough, although it suggests further quantitative easing will be deployed if downside risks materialise.

If we have learnt nothing else from the eurozone debt crisis, it is that highly indebted countries must maintain nominal GDP growth above their bond yield. Failure to do so results in the debt to GDP ratio expanding. Fortunately the MPC recognises this risk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.