COMMENT PERIOD ENDS: SEPTEMBER 23, 2011

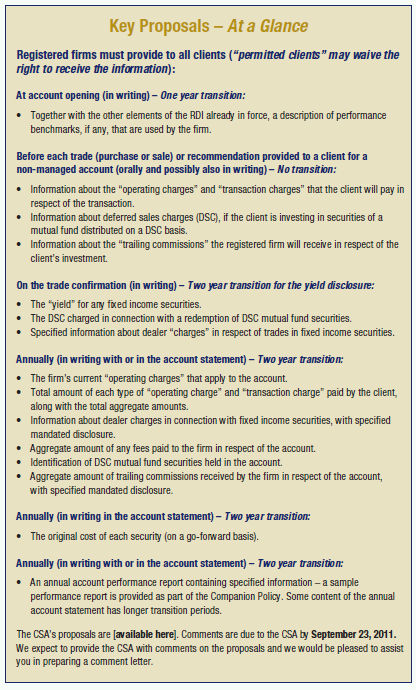

The comment period on the Canadian Securities Administrators' (CSA) proposed amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations to require additional "client relationship" disclosure ends on September 23, 2011. The proposed amendments published for comment on June 22, 2011 – referred to by the CSA as the "client relationship model" or "CRM-2" – build on the client "relationship disclosure information" mandated under NI 31-103 (RDI), and will require a registered firm (other than in its capacity as a registered investment fund manager) to provide a client with disclosure of:

- Account-level charges levied by the firm;

- Charges relating to certain investments held in, and transactions made for, the account;

- Compensation received by the firm in respect of the client's account; and

- Performance of the investments held in the account.

Registered firms will be required to provide information tailored to each client on account opening, on a pre-trade basis (for non-managed accounts) and annually. The CSA propose one to two year transition periods for compliance with the rules, although some provisions are proposed to become effective on the date the amendments come into force. Consistent with the regime established for registrants under NI 31-103, the proposed amendments to the Companion Policy contain much explanatory guidance that is essential reading to understand the full scope of the proposed rules, as well as the CSA's intentions.

In this Investment Management Bulletin we describe the proposals and highlight their potential impact on industry participants.

We also point out areas where we feel significant changes will be necessary in order to allow for effective and cost-efficient compliance, to acknowledge the regulatory scheme that applies to publicly offered investment funds and to achieve the CSA's objectives.

IMPACT OF PROPOSALS

All registered firms – other than a registered firm in its capacity as a registered investment fund manager – will be required to comply with the proposed new disclosure requirements.

We expect that the proposals will have significant impact on all registered firms, including those dealers that are members of the Mutual Fund Dealers Association of Canada (the MFDA) and the Investment Industry Regulatory Organization of Canada (IIROC). The CSA explain that they intend for these dealers to be exempt from most of the proposed requirements, but only where the CSA consider that the SROs of which they are members have substantially similar requirements.

During the past few years, both the MFDA and IIROC have developed and published for comment rules that cover the same ground as the CSA's proposals. The MFDA finalized its rules in December 2010, which were then approved by the CSA. Subject to any amendment as a result of the CSA's proposals, the MFDA's rules on cost disclosure will come into effect for new clients on September 28, 2011 and for existing clients on December 3, 2013; its rules on account performance reporting will come into effect on June 3, 2012.

IIROC published its proposed rules for a third comment period on January 7, 2011 and there has been no public information on the status of IIROC's consideration of comments received.

Although not specifically described by the CSA, there are substantive differences between the CSA's proposals and the rules of the SROs. The SROs will need to review the CSA's proposals to determine whether further amendments to their rules are necessary to harmonize them with the CSA requirements to ensure that the CSA will exempt SRO dealer members from having to comply with the changes to NI 31-103, in addition to the applicable SRO rules.

Similar to the concepts already in place for NI 31-103, a "permitted client" (as defined in NI 31-103) of a registered firm may waive receipt of much of the additional disclosure, which means the firm will have no obligation to provide that client with the information. Many registered firms will already have obtained permitted client waivers however, given the scope of the additional proposed requirements, it will likely be necessary for those firms to obtain new waivers that include references to the new requirements once they come into force.

PROPOSED AMENDMENTS TO RDI

The existing rules requiring RDI to be provided to clients of registered firms have been modified slightly, primarily to use the new proposed defined terms "operating charges" and "transaction charges" and to include a proposed requirement to give clients information about any performance benchmarks used by the firm.

The proposed amendments to the Companion Policy include detailed guidance on the information that must be provided in the RDI by registered firms. If adopted, this guidance may mean RDI currently being provided by registered firms will need enhancements, which may raise practical difficulties, since the CSA propose no transition for the proposed Companion Policy amendments.

The proposed defined terms "operating charges" and "transaction charges" are intended to replace the current references to "costs" in the current RDI disclosure requirements and include the charges by a registered firm to operate an account and to carry out a transaction. The CSA clearly intend a broad interpretation of these terms given the proposed guidance in the Companion Policy. The proposed Companion Policy amendments explain that the required cost and charges disclosure must include an explanation of the specified costs and fees paid by mutual funds if the client would likely be invested in mutual funds, in addition to the charges that will be levied against the account by the registered firm. Not only must disclosure about the fees and costs of a mutual fund investment be provided, the RDI must also explain how these costs "may affect the investment". It is clear that this disclosure may be generic investor education about investing in mutual funds and need not be tailored to a specific client, and presumably will only be required information if the client will be invested in investment funds.

The CSA also proposes a requirement to discuss performance benchmarks in the RDI, presumably only where the firm uses benchmarks to measure performance of their clients' accounts. Once effective, registered firms will have one year to include the additional disclosure on benchmarks in the RDI provided to new clients. We assume that the CSA intend registered firms to provide existing clients with supplemental information about benchmarks where relevant, although specific transition provisions have not yet been proposed.

PROPOSED PRE-TRADE/RECOMMENDATION DISCLOSURE

Registered firms will be required to provide clients with information about "operating charges" and "transaction charges" in connection with each investment to be made for the account on a pre-trade/pre-recommendation basis (other than for a managed account). In addition, for a purchase of a security, the firm must inform the client about:

- Any DSC that may be payable by the client on a future redemption of that security and

- Any trailing commissions that the firm may receive in respect of that security.

It is not clear whether this disclosure is required to be provided in writing, although the drafting of this proposed requirement differs from the RDI delivery requirement and we assume that the CSA expect this information to be provided as part of the discussion by the registered firm's registered individuals with the client about any intended trade or advice.

In addition, the CSA focus on averting churning of investments or inappropriate switches between different series or sales charge options of mutual funds, by focusing on registered firms' disclosure of switch fees and charges. The Companion Policy contains a proposed discussion of the CSA's views on the inappropriateness of switching a client's investment in a mutual fund on the books of the mutual fund from one sales load to another, even when that switch has no impact on the client, "in order to generate a higher amount of trailing commissions with no corresponding financial benefit to the client". This issue was addressed by the MFDA in 2005 and again in 2007 and this is the first time that the CSA has publicly referred to this matter (other than in connection with OSC comments on prospectus reviews). We recommend further clarity about this issue be provided in the Companion Policy, given that changes in sales loads are not generally actual "switches" of investments.

The CSA propose no transition for these requirements and, as noted above, do not refer to the existence of a prospectus and other disclosure documents for publically-traded securities. A permitted client can waive receipt of this information.

PROPOSED ENHANCED DISCLOSURE ON TRADE CONFIRMATIONS

Registered dealers will be required to provide additional disclosure on trade confirmations:

- The yield of any fixed income security purchased – "yield" is not defined and we recommend further clarity to ensure appropriate disclosure;

- Any DSC that will be "charged in respect of the transaction". We note that DSC are not charged by the registered firm, but rather are deducted from proceeds of redemption by the fund manager to reimburse the fund manager for the sales commissions it paid to the dealer when the client first purchased the mutual fund securities. DSC is clearly disclosed in the Fund Facts and prospectus and we question the appropriateness of registered firms being required to provide this information, without any additional explanation, given the significant potential for investor confusion; and

- Specific disclosure about dealer "charges" in connection with purchases or sales of fixed income securities. The CSA do not explain what they consider dealer "charges" to be nor how these should be calculated and disclosed.

The CSA propose a one-year transition only for the requirement to disclose yield – the other proposed disclosure requirements presumably are intended to come into force on the same date the proposed amendments become effective, and we question whether this is practically possible.

PROPOSED ANNUAL REPORTING OF "OPERATING CHARGES" AND "TRANSACTION CHARGES"

In an effort to reinforce to clients the costs that are associated with their account with a registered firm, the CSA propose that firms report on the following matters annually, in a written statement to each client – this written statement must be provided with or in the annual account statement to the client:

- The firm's current "operating charges" that may apply to the account – presumably a firm would update any changes from the RDI disclosure in this regard;

- In respect of operating charges and transaction charges that were levied against the account in the past 12 months:

-

- The total amount of each type of operating charge and transaction charge; and

- The total aggregate operating charges and the total aggregate transaction charges;

- In respect of fixed income securities purchased or sold during the 12 month period, specified disclosure that dealer "charges" were added to, or deducted from, the price of the securities;

- The aggregate amount of fees paid to the registered firm by any third party in relation to the client during the past 12 months – we assume that the CSA intend for any referral fees to be disclosed here, but this could also include payment by fund managers of sales commissions to dealers in respect of DSC mutual fund securities (trailing commissions in respect of all mutual fund investments are dealt with separately);

- Identification of any securities held in the account that are subject to DSCs; and

- Specific disclosure about the amount of trailing commissions received by the registered firm in respect of investments held in the client's account.

The CSA explain in the proposed guidance in the Companion Policy that this annual disclosure does not need to contain "product-related charges" "since the range of products offered by a registered firm may be quite broad and the types of products in a client's account may change over time". Although this is not clear, we consider that the CSA is signalling their acceptance of the mathematical impossibility for a registered firm to calculate the exact amount of fund-level fees and charges that were indirectly paid by the client in respect of the particular investment. This calculation would be next to impossible for fund managers to make within any degree of certainty and, in any event, registered firms do not have access to the data. As noted above, however, we recommend that registered firms refer clients to the continuous disclosure documents of investment funds for information about the costs and charges paid by those funds. This will at least ensure that clients are reminded annually that there is a cost to investing in investment funds.

The CSA propose a two-year transition period for this proposed requirement. A permitted client can waive receipt of this information.

PROPOSED ANNUAL PERFORMANCE REPORTING

The proposed amendments also introduce a requirement for registered firms to provide clients with an annual report on performance that would be either part of, or accompany, the annual account statement. Permitted clients can waive receipt of these statements.

The account statements would be required to include the original cost of each security, which is to be the total amount paid for a security, including any commissions or related fees. The CSA acknowledge that this information may be missing or incomplete for investments made before the implementation date of the proposed amendments and accordingly registered firms will be permitted to disclose the market value of the investments as the original cost going forward.

The proposed performance reports must include:

- Net amount invested, which should equate to the actual dollars invested (i.e. contributions less withdrawals) in securities by the account holder. The CSA propose accommodations to use market value as at the implementation date of the proposed rule amendments for accounts opened before this date where the net amount is not available;

- Total market value as at the end of the prior 12 month period;

- The change in value of the account over the last 12 months, which is to be calculated by reference to the market value at the beginning and end of the period and taking into account net amounts invested;

- The change in value of the account since inception. The CSA again propose accommodations in respect of the "since inception" changes in value, given that not every registered firm will have these records available;

- Annualized compound percentage returns for specified time periods – one, three, five, ten and "since inception periods" – periods of less than one year cannot be annualized;

- An explanation of the methods used to calculate performance – the CSA do not propose to mandate a particular performance calculation method, other than to say the method must be either a time weighted or dollar weighted methodology. Use of consistent methodology will be expected and any change in methodology must be disclosed to clients;

- Explanations of various terminology and content of the performance reports; and

- Performance must be presented by way of "text and a table, graph or chart". The proposed Companion Policy amendments include a sample performance report.

The CSA do not propose to mandate that benchmarks be used to compare account performance, but if a registered firm wishes to compare performance to a benchmark, the CSA propose that the registered firm and the client agree to the use of specific benchmarks as part of the account agreement. The CSA also propose detailed guidance about their expectations on benchmark usage in the Companion Policy, including their views that broad-based indices must be used and generally blended indices will not be appropriate.

A two-year staged transition is proposed for performance reports.

The proposed amendments to NI 31-103 are significant and should be reviewed carefully to determine whether the proposed information is relevant, useful and meaningful for investors.

About BLGThe content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.