Key Takeaways

- The U.S. Department of Treasury ("Treasury"), which is Chair of the Committee on Foreign Investment in the United States ("CFIUS" or the "Committee"), released a Notice of Proposed Rulemaking on April 11, 2024 ("NPRM") meant to "enhance [CFIUS'] procedures and sharpen its penalty and enforcement authorities."

- The NPRM invites public comment on the proposed changes to CFIUS' regulations. Public comments can be submitted through May 15, 2024.

- The proposed changes to CFIUS' implementing regulations (31 C.F.R. Parts 800 and 802) reflect lessons learned by the Committee with respect to compliance, deterrence, enforcement, and addressing U.S. national security risks in connection with the Committee's work. These changes seek to build on the Committee's Enforcement and Penalty Guidelines (our prior coverage is available here) that were published in 2022.

- The trendlines remain clear: CFIUS continues to be focused on managing the impact of foreign investments on U.S. national security and is strengthening and refining its tools to do so. Although CFIUS has historically only engaged in enforcement activities sparingly (there have only been two CFIUS enforcement actions disclosed pre-FIRRMA and none so far post-FIRRMA), the Committee has pursued new enforcement actions in recent years and the investment community is expecting additional information in connection with those actions over the months ahead.

This OnPoint analyzes CFIUS' proposed rule, which aims to enhance its monitoring, compliance, and enforcement capabilities.

CFIUS Notice of Proposed Rulemaking: Key Changes

CFIUS is an interagency committee, chaired by the U.S. Department of the Treasury, which has broad powers to review non-U.S. investments in, and acquisitions of, U.S. businesses to determine the potential impact on U.S. national security. CFIUS has the authority to review matters that are brought before it and to initiate its own transaction reviews. It may impose mitigation measures on transactions that it determines are a risk to U.S. national security and any failure to comply with such measures may result in the imposition of a penalty by the Committee.

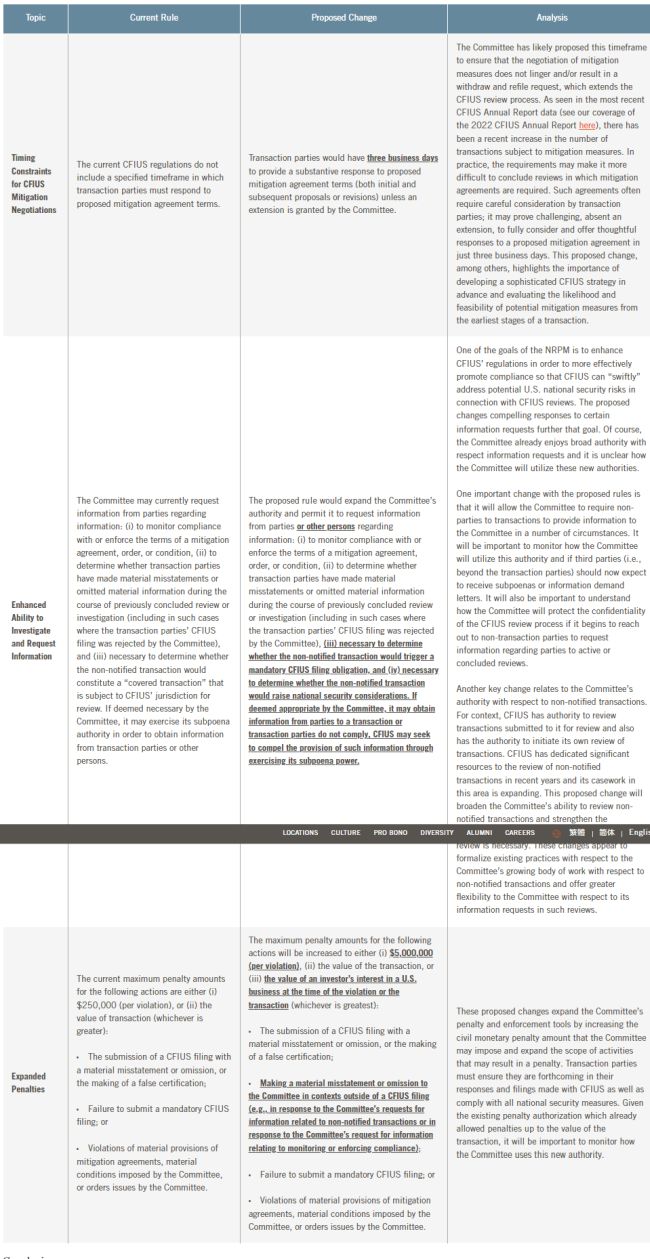

After almost a year of preview from CFIUS officials, Treasury has issued an NPRM that previews a series of amendments to CFIUS' implementing regulations (31 C.F.R. Part 800 and Part 802) designed to enhance CFIUS' enforcement authority, reduce mitigation negotiation timelines, and increase applicable civil monetary penalties, among other changes. Below, we highlight the proposals outlined in the NPRM, and how they compare to CFIUS' current authorities.

Conclusion

As evidenced by the NPRM, the CFIUS landscape continues to evolve in anticipation of an increasing workload for CFIUS. A sophisticated CFIUS strategy, at every step of the process, can make a significant difference. Parties contemplating transactions involving foreign investments in U.S. businesses should evaluate CFIUS considerations early in the transaction process and ensure that if mitigation measures are imposed, there is an actionable compliance program developed to oversee compliance with the parties' obligations. As the Committee continues to make clear now formally through the NPRM, the cost for failing to do so may be more than reputational.

Dechert has represented many clients through CFIUS reviews, including major operators and investors in the industries surrounding high tech, telecommunications, energy, defense, and infrastructure. We regularly advise foreign and domestic entities ("buyers" and "sellers," as well as other interested third parties) through the CFIUS review process, helping them determine whether or not to bring a transaction before the Committee (and whether or not CFIUS review is required), to assemble the required information and materials for a filing, and then (as necessary) to negotiate national security agreements with CFIUS in a manner that minimizes both delay and the imposition of conditions that might threaten the transaction. We also advise on strategies for identifying and addressing political and policy considerations that may arise.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.