The Isle of Man is able to offer an impressive variety of options for institutional and other clients seeking to create or restructure corporate vehicles to minimize risk to, and liability of, underlying assets.

In 2004, the Isle of Man Government introduced the concept of the protected cell company ("PCC") into Isle of Man law. Just like a conventional company, a PCC has a single separate legal personality, is distinct from both its members and directors, and is subject to all the provisions of the Isle of Man Companies Acts.

Uniqueness of a PCC

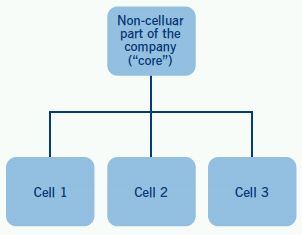

A PCC differs from a conventional company in that the company is sub-divided into a number of legally distinct portions, known as the core (the non-cellular part of the company) and cells. Each cell has its own share of the PCC's overall share capital, allowing a shareholder to be the sole owner of one cell while only having small interest in the PCC as a whole.

Illustrative diagram of a PCC:

The assets, liabilities and revenue streams attributable to each cell are segregated from those attributable to every other cell and from those attributable to the core.

PCC under the Companies Act 2006

The recently introduced Companies Act 2006 ("the 2006 Act") provides for a new and flexible companies regime, which has updated and modernised Isle of Man corporate vehicles.

A company incorporated or regulated under the 2006 Act (which could be structured as a PCC) is able, notwithstanding any provision to the contrary included in its memorandum and articles of association, to undertake any business activity, to do, or to be subject to, any act or enter into any transaction, irrespective of corporate benefit. Such activities would, for example, include the ability to declare and pay dividends and make capital distributions, and provide financial assistance subject only to meeting a statutory solvency test.

In the context of a PCC, the solvency test is applied in relation to the cell concerned with no account being taken of the assets and liabilities attributable to any other cell or the core. Under the 2006 Act, a cell will pass the solvency test if it can pay its debts as they become due in the normal course of its business and if the value of its assets exceeds the value of its liabilities. It is the responsibility of the directors to ensure that the cell can satisfy the solvency test.

Thus, while still protecting investors in individual cells from the liabilities and creditors of other cells, a PCC formed under the 2006 Act offers advantages of unlimited capacity and increased legal and administrative flexibility.

Liability of assets under a PCC

Assets attributable to a cell are available only to satisfy the claims of creditors of the PCC attributable to that cell and are protected from the creditors of the PCC attributable solely to the core or any other cell.

Pursuant to the 2006 Act, certain terms are implied into every transaction with a PCC. For example, any counterparty that seeks to make assets of a cell of the PCC liable in respect of a liability not attributable to that cell shall have an obligation to pay to the PCC an amount equivalent to the benefit received and/or hold the assets on trust for the PCC. In such an event, the amount or benefit held on trust will be used by the PCC to compensate the adversely affected cell.

Insolvency

A receivership mechanism exists under the 2006 Act in order to allow an "insolvent" cell to be "wound up" without the PCC as a whole entering liquidation. Thus, this would allow the PCC to carry on business notwithstanding the "insolvency" of any particular cell and without requiring the owner of the core to provide any further core or cell capital.

Cains

Cains is a leading Isle of Man law and professional services group. Its legal side is expert in advising clients in the fields of international financial services, commercial real estate structures, space and satellite, shipping and capital markets. The business acts for a broad range of clients including multi-national corporations, financial institutions, regulatory bodies and family offices. Cains also has a strong track record of working in partnership with leading law firms to effect international transactions for clients, including market listings.

Cains fiduciary services business is focused on the provision of services to international businesses and global financial institutions, private companies, family offices and property funds. Core services includes the provision of incorporation, administration, accounting and transaction management services as well as facilitating access to cross border tax planning and structuring advisory services, investment management, private banking and insurance solutions. Ancillary services include assisting clients with succession planning, pensions and employee benefits, yacht and aircraft financing and registrations and high-end residential and commercial property related matters.

Cains is the exclusive Isle of Man Member of Lex Mundi, the world's leading association of international law firms. In addition to the Isle of Man, the company has offices in London and Singapore. The Cains group have recently consolidated all their Isle of Man offices to the landmark Fort Anne Building in the Island's capital, Douglas, allowing them to offer clients an enhanced, seamless, high quality, professional service.

Cains recent accolades include recognition as Offshore Law Firm of the Year by Legal Week (2007) and The Lawyer (2008) and it was awarded a Queen's Award for Excellence in International Trade 2009. Cains has been shortlisted for Offshore Law Firm of the Year by Asian Legal Business (ALB), having been nominated for it every year since opening its office in Singapore.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.