Global financial regulators continue to push to dampen risk in the system and to improve their readiness to respond to the next crisis. After an initial focus on banks and insurance companies, that regulatory attention has been shifting to other sectors. Now certain regulators, notably the Financial Stability Board along with the International Organization of Securities Commissions, appear to be actively considering whether to expand "too big to fail" designations and accompanying oversight and restrictions to asset managers and investment funds. Against that backdrop, and perhaps to show that action by other regulators in this space is unnecessary, the US Securities and Exchange Commission proposes to dramatically expand reporting – both public and non-public – of portfolio and other data by US registered investment companies.

The proposed new requirements are numbingly detailed, but can be distilled to the following: there would be expansive monthly portfolio and risk reporting; more derivatives disclosures in fund financial statements; and a new annual "census-style" reporting form that would replace an obsolete existing SEC form. As a modest sweetener, the agency also proposes to permit posting shareholder reports to a website instead of mailing them under certain circumstances. This alert summarizes each of the proposals. A companion alert covers new reports proposed at the same time for investment advisers that file Form ADV with the SEC.

The SEC is soliciting comments on its rulemaking proposals. Comments are due within 60 days following publication of the proposals in the Federal Register.

Changes to Current Reporting Regime Form

N-PORT

Currently, SEC-registered management investment companies, other than small business investment companies (SBICs), are required to report their complete portfolio holdings to the SEC on a quarterly basis. These funds file reports on Form N-Q as of the end of each first and third fiscal quarter and on Form N-CSR as of the end of each second and fourth fiscal quarter.

The new proposed rules intend to rescind Form N-Q and adopt a new portfolio holdings reporting form, Form N-PORT, which would be filed by all registered management investment companies (including unit investment trusts (UITs) that operate as ETFs), other than money market funds and SBICs.1 Reports on Form N-PORT would include a fund's complete portfolio holdings in a structured data format. Form N-PORT also would include a battery of new information not currently required to be calculated or compiled in any venue. For example, the form would require certain risk metric calculations intended to measure a fund's exposure and sensitivity to changing market conditions (i.e., changes in asset prices, interest rates or credit spreads). New information about fund activities such as securities lending, repurchase agreements, and reverse repurchase agreements, OTC derivatives transactions and the counterparties to which the fund is exposed in those transactions will also be required.

The proposal would require funds to report information on Form N-PORT monthly in an XML format no later than 30 days after the close of each month. The SEC is considering whether reports on Form N-PORT should be submitted through EDGAR or another electronic filing system.

Once filed, the report for every third month would become available to the public 60 days after the end of the fund's fiscal quarter. This cycle has the effect that Form N-PORT would be filed for two months out of every three on a non-public basis. The third month would be public, but only after a lag that approximates that for existing public financial reports by registered investment companies.

If Form N-PORT is adopted, the SEC expects to provide for tiered compliance dates based on asset size. For larger registered fund families that have net assets of $1 billion or more as of the end of the most recent fiscal year the proposal sets a compliance date of 18 months after the effective date (which is not yet known) to comply with the new reporting requirements. For smaller fund families the proposal provides for an extra 12 months (i.e. 30 months after the effective date).

Specific information regarding proposed reporting on Form N-PORT, and the structure of the form, can be found in the following chart:

| Section | Applicable Firm Would Report: |

| General Information and Instructions |

|

| Information Regarding Assets and Liabilities |

|

| Portfolio Level Risk Metrics |

|

| Securities Lending |

|

| Return Information |

|

| Share Sales and Redemption (Flow) Information |

|

| Schedule of Portfolio Investments |

|

| Explanatory Notes |

|

| Exhibits |

|

Amendments to Regulation S-X

The proposal also includes amendments to Regulation S-X, which prescribes the form and content of financial statements required in fund registration statements and shareholder reports. Currently, Regulation S-X does not prescribe specific information for most types of derivatives, including swaps, futures and forwards, with the result that disclosure practices can vary meaningfully firm to firm. The proposed amendments would both enhance and standardize derivatives disclosures in fund financial statements.

Many of the proposed amendments to Regulation S-X, particularly the amendments to the disclosures concerning derivative contracts, are similar to proposed requirements under Form N-PORT. Specifically, proposed amendments to Articles 6 and 12 of Regulation S-X would:

- Require new, standardized disclosures regarding fund holdings in open futures contracts, open forward foreign currency contracts, and open and additional disclosures regarding fund holdings of written and purchased option contracts.

- Update the disclosures for other investments, as well as reorganize the order in which some investments are presented.

- Amend the rules regarding the general form and content of fund financial statements.

The amendments also would require more prominent placement of disclosures regarding investments in derivatives in a fund's financial statements. Finally, the amendments would require a new disclosures in the notes to the financial statements relating to a fund's securities lending activities.

If the Regulation S-X amendments are adopted, the SEC expects to set a compliance date of eight months after the effective date for the rulemaking.

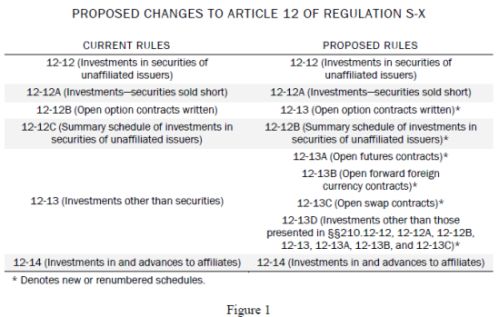

The proposed rules will renumber the current schedules in Article 12 of Regulation S-X and break out the disclosure of derivatives currently reported on Schedule 12-13 into separate schedules. These changes are summarized in Figure 1 below:

Amendments to Rules 12-12 through 12-12C

Although no changes to the schedules for rules 12-12, 12-12A, and 12-12C are being proposed, there are certain additional rule instructions that would include new disclosures, as well as certain clarifying changes, including renumbering several of the schedules.

Certain modifications to the instructions to rule 12-12, the rule concerning disclosure of investments in securities of unaffiliated issuers, would require funds to:

- Categorize the schedule by type of investment, the related industry, and the related country, or geographic region.

- Indicate the interest rate or preferential dividend rate and maturity rate for certain enumerated debt instruments. When disclosing the interest rate for variable rate securities, funds would have to describe the referenced rate and spread.

- Indicate where any portion of securities held in connection with open put or call option contracts and loans for short sales of securities is on loan.

Open Options Contracts Written – New Rule 12-13

New rule 12-13 would require funds to disclose: (1) description; (2) counterparty; (3) number of contracts; (4) notional amount; (5) exercise price; (6) expiration date; and (7) value. Instruction would be added to current rule 12-12, which is the schedule on which purchased options are required to be disclosed, that would require funds to provide all information required by proposed rule 12-13 for written option contracts.

For options where the underlying investment would otherwise be presented in accordance with another provision of rule 12-12 or proposed rules 12-13 through 12-13D, the presentation of that investment would have to include a description, as required by those provisions. Thus, if an investment contains some sort of optionality (e.g., put or call features), the investment's disclosure must include both a description of the optionality, as required by proposed rule 12-13, and a description of the underlying investments, as required by the applicable provisions of proposed rules 12-12, 12-12A, and 12-13 through 12-13D. For example, reporting for a swaption would include the disclosures required under both the swaps rule (proposed rule 12-13C) and the options rule (proposed rule 12-13).

Instructions to rule 12-13 and the other proposed rules concerning derivatives holdings (e.g., open futures contracts, open swap contracts) would require funds to:

- Indicate if an investment cannot be sold because of restrictions or conditions applicable to the investment.

- Indicate if a security's fair value was determined using significant unobservable inputs.

- Identify illiquid investments.

In the case of an option contract with an underlying investment that is an index or basket of investments whose components are publicly available on a website as of the fund's balance sheet date, or if the notional amount of the holding does not exceed one percent of the fund's NAV as of the close of the period, the fund would provide information sufficient to identify the underlying investment, such as a description. However, if the underlying investment is an index whose components are not publicly available on a website as of the fund's balance sheet date, or is based upon a custom basket of investments, and the notional amount of the option contract exceeds one percent of the fund's NAV as of the close of the period, the fund would list separately each of the investments comprising the index or basket of investments. For consistency purposes, a similar instruction is proposed to be included for derivative holdings.

Open Futures Contracts — New Rule 12-13A

New rule 12-13A would require standardized reporting of open futures contracts. Funds with open futures contracts would report: (1) description; (2) number of contracts; (3) expiration date; (4) notional amount; (5) value; and (6) unrealized appreciation and depreciation.

Open Forward Foreign Currency Contracts — New Rule 12-13B

New rule 12-13B would require standardized disclosures for open forward foreign currency contracts. Funds holding open forward foreign currency contracts would therefore report the: (1) amount and description of currency to be purchased; (2) amount and description of currency to be sold; (3) counterparty; (4) settlement date; and (5) unrealized appreciation and depreciation.

Open Swap Contracts — New Rule 12-13C

New rule 12-13C would require standardized reporting of fund positions in open swap contracts. Funds would report for each swap the: (1) description and terms of payments to be received from another party; (2) description and terms of payments to be paid to another party; (3) counterparty; (4) maturity date; (5) notional amount; (6) value; (7) upfront payments/receipts; and (8) unrealized appreciation and depreciation.

Option for Website Transmission of Shareholder Reports

The proposal contains a new rule 30e-3 under the Investment Company Act, which would, if adopted, provide funds with an optional method to satisfy shareholder report transmission requirements by posting reports online. In order to rely on the rule, funds would be required to make the report and other required materials publicly accessible and free of charge at a website address specified in a notice to shareholders, and meet certain conditions relating to shareholder consent, and notice to shareholders of the website availability of shareholder reports and of the methods by which a shareholder could request a paper copy of the materials.

If rule 30e-3 is adopted as proposed, the SEC expects to allow funds to opt into the rule's reporting framework at any time after the effective date for the rulemaking.

Form N-CEN

Currently, the SEC collects census-type information on management investment companies and UITs on reports on Form N-SAR, which was adopted in 1985.14 Form N-SAR is widely viewed as obsolete, and the proposal would rescind it and replace it with Form N-CEN. Form N-CEN would include much of the same content as Form N-SAR, but would remove or replace outdated items. All registered investment companies (except so-called face amount certificate companies, of which there are very few) would file reports on Form N-CEN.

Like Form N-SAR, the sections of Form N-CEN that a fund is required to complete would depend on the type of fund.15 All funds would be required to complete Parts A and B, and file any attachments required under Part G. In addition, funds would complete the following Parts as applicable:

- All management investment companies, other than SBICs, would complete Part C;

- Closed-end funds and SBICs would complete Part D;

- ETFs (including those that are UITs) would complete Part E; and

- UITs would complete Part F.

Additionally, Form N-CEN would be filed annually, rather than semi-annually as is required for reports on Form N-SAR. The proposal requires a filing period of 60 days after the end of the fiscal year for funds to file reports on Form N-CEN, which is the same filing period that companies currently have under Form N-SAR.

If Form N-CEN is adopted, the SEC expects to set a compliance date for transition from Form N-SAR to Form N-CEN of eighteen months after the effective date for the rulemaking. A general description of the section requirements in Form N-CEN are listed below:

Part A — General Information (Required for all funds)

Part A requires general information about the reporting period covered by the report. Also requires funds to report the fiscal-year end date and indicate if the report covers a period of less than 12 months.

Part B — Information About the Registrant (Required for all funds)

Part B requires certain background and other identifying information about the fund. (i.e. fund name, fund address, telephone number, and public website (if any), location of the fund's books and records, Investment Company Act filing number, CIK and LEI).

Part C — Items Relating to Management Investment Companies

- Background and Classification of

Funds

Part C is required to be completed by management investment companies other than SBICs. Unlike Form N-SAR, it would request specific information on the classes of open-end management investment companies, including information relating to the number of classes authorized, added, and terminated during the relevant period. Part C also would require identifying information for each share class outstanding, including the name of the class, the class identification number, and ticker symbol.

A management investment company would be required to identify if it is any of the following types of funds: ETF or ETMF; index fund; fund seeking to achieve performance results that are a multiple of a benchmark, the inverse of a benchmark, or a multiple of the inverse of a benchmark; interval fund; fund of funds; master-feeder fund; money market fund; target date fund; and underlying fund to a variable annuity or variable life insurance contract.

ETFs and ETMFs, index funds and master-feeder funds also would be required to provide the additional information in Part E. - Investments in Certain Foreign

Corporations

Part C requires a management investment company to identify if it invests in a controlled foreign corporation for the purpose of investing in certain types of instruments, such as commodities, including the name and LEI of such corporation, if any. - Securities Lending

Part C requires that funds disclose information regarding their securities lending practices, including information about the fees associated with securities lending and relationships with certain securities lending service providers. - Reliance on Certain Rules

Like Form N-SAR, Part C requires that management investment companies report whether they relied on certain rules under the Investment Company Act during the reporting period. However, proposed Form N-CEN would require this information with respect to additional rules not currently covered by Form N-SAR. - Expense Limitations

Like Form N-SAR, Part C would require information regarding expense limitations. The requirements in Form N-CEN, however, would be modified from Form N-SAR by requiring information on whether the management investment company had an expense limitation arrangement in place, whether any expenses of the fund were waived or reduced pursuant to the arrangement, whether the waived fees are subject to recoupment, and whether any expenses previously waived were recouped during the period. - Service Providers

Similar to Form N-SAR, Form N-CEN would collect identifying information on the management investment company's service providers, including its advisers and sub-advisers, transfer agents, custodians (including sub- custodians), shareholder servicing agents, third-party administrators, and affiliated broker-dealers. New requirements would request information on whether a fund service provider was hired or terminated during the reporting period and whether it is affiliated with the fund or its adviser(s).

Part D — Closed-End Management Investment Companies and Small Business Investment Companies

Like Form N-SAR, Part D would require additional information to be reported by closed-end funds and also would treat SBICs differently than other management investment companies, requiring them to complete Part D of the form in lieu of Part C. Information requested would include information on the securities issued by the closed-end fund or SBIC, including the type of security issued (common stock, preferred stock, warrants, convertible securities, bonds, or any security considered "other"), title of each class, exchange where listed, and ticker symbol. In addition, information relating to rights offerings and secondary offerings by the closed-end fund or SBIC, including whether there was such an offering during the reporting period and if so, the type of security involved. However, unlike Form N-SAR, which requires information on the number of shares or principal amount of debt and net consideration received or paid for sales and repurchases for common stock, preferred stock, and debt securities, Form N-CEN would only require the closed-end fund or SBIC to indicate if it repurchased any outstanding securities issued by the fund during the reporting period and indicate which type of security. Similar to Form N-SAR, Part D would require other census-type information.

Part E — Exchange-Traded Funds and Exchange-Traded Managed Funds P

Part E would be related specifically to ETFs and ETMFs. Such fund would be required to complete this section in addition to Parts A, B, and G, and either Part C (for open-end funds) or Part F (for UITs).

Part F — Unit Investment Trusts

Part F requires information specific to UITs.

Part G — Attachments

Part G requires various attachments to the filing.

Conclusion

These proposed changes are significant and can be expected to be the subject of a broad range of public comments. We will continue to track and report on the rulemaking as it progresses.

Footnotes

1 Money market funds already file reports on Form N-MFP on a monthly basis and, thus, would not be required to file reports on Form N-PORT.

2 See Form N-PORT, Items A.1 and A.2. Funds would provide the name of the registrant, the Investment Company Act and CIK file numbers for the registrant, and the address and telephone number of the registrant. Funds also would provide the name of and EDGAR identifier for the series.

3 The LEI is a unique identifier associated with a single corporate entity and is intended to provide a uniform international standard for identifying counterparties to a transaction. Funds or registrants that have not yet obtained an LEI would be required to obtain one, which entails a modest fee.

4 Form N-PORT would allow funds to report an aggregate amount not exceeding five percent of the total value of the portfolio investments in one amount as "Miscellaneous securities," provided that securities so listed are not restricted, have been held for not more than one year prior to the date of the related balance sheet, and have not previously been reported by name to the shareholders, or set forth in any registration statement, application or annual report or otherwise made available to the public. These are the same requirements currently in Regulation S-X.

5 See Form N-PORT, Instruction E (providing that "controlled foreign corporation" has the meaning defined in section 957 of the Internal Revenue Code [26 U.S.C. 957]) and Item B.2.b (requiring funds to report assets invested in controlled foreign corporations).

6 As reported pursuant to rule 6-04(13)(a) of Regulation S-X [17 CFR 210.6-04(13)(a)].

7 Specifically, the SEC proposes to calculate notional value as the sum of the absolute values of: (i) the value of each debt security, (ii) the notional amount of each swap, including, but not limited to, total return swaps, interest rate swaps credit default swaps, for which the underlying reference asset or assets are debt securities or an interest rate; and (iii) the delta-adjusted notional amount of any option for which the underlying reference asset is an asset described in clause (i) or (ii). See Form N-PORT, Item B.3, Instruction.

8 For duration, the proposal would require that a fund calculate the change in value in the fund's portfolio from a 1 basis point change in interest rates for each applicable key rate along the risk-free interest rate curve (i.e., 1 month, 3 month, 6 month, 1 year, 2 year, 3 year, 5 year, 7 year, 10 year, 20 year and 30 year interest rate, for each applicable currency in the fund). Similarly, the same funds would provide a measure of spread duration at the portfolio level for each of the same maturities listed above, aggregated by non-investment grade and investment grade exposures.

9 If the fund is a multiple class fund, it would report returns for each class and also report their class identification numbers.

10 This item is modeled after disclosure requirements in Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 815, which governs the accounting disclosure for derivatives and hedging.

11 See Form N-PORT, Item B.5.d. The proposal also would amend Regulation S-X to require funds to report similar information in their financial statements, although Regulation S-X would require such information to be aggregated by type of derivative contract, rather than by category of exposure as required by Form N-PORT.

12 This information is similar to fund flows currently reported on Form N-SAR, though the Form N-PORT information would be reported more frequently.

13 These portfolio holdings would be presented in accordance with the schedules set forth in §§210.12-12 to 12-14 of Regulation S-X.

14 See rules 30a-1 and 30b1-1 under the Investment Company Act [17 CFR 270.30a-1 and 17 CFR 270.30b1-1].

15 See General Instruction A (Rule as to Use of Form N-CEN) to proposed Form N-CEN. As reflected in General Instruction A, registrants would be required to respond to each item in their required sections. To the extent an item in a required section is inapplicable to a registrant, the registrant would respond "N/A" to that item. Registrants would not, however, have to provide responses to items in sections they are not required to fill out.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.