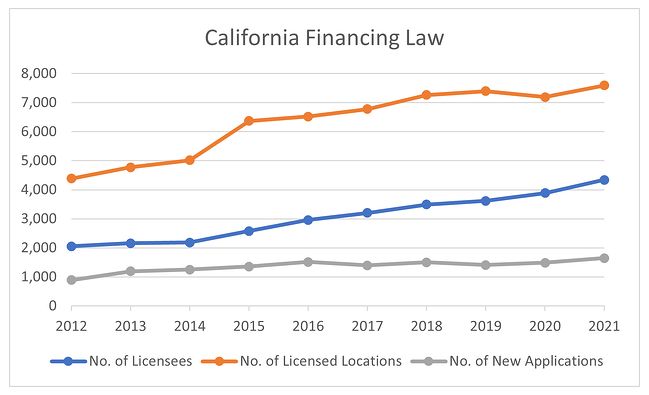

The California Department of Financial Protection & Innovation recently issued is 2021 Annual Report of Operation of Finance Lenders, Brokers, and PACE Administrators Licensed Under the California Financing Law. The DFPI reports a nearly 12% increase in the number of licensees from 3,886 to 4,340. Interestingly, about 6% of the licensees, or 454, failed to file the required annual report.

With respect to commercial lending, the DFPI noted the following highlights:

- The number of commercial loans originated in 2021 increased by 8 percent to 762,253 from706,228 in 2020. The total principal amount of commercial loans increased by 33.5 percent over the same period, to $214.2 billion from $160.4 billion.

- The number of online commercial loans originated in 2021 increased by 3 percent to 37,110from 36,016 in 2020. The total principal amount of online loans increased by 39.1 percent over the same period, to $3.4 billion from $2.4 billion.

The following chart summarizes some of the data included in the report regarding the number of licensees, licensed locations and new applications:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.