Doing business in KSA? Sending employees to KSA? Not without a licence!

Sending employees to KSA

The Kingdom of Saud Arabia (KSA) is one of the largest economies in the Middle East and a market which has attracted more and more activity in the past six years. Often businesses will seek to explore the market through a partner or a third party with which employees are placed and through which they seek to operate in the Kingdom.

Such operations will more often than not fall foul of KSA legislation designed to prevent a non KSA entity using a KSA entity's trade licence to do business in the Kingdom. Over the past three years, we have seen the KSA authorities clamp down on activities they regard as harmful to the economy and in breach of legislation.

In 2013 a six month immigration amnesty resulted in millions of individuals correcting their status, and thousands being deported for illegal working.

This regulatory clampdown has continued into 2015. In the past few months the Ministry of Commerce and Industry (MOCI) has intensified its campaign against illegal business ventures being conducted by expatriates in the name of Saudis (Concealment) (referred to in Arabic as ''Tasattur'') as part of efforts to put an end to what it called "the most dangerous practice" affecting the business community in the Kingdom.

Article 1 of the Saudi Arabian Anti Concealment Law issued by Royal Decree No. (M/22) dated 4/5/1425H (corresponding to 22/6/2004) (Anti Concealment Law) provides that any Saudi who enables a non-Saudi to use the Saudi's licenses and other facilities to invest or engage in commercial activities in KSA without (where available) the necessary authorisations and licenses shall be considered as committing the offence of "concealment". Articles 4 and 5 of the Concealment Law provide that a party guilty of "concealment" may be punished by:

- A fine not exceeding SAR 1 million (approximately USD 266,667)

- Imprisonment for a term not exceeding two (2) years

- Deportation from the Kingdom

- Being barred from re-entering the Kingdom

In addition, the foreign party involved in any "concealment" may be assessed for tax by the Department of Zakat and Income Tax on the basis of the deemed profits earned in the course of the activities that were "concealed".

Various arrangements can fall foul of the Anti- Concealment Law, including the placement of employees into an agent, client or other partner. The key concern is to monitor employees' activities, business cards and their presentation to the market.

Recently, the Council of Ministers has instructed relevant agencies to carry out surprise inspections in the market and report Tasattur businesses to MOCI. As a tool of enforcing the Anti Concealment Law, the Kingdom is planning to monitor the foreign currency transfers of expats, in order to check if such transfers are coming from Tasattur business activities.

New measures impacting foreign investment

In recent months the Saudi Arabian General Investment Authority (SAGIA) has introduced a number of changes that will impact foreign investors. These include:

- the announcement in June 2014 of a fast-track license application procedure for certain qualifying applicants (Fast Track Procedure);

- the implementation in October 2014 of a new programme to measure the impact of foreign investment in KSA (Impact Programme).

Overall this appear to be part of an emerging twin track approach of encouraging foreign investment whilst simultaneously being more choosy about which foreign investors can come into the market (and which can stay).

The Fast Track Procedure

Under the Fast Track Procedure the following type of foreign investors may be eligible to submit an abbreviated licence application:

- Multinational companies

- Publicly listed companies on an international stock exchange

- Foreign companies that manufacture products that are classified and approved by independent agencies and employ certified process technology

- Foreign companies that own certain registered trademarks, patents, or copyrights

- Foreign companies that are establishing a regional office in KSA

- Foreign construction companies that are classified as Class A in their home country

- Foreign companies with assets worth more than USD 13.33 million, that have above 2,000 employees, and that have completed at least one project with a value of at least USD 133.3 million

- Foreign companies contracting with the KSA government or a KSA government-owned entity or entering into a joint venture with a KSA company listed on the KSA Exchange

As a firm we have successfully made a number of Fast Track Procedure applications. In some cases the SAGIA licence was issued in as little of one week – although it should be noted that it still takes time to gather together all the application documents.

The Impact Programme

Under the programme, the impact of licensed entities will be measured according to the following foreign investment objectives:

- Transfer and localization of technological know-how

- Diversification of KSA's economy

- Increasing of exports and decreasing of imports

- Developing KSA human resources

- Reinforcing economic competitiveness in both domestic and international markets

- Balanced development among the different regions of KSA

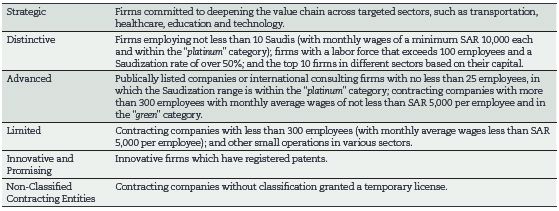

Entities which demonstrate that they are fulfilling these objectives will be granted special incentives and privileges to help promote and motivate excellence and sustainability. According to the programme, licensed entities will be divided into the following categories:

It will take time to see the full impact of this programme in practice. However, the potential advantages and benefits will be granted to licensed foreign investments according to their categorisation. For example, longer SAGIA license periods will be available to entities which are strategic (5 years), distinctive (3 years) and advanced (2 years)together with enhanced service priority in business centres.

SAGIA has also confirmed its intention to develop new formulae to measure the 'added value' provided by licensed entities. These are to be based on quantitative data derived from the balance sheets of such entities together with qualitative data derived from analysis of their operations in practice.

Conclusion

In summary, the Fast Track Procedure and Impact Programme represent a new approach by SAGIA to encourage and measure the foreign investments into the Kingdom. It is too early to assess fully the impact these initiatives will have on foreign investments, however, both existing licensed foreign investors and those considering an investment in the Kingdom will wish to examine and assess the new SAGIA objectives carefully.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.