One year ago today, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"). While the Dodd-Frank Act focuses principally on changes to the financial regulatory system, several corporate governance, compensation and disclosure provisions of the Dodd-Frank Act specifically target public companies of all types. These include:

- a requirement that public companies solicit an advisory vote on executive compensation (the "Say-on-Pay" vote), an advisory vote on the frequency of holding an advisory vote on executive compensation (the "Say-on-Frequency" vote) and, in the event of a merger or other similar extraordinary transaction, a vote on certain golden parachute compensation that is triggered by the transaction (a "Say-on-Golden Parachute") vote;

- requirements that the U.S. Securities and Exchange Commission (the "SEC") adopt rules directing the securities exchanges to adopt listing standards with respect to the independence of members of the compensation committee and the use of consultants and other advisers to the compensation committee;

- provisions calling for the SEC to adopt expanded disclosure requirements regarding executive compensation matters, including the relationship of pay to performance, the ratio of the amounts of median employee total compensation to CEO total compensation, and whether any employee or director is permitted to purchase financial instruments designed to hedge the value of equity securities;

- provisions that require the SEC to direct the securities exchanges to adopt listing standards with respect to compensation recovery policies that provide for the recoupment of executive compensation in the event of an accounting restatement;

- provisions impacting the ability of brokers to vote uninstructed "street name" shares in their discretion on matters related to director elections, executive compensation and potentially other matters to be determined by the SEC;

- authorization for the SEC to adopt rules permitting shareholders meeting specified criteria to nominate director candidates that must be included in a company's proxy statement (so-called "proxy access"); and

- new disclosure requirements regarding conflict minerals, mine safety and payments by companies engaged in resource extraction (referred to collectively as "Specialized Corporate Disclosure").

The SEC has adopted rules implementing the Say-on-Pay, Say-on-Frequency and Say-on-Golden Parachute requirements. Final rules have also been adopted prohibiting broker discretionary voting on executive compensation matters. The SEC adopted rules implementing proxy access (which had been proposed prior to enactment of the Dodd-Frank Act), although the effectiveness of those rules has been stayed pending the resolution of litigation challenging the validity of the rules.

The SEC has proposed rules regarding compensation committee independence and the use of compensation consultants and other advisers, but has not yet adopted any final rules. Further, the SEC has proposed rules implementing the Specialized Corporate Disclosure provisions, but has not yet adopted final rules. No rules have been proposed or adopted with respect to the relationship of pay to performance, the ratio of the amounts of median employee total compensation to CEO total compensation, and whether any employee or director is permitted to purchase financial instruments designed to hedge the value of equity securities. Further, no rules have been proposed to direct the securities exchanges to adopt listing standards with respect to compensation recovery policies that provide for the recoupment of executive compensation in the event of an accounting restatement. Final action on these proposed rules and expected rules is planned for later this year.

ADVISORY VOTES ON EXECUTIVE COMPENSATION

Dodd-Frank Act Requirements

Beginning with shareholder meetings occurring on or after January 21, 2011, Section 951 of the Dodd-Frank Act required that all public companies (except those companies exempted from the requirement by the SEC) include a resolution in their proxy statements asking shareholders to approve, in a nonbinding vote, the compensation of their executive officers, as disclosed under Item 402 of Regulation S-K. A Say-on-Frequency vote is required in the form of a separate resolution asking stockholders to cast an nonbinding vote on whether the Say-on-Pay vote takes place every one, two, or three years.

Section 951 of the Dodd-Frank Act also provides that if golden parachute compensation has not been approved as part of a Say-on-Pay vote, then a company must solicit shareholder approval of certain golden parachute compensation through a separate nonbinding vote at the meeting where the shareholders are asked to approve a merger or similar extraordinary transaction that would trigger payments under the "golden parachute" provisions. The Dodd-Frank Act also requires that any proxy statement used for soliciting the Say-on-Golden Parachute vote must include "clear and simple" disclosure of the golden parachute arrangements or understandings and the amounts payable.

The SEC's Implementing Rules

In order to implement these requirements, the SEC adopted new Exchange Act Rule 14a-21, which governs advisory votes on executive compensation going forward (with the exception of those issuers that have indebtedness outstanding under the TARP program, who must solicit annual Say-on-Pay votes under the Emergency Economic Stabilization Act, as amended (the "EESA"), and Exchange Act Rule 14a-20). The SEC also adopted a number of additional rule, form and schedule changes to accommodate the new Say-on-Pay, Say-on-Frequency and Say-on-Golden Parachute votes.

Say-on-Pay Votes

New Rule 14a-21(a) provides that if a solicitation is made by an issuer relating to an annual or other meeting of shareholders at which directors will be elected and for which the SEC's rules require executive compensation disclosure pursuant to Item 402 of Regulation S-K, then the issuer must conduct a Say-on-Pay vote, and a Say-on-Pay vote must occur thereafter no later than the annual or other meeting of shareholders held in the third calendar year after the immediately preceding Say-on-Pay vote. The Say-on-Pay vote relates to the executive compensation disclosure required to be included in the proxy statement pursuant to Item 402 of Regulation S-K, which generally includes the Compensation Discussion and Analysis (the "CD&A"), the compensation tables, and the narrative disclosure on executive compensation.

The SEC states in the adopting release for the Say-on-Pay rules that it views Section 951 of the Dodd-Frank Act as requiring a separate shareholder vote on executive compensation only with respect to "an annual meeting of shareholders for which proxies will be solicited for the election of directors, or a special meeting in lieu of such annual meeting." Accordingly, Rules 14a-21(a) and 14a-21(b) (governing the Say-on-Frequency vote, as discussed below) are intended to apply in connection with the election of directors when the related proxy materials must include executive compensation disclosure.

Instruction 1 to Rule 14a-21 provides that the Say-on-Pay vote does not cover director compensation disclosed pursuant to paragraphs (k) and (r) of Item 402 of Regulation S-K, as well as any disclosure pursuant to Item 402(s) of Regulation S-K about the company's compensation policies and practices as they relate to risk management and risk-taking incentives. However, if risk considerations are a material aspect of the company's compensation policies or decisions for named executive officers, then the Instruction indicates that the company must discuss these considerations as part of the CD&A, and such disclosure will then be subject to the Say-on-Pay vote.

Rule 14a-21(a) does not require that issuers use a specific form of resolution. However, the Instruction to Rule 14a-21(a) provides the following nonexclusive example that would satisfy the requirements of the rule: "RESOLVED, that the compensation paid to the company's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED." While the SEC has provided this nonexclusive example of a form of resolution, the SEC states in the adopting release that companies "should retain the flexibility to craft the resolution language." Companies often adopted different language in order to present their Say-on-Pay vote in the 2011 proxy season, including presenting the vote in the form of a proposal rather than a resolution. In Exchange Act Rules Compliance and Disclosure Interpretations Question 169.05, the SEC Staff has indicated that it is permissible for the Say-on-Pay vote to omit the words, "pursuant to Item 402 of Regulation S-K," and to replace those words with a plain English equivalent, such as "pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in this proxy statement."

Say-on-Frequency Votes

Rule 14a-21(b) provides that if a solicitation is made by a company relating to an annual or other meeting of shareholders at which directors will be elected, and for which the SEC's rules require executive compensation disclosure pursuant to Item 402 of Regulation S-K, then that issuer must conduct a Say-on-Frequency vote for its first annual or other meeting of shareholders occurring on or after January 21, 2011, and that such Say-on-Frequency vote must occur thereafter no later than the annual or other meeting of shareholders held in the sixth calendar year after the immediately preceding Say-on-Frequency vote.

Under Rule 14a-21(b), the required Say-on-Frequency resolution must ask shareholders to indicate whether future Say-on-Pay votes should occur every one, two or three years. As a result, shareholders are given four choices on the proxy card: whether the Say-on-Pay vote will take place every one, two, or three years, or to abstain from voting on the resolution. In order to implement the voting choices for the Say-on-Frequency vote, the SEC amended Exchange Act Rule 14a-4 to specifically allow proxy cards to reflect the choices of one, two, or three years, or abstain. Rule 14a-21(b) does not require that issuers use a specific form of resolution. Unlike the Say-on-Pay vote requirement in Rule 14a-21(a), the SEC does not provide a nonexclusive example of a Say-on-Frequency resolution. Exchange Act Rules Compliance and Disclosure Interpretations Question 169.04 states, however, that the Say-on-Frequency vote need not be set forth as a resolution. Separately, the Staff has informally cautioned that the Say-on-Frequency vote must be clearly stated, and that in this regard it must be clear that shareholders can vote on the options of every one, two or three years (or abstain from voting), rather than solely following management's recommendation (if any is provided). The SEC Staff also indicates in Exchange Act Rules Compliance and Disclosure Interpretations Question 169.06 that it is permissible for the Say-on-Frequency vote to include the words "every year, every other year, or every three years, or abstain" in lieu of "every 1, 2, or 3 years, or abstain."

Neither Rule 14a-21(b) nor the SEC's other proxy rules require that an issuer make a recommendation with respect to the Say-on-Frequency vote; however, the SEC notes that proxy holders may vote uninstructed proxy cards in accordance with management's recommendation only if the company follows the existing requirements of Rule 14a-4, which include specifying how proxies will be voted (e.g., in accordance with management's recommendations) in the absence of instruction from the shareholder.

Exemption for Smaller Reporting Companies

Companies that qualify as "smaller reporting companies," as that term is defined in SEC rules, as of January 21, 2011 or as a result of being new public thereafter, are not subject to the Say-on-Pay or Say-on-Frequency requirements and the SEC's related rules until the first annual meeting or other meeting of shareholders at which directors will be elected, and for which executive compensation disclosure is required, occurring on or after January 21, 2013. This temporary exemption does not apply to the Say-on-Golden Parachute vote requirement under Exchange Act Section 14A and the SEC's rules.

ADDITIONAL REQUIREMENTS

The SEC adopted other changes to rules and forms relating to Say-on-Pay and Say-on-Frequency. The SEC amended Exchange Act Rule 14a-6(a) to add any shareholder advisory votes on executive compensation, including the Say-on-Pay or Say-on-Frequency votes, to the list of items that will not trigger the requirement to file a preliminary proxy statement with the SEC. This amendment contemplates an advisory vote on executive compensation that is not required by Section 14A of the Exchange Act. The SEC adopted Item 24 to Schedule 14A, which requires disclosure, in the proxy statement in which the company is providing a Say-on-Pay, Say-on-Frequency or Say-on-Golden Parachute vote, that the company is providing such vote as required pursuant to Section 14A of the Exchange Act. Further, the company must explain the general effect of such vote, such as that the vote is nonbinding. Companies also must disclose, when applicable, the current frequency of Say-on-Pay votes and when the next Say-on-Pay vote will occur.

The SEC amended Item 402(b)(1) of Regulation S-K to require that a company must address in its CD&A whether and, if so, how the company has considered the results of the most recent shareholder advisory vote on executive compensation (as required by Section 14A of the Exchange Act or Exchange Act Rule 14a-20, which is the rule governing Say-on-Pay votes required for recipients of financial assistance under TARP) in determining compensation policies and decisions and, if so, how that consideration has affected the company's compensation decisions and policies. This requirement is included among the mandatory CD&A disclosure items specified by Item 402(b)(1) of Regulation S-K.

Item 5.07 of Form 8-K, as amended, requires that an issuer must disclose its decision as to how frequently the issuer will conduct Say-on-Pay votes following each Say-on-Frequency vote, either in the Form 8-K reporting the preliminary or final results, or in an amendment to the Item 5.07 Form 8-K filing (or filings) that disclose the preliminary and final results of the

Say-on-Frequency vote (see Exchange Act Form 8-K Compliance and Disclosure Interpretations Question 121A.04). The Form 8-K amendment is due no later than 150 calendar days after the date of the end of the annual meeting in which the Say-on-Frequency vote occurred, but in no event later than 60 calendar days prior to the deadline for the submission of shareholder proposals as disclosed in the proxy materials for the meeting at which the Say-on-Frequency vote occurred. A company must disclose in Item 5.07 of Form 8-K the number of votes cast for each of the choices of every one, two or three years, as well as the number of abstentions.

The SEC added a new Note to Exchange Act Rule 14a-8(i)(10) in order to permit the exclusion of a shareholder proposal as "substantially implemented" if the proposal would provide for a Say-on-Pay vote, seek future Say-on-Pay votes, or relate to the frequency of Say-on-Pay votes. Such shareholder proposals may be excluded under this new Note if, in the most recent Say-on-Frequency vote, a single frequency received a majority of the votes cast and the company adopted a policy for the frequency of Say-on-Pay votes that is consistent with that choice. The Staff has noted that this Note will also apply to shareholder proposals seeking votes on matters that are already "subsumed" within the Say-on-Pay or Say-on-Frequency vote, not just a Section 14A-compliant Say-on-Pay/Say-on-Frequency proposal.

SAY-ON-GOLDEN PARACHUTE VOTE

Rule 14a-21(c) provides that if a solicitation is made by the company for a meeting of shareholders at which the shareholders are asked to approve an acquisition, merger, consolidation, or proposed sale or other disposition of all or substantially all of the assets of the issuer, then the company must provide a separate shareholder vote to approve any agreements or understandings and compensation disclosed pursuant to Item 402(t) of Regulation S-K. However, if such agreements or understandings have been subject to a shareholder advisory vote under Rule 14a-21(a) (the Say-on-Pay vote), then a separate shareholder vote is not required. Consistent with Exchange Act Section 14A(b), any agreements or understandings between an acquiring company and the named executive officers of the issuer, where the issuer is not the acquiring company, are not required to be subject to the separate shareholder advisory vote. The SEC did not adopt any specific form of the Say-on-Golden Parachute resolution and has clarified the advisory nature of the Say-on-Golden Parachute vote.

New Item 402(t) of Regulation S-K requires disclosure of named executive officers' golden parachute arrangements in a proxy statement for shareholder approval of a merger, sale of a company's assets or similar transactions. This Item 402(t) disclosure is only required in annual meeting proxy statements when an issuer is seeking to rely on the exception from a separate merger proxy shareholder vote by including the proposed Item 402(t) disclosure in the annual meeting proxy statement soliciting a Say-on-Pay vote.

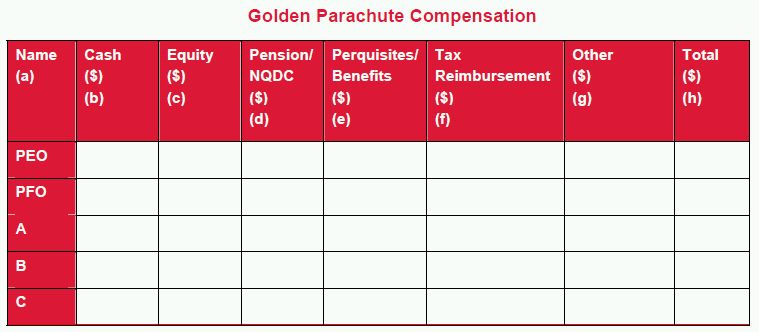

Golden parachute compensation must be disclosed in a table along with accompanying footnotes and narrative disclosure. This new table is set forth below:

The table requires quantification with respect to any type of compensation, whether present, deferred or contingent, that is based on or relates to an acquisition, merger, consolidation, sale or other disposition of all or substantially all of the assets, including:

- cash severance payments;

- the value of equity awards that are accelerated or cashed out;

- pension and nonqualified deferred compensation enhancements;

- perquisites and other personal benefits;

- tax reimbursements;

- in the "Other" column, any additional compensation that is not included in any other column; and

- separate footnote identification is required for amounts attributable to "single-trigger" and "double trigger" arrangements.

Item 402(t) of Regulation S-K also requires a description of any material conditions or obligations applicable to the receipt of payment, including but not limited to non-compete, non-solicitation, non-disparagement or confidentiality agreements, their duration, and provisions regarding waiver or breach. Moreover, disclosure of the specific circumstances that would trigger payment, whether the payments would be lump sum, or annual, and their duration, and by whom the payments would be provided, and other material factors regarding each agreement is also required by Item 402(t). Separate disclosure or quantification with respect to compensation disclosed in the Pension Benefits Table and Nonqualified Deferred Compensation Table (unless such benefits are enhanced in connection with the transaction), previously vested equity awards and compensation from bona fide post-transaction employment agreements entered into in connection with the merger or acquisition is not required.

In Regulation S-K Compliance and Disclosure Interpretations Question 128B.01, the SEC Staff indicates that Instruction 1 to Item 402(t) specifies that Item 402(t) information must be provided for the individuals covered by Items 402(a)(3)(i), (ii) and (iii) of Regulation S-K. Instruction 1 to Item 402(t)(2) applies only to those executive officers who are included in the Summary Compensation Table under Item 402(a)(3)(iii), because they are the three most highly compensated executive officers other than the principal executive officer and the principal financial officer. Given that under Items 402(a)(3)(i) and (ii), the principal executive officer and the principal financial officer are named executive officers, regardless of compensation level, Instruction 1 to Item 402(t)(2) is not instructive as to whether the principal executive officer or principal financial officer is a named executive officer.

Additional forms, schedules and disclosure requirements have been amended in order to address golden parachute compensation, such as Schedule 14A, Schedule 14C, Forms S-4 and F-4, Schedule 14D-9, Schedule 13E-3 and Item 1011 of Regulation M-A. The SEC adopted an amendment to Schedule TO in order to clarify that Item 402(t) disclosure is not required in a third-party bidders' tender offer statement, so long as the subject transaction is not also Rule 13e-3 going private transaction. Companies filing solicitation/recommendation statements on Schedule 14D-9 in connection with third-party tender offers will be obligated to provide the disclosure required by Item 402(t) of Regulation S-K.

IMPLEMENTING SAY-ON-PAY, SAY-ON-FREQUENCY AND SAY-ON-GOLDEN PARACHUTE IN 2011

The implementation of Say-on-Pay votes was one of the most widely-anticipated corporate governance developments in the United States over the past five years. Advocates for Say-on-Pay in the United States hoped that the advisory votes on executive compensation would serve to encourage greater accountability for executive compensation decisions, as well as more focused compensation disclosure in proxy statements and expanded shareholder engagement.

During the 2011 proxy season, only forty companies failed to achieve majority shareholder support for mandatory Dodd-Frank Say-on-Pay resolutions. The high level of shareholder support for Say-on-Pay resolutions during the 2011 proxy season was similar to the experience in the recent past with respect to those companies who held Say-on-Pay votes on a voluntary basis, or because the company was required to hold a Say-on-Pay vote because it had outstanding indebtedness under the TARP program. In the vast majority of those situations, shareholders have provided strong support for Say-on-Pay proposals, absent some significant concerns with the company's executive compensation programs. Even with the likelihood of shareholder support relatively high for Say-on-Pay resolutions, companies paid very close attention to the message communicated in through their CD&A and other disclosures, while at the same time seeking to engage with key shareholder constituencies.

Disclosure for Say-on-Pay

In many ways, the disclosure that is provided in the proxy statement remains the key point of engagement with shareholders on executive compensation issues. The Say-on-Pay vote caused many companies to streamline and clarify their CD&A disclosure to facilitate utilizing the CD&A to explain why shareholders should support the Say-on-Pay vote. In addition, companies have sought to emphasize the overall "pay for performance" message in the CD&A and throughout the executive compensation disclosure in the proxy statement. To this end, many companies began the CD&A with an "Executive Summary" or "Overview" section. The Executive Summary has proven to be an effective way of communicating the key executive compensation information that shareholders need to make an informed decision on the Say-on-Pay votes. An effective Executive Summary should include:

- a brief description of the company's financial and business results for the last completed fiscal year, focusing in particular on measures of performance that are relevant to determining the compensation for the named executive officers, while complying with any applicable requirements with respect to the use of non-GAAP measures (see Non-GAAP Financial Measures Compliance and Disclosure Interpretations Question 108.01);

- a discussion of how the issuer's results have impacted executive compensation decisions in the last fiscal year;

- a list of important compensation actions during the last completed fiscal year, including the actions with respect to the CEO and the other named executive officers; and

- a discussion of significant compensation policies and practices implemented or revised, as well as any pre-existing governance and compensation-setting procedures, which demonstrate the issuer's "pay for performance" philosophy and commitment to compensation and corporate governance best practices.

Companies have also been utilizing graphic presentations in the Executive Summary and in the rest of the CD&A as a means of effectively highlighting the issuer's business results and relating those results to the compensation decisions.

An overriding theme has been the relationship between pay and performance. As a result, the Executive Summary and the remainder of the CD&A often focused on how the compensation programs have aligned pay and performance, which necessitated fulsome disclosure about the performance target measures used to determine the level of performance, as well as more detailed disclosure concerning the individual achievements of the named executive officers when such performance is an element pursuant to which compensation is determined.

Disclosures in the 2011 proxy season also included more discussion of how the compensation committee considered the relationship between compensation programs and risks arising for the company in the course of making decisions and taking actions with respect to compensation. This area of focus will likely continue to drive more detailed disclosure in proxy statements about the relationship between compensation and risk.

Many companies addressed the adoption or revision of some key compensation policies, including stock ownership and equity holding policies, compensation recovery policies, policies limiting perquisites and other personal benefits and policies with respect to limiting severance and post-retirement benefits.

Engagement for Say-on-Pay Votes

Active engagement with shareholders on executive compensation and corporate governance issues is one of the expected results of a Say-on-Pay vote. Companies have explored a variety of approaches to accomplish effective engagement with shareholders.

Direct Interaction with Shareholders

Some companies elected to conduct a "roadshow" focused on (or including as a component) executive compensation and corporate governance matters. These roadshows typically took place in advance of the filing of the proxy statement (e.g., 30-60 days before the proxy statement filing) and were conducted in person or via teleconference, typically involving both portfolio managers and voting analysts at institutional investors and senior level management, and in some cases a director, from the company. The roadshows are largely designed to be informational, rather than serving to actively solicit any vote on expected proposals for the annual meeting, which could present solicitation issues under the SEC's proxy rules. Participants in these engagement activities usually address publicly-disclosed corporate governance and executive compensation initiatives demonstrating the company's responsiveness to shareholders, pay-for-performance considerations and the issuer's continuing attention to shareholder concerns (if any) on corporate governance and executive compensation issues. Participants typically avoid discussing material non-public information about the issuer's performance or plans for corporate governance and executive compensation program changes.

In the 2011 proxy season, a group of large institutional investors requested that some large companies hold a "fifth analyst call" to focus on executive compensation and corporate governance issues. The fifth analyst call would take place after a company mailed its proxy statement, but before the annual meeting. The institutional investor proposal for a Fifth Analyst Call sought board member involvement in the call, such as the chairman of the board or the lead independent director. Only one company apparently held a fifth analyst call during the 2011 proxy season.

The Use of Additional Soliciting Material

In a number of situations during the proxy season, Say-on-Pay voting led to the filing of additional soliciting material (filed as under the submission type "DEFA14A" on the SEC's EDGAR filing system) by companies during the period of time between the mailing of the proxy statement and the annual meeting. In many of these situations, the additional soliciting material responded to an adverse Say-on-Pay recommendation made by a proxy adviser, either Institutional Shareholder Services ("ISS") or Glass, Lewis & Co. Companies used the additional soliciting material to identify errors or flaws in the analysis underlying the proxy adviser's recommendation, while at the same time providing arguments as to why the Say-on-Pay proposal should be supported. The use of the additional soliciting material, along with active engagement efforts, most often led to a successful Say-on-Pay vote – approximately 12-13% of recommendations made by proxy advisers were against the Say-on-Pay proposal, while less than 2% of companies failed to obtain majority support in the Say-on-Pay vote during the 2011 proxy season.

A significant proportion of the additional soliciting material filed by companies related to a Say-on-Pay vote responded to an adverse Say-on-Pay recommendation driven in whole or in part by a CEO "pay-for-performance disconnect," as determined under an analytical framework developed by ISS. The ISS CEO pay-for-performance policy is applicable to Russell 3000 companies, and generally screens for a company which has total shareholder returns (as determined by adding stock price appreciation and dividends) over the past 1- and 3- fiscal years below the median level of similar returns for the company's industry "peers," as determined by the issuer's 4-digit GICS grouping. If both the 1- and 3-year returns are below the industry median, then ISS looks to the CEO's "Total Direct Compensation" ("TDC"), as determined by ISS by computing the sum of the salary, bonus, non-equity incentive plan compensation, change in pension and above-market non-qualified deferred compensation earnings and all other compensation directly from the Summary Compensation Table, plus the value of equity awards as calculated by Equilar using their own assumptions. If CEO TDC has not significantly decreased in the last year, then ISS does further analysis, looking at, among other things, the alignment between shareholder returns and CEO TDC over the past five years. Companies complained in additional soliciting material about the limitations of the ISS pay-for-performance analysis, in particular that the GICS peer groups did not match with the issuer's actual peers, the Equilar option valuation was significantly different than the company's determination of grant date fair value as reported in the Summary Compensation Table, TSR represents too narrow of a performance measure, the evaluation time horizon (1 and 3 years) was too short, the analytical approach didn't factor in more recent performance or pay changes, and the ISS approach otherwise failed to capture aspects of a company's compensation program that warranted special attention. Some companies specifically pointed out errors in the ISS or Glass Lewis reports, such as how the proxy adviser may have mistakenly interpreted gross-up provisions or performance- based equity awards, calling into question the basis for the recommendation and providing shareholders with more accurate information on which to base a voting decision. In some situations, the additional soliciting material provided additional information relevant to supporting a vote for Say-on-Pay, rather than specifically addressing the recommendation of a proxy adviser.

Say-on-Frequency Recommendations and Voting

Most proxy statements filed in the 2011 proxy season with mandatory Say-on-Frequency votes included a recommendation as to the preferred frequency of future Say-on-Pay votes, with the majority of those recommendations favoring Say-on-Pay votes every year. In approximately half of those cases where issuers recommended a once every three years frequency, shareholders supported an annual Say-on-Pay vote, notwithstanding the once every three years recommendation. In the relatively few situations where the board recommended a Say-on-Pay vote once every two years, an annual frequency for Say-on-Pay voting was favored in approximately 65 percent of those cases. In the few circumstances where no recommendation from the board was provided, shareholders mostly supported an annual Say-on-Pay vote.

Proxy advisory firms ISS and Glass Lewis will only recommend voting for an annual Say-on-Pay vote frequency. Some institutional investors that do not follow ISS or Glass Lewis recommendations also adopted policies supporting annual Say-on-Pay votes. However, a few institutional investors adopted policies providing support for Say-on-Pay votes that occur once every three years. Given these circumstances, obtaining the plurality or majority support of shareholders for an "every three years" or an "every two years" Say-on-Pay voting interval became increasingly difficult as the 2011 proxy season unfolded.

Say-on-Golden Parachute Compensation

A company seeking to avoid an advisory vote on golden parachute compensation in connection with a future vote on a merger or similar extraordinary transaction may voluntarily include the Item 402(t) tabular and narrative disclosures in the proxy statement for an annual meeting at which a Say-on-Pay vote will be held under the Dodd-Frank Act and the SEC's rules. However, if there are changes to the arrangements after the date of the vote or if new arrangements are entered into that were not subject to a prior Say-on-Pay vote, then a separate shareholder advisory vote on the golden parachute compensation is still required. In that case, the Say-on-Golden Parachute vote is required only with respect to the amended golden parachute payment arrangements. Other than changes that result only in a reduction in the amount of golden parachute compensation or that arise because of a change in the stock price, any other change to the golden parachute arrangements after the Say-on-Pay vote will trigger the requirement for a new vote.

During the 2011 proxy season, only a few companies included the golden parachute compensation disclosure in annual meeting proxy statements where no vote was taking place with respect to a merger or similar transaction. It appears likely that companies will avoid such "advance" votes on golden parachute compensation, given concerns about how the required disclosures concerning golden compensation arrangements could impact the Say-on-Pay vote. In addition, companies may be concerned that providing such disclosures may voluntarily signal to the market that the company could be engaged in a significant transaction in the near future.

Companies have generally adhered closely to the requirements of the Golden Parachute Compensation Table in merger proxies, registration statements and other transactional forms filed since the rules became effective. In some cases, the new disclosure results in an additional page of disclosure in the applicable form or schedule, while in other cases the table and footnotes extend over several pages because of the complexity of various scenarios and triggering events. In addition, many companies that have filed merger proxies or registration statements that require a shareholder advisory vote on golden parachutes have described the relationship of the golden parachute advisory vote to other votes on the transaction, including approval of the merger or other transaction itself. While companies are required to disclose that the golden parachute vote is nonbinding, many have gone further to disclose whether or not the golden parachute vote is a condition of the transaction and whether the results of the advisory vote on golden parachutes would affect the consummation of the merger. Approval of the golden parachute arrangements is typically not a condition of the transaction, and a lack of approval of the golden parachutes will not affect consummation of the transaction.

Many companies have included disclosure regarding the effect of the golden parachute advisory vote on the status of the golden parachute payments. This type of disclosure typically notes that the golden parachute arrangements are contractual obligations of the company, and that even though the company values the input of shareholders as to whether such arrangements are appropriate, the company would nonetheless be required contractually to make, and would make, such payments even if the arrangements are not approved by the shareholders in the advisory vote.

To read this article in full please click here.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved