FOREWORD: BRIGHT IDEAS

By Giles Murphy

It seems like an eternity since Sir David Clementi published his findings on the future framework for legal services, yet now, with less than six months to go until the resulting Legal Services Act is fully implemented, we are starting to see firms announce their intentions.

While the headlines have been grabbed by the recent news from Irwin Mitchell, the reality is that many law firms are already facing new competition from the likes of the AA, SAGA and Halifax. Just google 'legal advice' and the more than 14 million results demonstrate a market that is already undergoing significant change.

This is not new to other professional practices sectors: the existence of external capital and stock market listings of accountants, architectural firms and surveying practices has been the norm for some years.

We have also seen the merging of firms from different professions, demonstrated by the joining of Drivers Jonas and Deloitte, which may be a model that is more likely to develop going forward.

However, for many professional firms the key issues are closer to home, with cash flow management, partner performance and an increasing tax burden being the matters that will really affect the state of any firm entering the new post-Legal Services Act world. Our newsletter covers all of these areas, and others, which may be of relevance. I hope you enjoy the contents.

DON'T WAIT FOR THE LEGAL SERVICES ACT IMPLEMENTATION - TIME TO GET AN 'ANTI-EMBARRASSMENT' CLAUSE IN PLACE?

By Giles Murphy

Giles Murphy highlights some practical issues for firms to consider as full implementation of the Legal Services Act looms.

With only six months or so to go until full implementation of the Legal Services Act 2007 (the Act), there is much speculation as to what will happen after 6 October 2011.

There will undoubtedly be a small number of firms looking to take advantage of the opportunity (and the publicity) of adopting alternative business structures from day one, and there may be a larger number who follow suit over the subsequent months. Many firms, however, will have no intention of changing their structure in the foreseeable future, but this doesn't mean they should be doing nothing at the moment.

Every law firm should have the Act on its agenda and consider the opportunities and threats it may provide. As a minimum, firms should think about the defensive strategy they might adopt if a direct competitor decides to take advantage of the liberalisation of the legal services market.

Ownership issues

There are also some practical issues that should be addressed. A review of the partnership or LLP agreement would be worthwhile, as it is unlikely that it was written with the Act in mind. For example, to what extent does it define how the firm is actually owned? There may well be some reference to how capital profits would be shared, but it is unlikely that the agreement was written to take account of the possible 'sale' of the whole business.

Many firms may default to the view that ownership should be based on seniority of partners, often reflected in their lockstep 'points', but it is likely that any sale of the business will reduce partner profit shares in the future (as they will only be rewarded as employees and not owners). It is therefore arguable that younger partners, who will suffer the most financially from a sale, should benefit the most from the money paid to buy the business. Even if this clause is never used, now is the time to clarify ownership, rather than when there is a £50m offer for the firm on the table!

'Anti-embarrassment' clauses

There is also likely to be an absence in the agreement of what are referred to as 'anti-embarrassment' clauses. These clauses allow for former partners to benefit from a sale of the business for a period after their departure. They are intended to reward a partner who may have been instrumental in building up the goodwill (and therefore value) of the firm over his or her career, but who may have retired just before the sale occurs. As a result, such clauses should help mitigate the risk of partners, whose performance has waned, postponing their retirement in the hope that a sale may be forthcoming.

Obviously, the interaction of such clauses with the way in which ownership is divided will be critical.

Ultimately, we can only speculate as to the impact of the Act, but those firms that give careful thought to how they might be affected will find they are well placed to take advantage if an appropriate opportunity arises.

TRUE FINANCIAL PERFORMANCE REVEALED - WHAT DO THE FINANCIAL STATEMENTS OF THE TOP 100 LAW FIRMS TELL US?

By Pambos Patsalides

Our analysis of the LLP financial statements submitted by the top 100 law firms throws up some interesting trends.

The legal sector appears to be holding up relatively well, according to financial statements available for the year ended 30 April 2010, despite the difficult trading conditions during this period, according to our latest analysis of published accounts. However, there are some significant variations in financial performance according to size of firm. We will await 2011 results with interest to see whether there are further signs of erosion of the top firms' dominance and whether some of the less well performing firms have managed to turn the corner.

Signs of a shift?

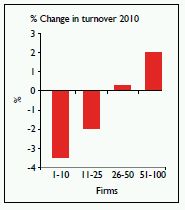

Fees generated by the top ten law firms fell by just over 3% on average in the year ended 30 April 2010. Firms ranked 11 to 25 show an average 2% fall compared to the previous year. By contrast, firms in the 26 to 50 group have consistently maintained fee levels, while firms in the 51 to 100 range have seen just over a 2% increase in fee levels on average. This seems to support anecdotal evidence that smaller firms are challenging the offering of larger firms, and we will watch with interest to see whether this shift becomes a more pronounced trend.

Staff costs

Staff costs as a share of turnover have remained broadly consistent across all sizes of firm among the top 100 – averaging between 40% and 45% of fees over the last two years. Firms in the 26 to 50 group are the most consistent, with their staff-to-fees cost percentage at a static average of 40%, while the average for all other categories of firm has fallen marginally.

Fees and profit per member

Fees per member remained fairly static compared to the previous year. There was a fall in the number of members in the top 25 firms, against a slight increase in the number of members for the 26 to 100 range. Average fees per member were just over £2m for the top ten, just over £1m for 11 to 25, just below £1m for 26 to 50, and just over £500,000 for the 51 to 100 bracket.

In terms of profitability, all but the top ten have shown increases compared to the previous year. However, the top ten are still significantly more profitable than the rest, with average profits per member at over £650,000, compared to the lowest group of 51 to 100, with average profits per member of just below £200,000.

Working capital

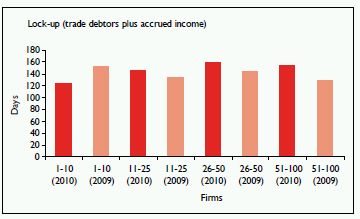

Across all top 100 firms, there has been a fall in the number of days that clients take to pay invoices. The largest fall in debtor days is for firms in the top ten, which have achieved an average reduction of over 30 days to just over 100 days in total.

Total lock-up, however, has only improved for the top ten. Taking into account recorded levels of work in progress, all other firms have shown on average an increase in total lock-up levels over the last two years.

It is perhaps surprising to see an increase in total lock-up, given increased pressure on law firms' finances, but this highlights the ongoing struggle that many firms face in getting their clients to pay on time.

Net assets per member

Unsurprisingly, the top ten firms show the highest average net assets per member, at just below £700,000, a slight fall compared to the previous year. This is in contrast to firms ranked 51 to 100, which on average show a slight increase, but still only to just above £200,000 per member. Net assets per member for firms in the 11 to 50 group are around £350,000 to £450,000 per member.

These figures are based on our analysis of the latest published LLP financial statements submitted by the UK's top 100 law firms.

BUILDING A PARTNER PERFORMANCE MODEL

By Rachel Stone

Apart from the monthly billing figures, how do you assess the contribution of each partner to the success of the firm, asks Rachel Stone?

We are often asked to assist managing partners with the challenging task of setting out performance criteria for partners. Many firms still focus on billable hours, but recognise that they should be taking a broader approach. By looking at overall partner responsibilities, it is possible to build a far more specific and adaptable model to identify clear performance indicators for each partner. We usually start with a simple model of the four areas where all partners have some responsibility, whatever their role.

Identifying key performance indicators

All partners have responsibilities in each area, but clearly the balance is different for each partner role. Working with your partner group, you can build a set of performance measures that reflect your current and future expectations of each partner. This gives you a structured starting point from which to discuss development objectives. For example, financial measures such as billable hours, recovery and team revenue are all important; so too are business development measures such as marketing activity, lead generation and conversion of prospects into clients.

Over time, this model can also form the basis of a more focused approach to partner reward, creating an opportunity to build a reward package that reflects financial contribution to the firm, but also assessing the impact of partners' work in other areas, particularly in developing and winning new business.

A CAREFUL BALANCING ACT - SMARTER WORKING CAPITAL MANAGEMENT

By Pambos Patsalides

Effective cash flow management is more important than ever. Pambos Patsalides gives a guide to getting it right.

Managing your firm's working capital – the amount of money needed to bridge the gap between paying out the firm's outgoings and getting paid by your clients – has a major impact on partner contributions and drawings. With banks becoming more demanding regarding bridging cash flow shortfalls, this balancing act has become critical to a firm's overall survival. Entrenched in this balancing act is the management of lock-up and the firm's ability to look into the future to deal with the cash flow peaks and troughs that may be looming.

Lock-up

First, let's go back to the basics of lock-up. Say a firm's debtors and work in progress (WIP) amount to £5m; and its lock-up (calculated by dividing debtors and WIP at selling value by annual income) is 150 days. This means that, on average, if work begins on a job on 1 January, the firm does not get paid for that work until 1 June. If this firm sets an objective of improving lock-up by 30 days (i.e. getting paid on average by 1 May), the effect of achieving this would be to reduce lock-up by £1m – increasing cash in the bank by the same amount. This means the firm is less likely to require additional finance for its day-today activities – either externally or from the partners themselves.

Practical steps to improve lock-up

- Manage your clients' expectations – provide a quote before you start work and agree a billing and payment schedule in writing in advance. This should also help to minimise fee disputes.

- Give early warning on fee changes – if costs are likely to exceed your fee quote, advise your client immediately and agree a new billing and payment schedule.

- Monitor WIP and debtor days – this should certainly be by department and possibly by individual fee earner. Instigate lock-up and billing targets, and compare the relative performance of different practice areas.

- Separate and empower debt collection – ensure support for fee earners to make billing and collection as easy as possible.

- Understand your client's situation – be aware of how the current economic environment is affecting your client and the likelihood of your fee being paid on time, or at all.

- Reward or penalise teams for their lockup performance – this should be part of the annual appraisal of those responsible.

Seeing the future

The firm's future cash flow requirements must never be left to chance. Your firm should forecast its cash flow projections on at least a 12-month rolling basis. This discipline will ensure that pressure spots, such as partners' tax, VAT and rent payment dates, are identified and do not come as a shock. Your projections model should be based on assumptions regarding income timing and quantum and take account of known and uncertain costs. Share your projections with your bank and keep them informed of changes, giving them plenty of warning regarding potential breaches in facility limits or covenants.

During these difficult times, cash flow management needs be a multi-pronged approach. Lock-up certainly needs to be controlled actively. However, the firm's management also need the right tools to look at least 12 months into the future and to predict the pressure points before they happen.

THE BENEFIT OF CHANGE - YET MORE NEW RULES FOR PENSIONS

By Ian Luck

New pension arrangements could have a positive impact on firms, explains Ian Luck.

It was never actually in doubt but, having gone through an independent review, the Government is proceeding full steam ahead with the implementation of fundamental changes to the way in which work-based pensions are to be provided in the future.

Until now, the provision of pension benefits for staff has been at the discretion of the firm, with the exception of the requirement to have in place a stakeholder pension scheme that employees can join if they so wish. The new legislation will change this voluntary approach to retirement savings, with the requirement for every employer to make pension provision for its staff.

Auto-enrolment

Employers will have to enrol automatically staff into a pension scheme; either a private arrangement established by them, or a centralised arrangement being set up by the Government known as the National Employee Savings Trust (NEST). Once enrolled, members who do not want to remain within the scheme can opt out. However, for all those who stay, the firm must then make contributions on their behalf.

Larger firms must implement these requirements from October 2012; and all firms will be affected by October 2016, by which date their contribution will be set at 1% of their employees' salaries. This will then increase by 1% each year for the next three years so that, from October 2017, employers will be paying 3% pension contributions for their staff. Employees will have to make contributions as well, which the employer must deduct from salary and pay across to the scheme.

These changes are deemed necessary to address the problem, highlighted by the department of work and pension's own figures, that some seven million people in the UK are not currently making any provision for their income in retirement. So, by automatically enrolling staff into a pension plan, and repeating the process every three years for those who opt out, it is hoped that inertia will eventually ensure members remain within the schemes long enough to accumulate a reasonable level of pension provision.

Assessing the impact

Many firms will just see the additional cost and added layer of administration as another example of the Government passing the burden of implementing the social changes it deems necessary on to employers.

However, by embracing these changes, particularly before they are forced to do so, firms may have a great opportunity to engage with their staff in a positive way.

Recent research, undertaken by an occupational psychologist on behalf of Standard Life, revealed that most employees accept that state pension provision will not be sufficient for the standard of living they are looking for and that, ultimately, financial responsibility lies with themselves, and not with the state or with their employer. The problem they face is where to turn to for help. They tend to look to their employer for guidance in such matters, and would genuinely welcome support from their employer in making decisions. Interestingly, the research also revealed that employers consider it part of their role to assist their employees in securing their financial future.

Adopting these pension changes willingly, and early, will help firms to be seen as supportive of staff. This will undoubtedly help with recruitment and retention – two-thirds of employees say they would be attracted to an employer who offered help with financial planning. So, perhaps employers can also benefit from these important pension changes.

TRADING WHILE INSOLVENT

By Henry Shinners

Henry Shinners explores the consequences of 'wrongful trading' for professional practices.

The UK economy has just emerged from the worst recession in living memory and we are far from out of the woods. Growth is at best slow, public borrowing is extremely high, and, while earlier fears of a double-dip recession have subsided, inflation is running at double the rate the Bank of England is mandated to achieve. The effects of the spending cuts flowing out of the Government's Spending Review have yet to be felt in the wider economy and the availability of credit remains restricted.

It's a pretty gloomy economic picture, yet a combination of record low interest rates and a long period during which HM Revenue & Customs has been extremely supportive of businesses seeking to defer repayment of tax arrears has meant that, to date, there have been fewer business failures than one would have expected during such economic turmoil. Nevertheless, a significant number of UK businesses (including some professional practices) are in poor financial health and many of those may, unwittingly or otherwise, be trading while insolvent.

Impact on LLPs

So, what is trading while insolvent (or 'wrongful trading' to give it its formal title) and does it apply or matter in a professional practices context? In a traditional partnership, where partners have unlimited personal liability for all of the debts of the business, there are no increased financial consequences for the partners personally if they should continue to trade an insolvent business beyond the point that they should. However, in an LLP, where the members will consider themselves to have limited liability, greater care is needed if a nasty surprise is to be avoided.

It's important to remember that LLPs are analogous to limited companies in that an LLP is a body corporate, with a separate legal identity, and its members have limited liability. The corporate (rather than personal) provisions of the insolvency legislation are broadly applied to LLPs in the same way that they are to companies. As with companies, there are certain circumstances in which the corporate veil can be pierced, and a key risk for the members of a financially distressed LLP is that they could be held personally liable for debts of the LLP if they are found to have been trading wrongfully.

Procedure

Wrongful trading is a civil action brought by a liquidator, who will consider whether the LLP's members continued to trade the business beyond the point that they knew, or ought to have known, that there was no reasonable prospect of avoiding insolvent liquidation and whether, in doing so, they worsened the position for creditors. Upon a successful application by a liquidator, the court may make any declaration it sees fit, but ordinarily it would be that the members should personally make a contribution to the LLP's assets. The quantum would be such as to restore the position for creditors to what it would have been if the LLP had not continued trading beyond that point of no return.

Unfortunately, for members of LLPs who may find themselves in these circumstances, the defences against a claim for wrongful trading are limited. It is not sufficient to say, for example, that one was acting honestly or in the best interests of the partnership – the interests of creditors take priority when a business is insolvent or at risk of insolvency. In practice, the best way for members of a potentially insolvent LLP to minimise the risk of a wrongful trading claim and personal liability is to take professional advice as early as possible from an insolvency practitioner. He or she will be able to guide the members through the steps that should be taken to minimise the potential loss to creditors and the options available to the members generally.

Adjustment of withdrawals

Finally, no discussion of personal liability for members of an LLP would be complete without reference to the 'adjustment of withdrawals' or 'clawback' provisions of the Insolvency Act 1986, which are unique to LLPs and apply to members of an insolvent LLP who withdrew for their own benefit property of the LLP during the period of two years ending with the commencement of a liquidation. For these purposes, property includes share of profits, payment of interest on a loan to the LLP or any other withdrawal of property.

In common with the wrongful trading remedies available to a liquidator, the 'knew or ought to have known' insolvency test will apply and the court can make any order it thinks fit, which, in a proven case, is likely to be an order that the members repay any withdrawals for their personal benefit in the period.

WHAT TO WATCH OUT FOR IN THE NEW TAX YEAR

By Pamela Sayers

Pamela Sayers reviews key tax considerations affecting professional practices.

With the top rate of income tax at 50% (at least for the time being), increased national insurance rates from 6 April 2011 and a decrease in the main and small companies' tax rates from 1 April 2011, there are undoubtedly tax arbitrage opportunities from using different corporate structures with a tax differential of 26% or more.

Service companies

Professional practices will continue to make use of service companies, together with the transfer pricing opportunities introduced in April 2004. The results of our 2010 Annual Survey of Law Firms showed that a third of respondents were considering the introduction of a service company, while for a third this was already complete or in progress. The Government announced on 9 December 2010 that it would incorporate the latest definition of 'transfer pricing guidelines' into legislation based on recent Organisation for Economic Co-operation and Development guidance. Legislation has now been introduced by the Finance Bill 2011 to bring this into effect for accounting periods commencing on or after 1 April 2011 for corporation tax, and for the 2011/12 tax year and onwards for income tax purposes.

High earners

Those earning over £42,475 a year will be paying more income tax and national insurance from 6 April 2011, so they will certainly be feeling the pinch. However, changes to the pension rules from 6 April 2011 will enable high earners to obtain tax relief at their highest marginal rate (and therefore reduce the average tax rate) on pension contributions of up to £50,000. In addition, it will be possible to bring forward unused annual allowance from the previous three fiscal years if there was a registered pension scheme in those prior years.

Taxes had already been increased for those on higher incomes with effect from 6 April 2010, with those on £100,000 a year and upwards losing the benefit of the personal allowance, and those on taxable incomes over £150,000 a year paying tax at 50% on income above this level. However, the Chancellor indicated in the Budget that there are too few top-rate taxpayers to fill the empty coffers, hence the need to widen the net – and share the pain. It was interesting to hear the Chancellor say that the 50% income tax rate was "temporary", but that was what Robert Peel said about income tax in 1842!

Capital expenditure

For professional practices wishing to undertake capital expenditure, it would be advisable to consider whether it is possible to accelerate the expenditure and bring the asset into use, to take advantage of the annual investment allowance of £100,000, prior to its reduction to £25,000 from April 2012. Furthermore, firms will need to review their short-life assets in more detail. Prior to the Budget, short-life assets had to be disposed of within four years of purchase to be pooled separately, and for the benefit of the pool to be written off if the assets were scrapped within that time. The time limit permitted before disposal has now been increased to eight years.

Tax simplification?

Finally, the establishment of the Office of Tax Simplification will result in many outdated reliefs being removed. Unfortunately, the relief for late-night taxis is also on the list for abolition, which will undoubtedly cause frustration for professional practices, since this has been the subject of much discussion over the last three years.

There will also be a period of consultation on merging the operation of income tax and national insurance contributions, which could simplify the tax system dramatically if it ultimately leads to a full merger. This is clearly a major issue which will take time to resolve.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.